As The Real Estate Market Slows, Canadians Continue To Plunder Equity From Their Homes

Canadians are accelerating the rate at which they borrow cash against their homes, despite the fact that the real estate market is slumping in the country. This exposes the country's financial system to obvious vulnerabilities, according to rating company DBRS and Bloomberg.

Home equity lines of credit in Canada reached a record $184.5 billion (USD) as of October 31, which equates to 11.3% of total household credit. This is the highest share since mid-2015, according to a report released last Thursday. Canadians are drawing on their home's equity to fund everything from home renovations to car purchases.

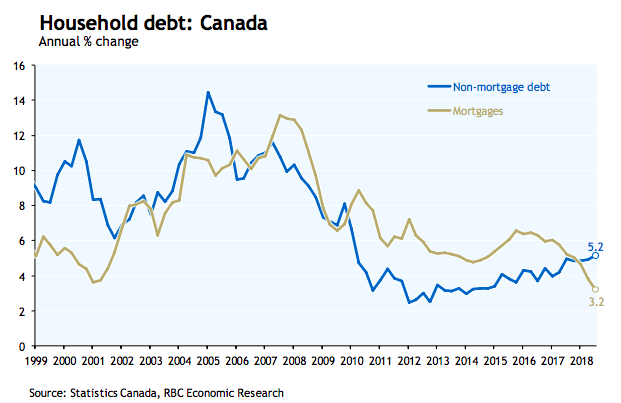

And they’re doing it so quickly that borrowing has grown faster than mortgages since 2017.

Analyst Robert Colangelo, who published the report on Thursday, commented: “The flexibility of Helocs could increase financial system vulnerabilities. In the event of a correction, borrowers could find themselves with a debt load that exceeds the value of their home, which is often referred to as negative equity.”

Obviously, home equity lines of credit can decrease visibility for lenders to identify credit problems as consumers use the equity in their homes to consolidate high-interest loans and unsecured debt into one lump sum at a lower rate.

Out of all of the Canadian banks, Toronto Dominion bank has the largest exposure to Helocs at about 39%, followed by Royal Bank of Canada which has 18% exposure. Other large banks are averaging 11% exposure, according to the report.

And the timing for Helocs to grow couldn't be worse. Toronto’s real estate market continues to feel pain. Sales of new homes in the city fell to the lowest in almost 2 decades in 2018 and a glut of unsold condominiums continue to pile up, according to a Building Industry and Land Development Association report released February 1. Vancouver, still feeling the deflationary effects of a foreign real estate bubble popping, saw home sales fall about 40% in January from the same month a year earlier.

In early January, we reported that Canadian mortgage credit growth had dropped to 22-year lows, signaling the end of the housing boom. Per a report from RBC, mortgage credit growth had decelerated to 3.2%.

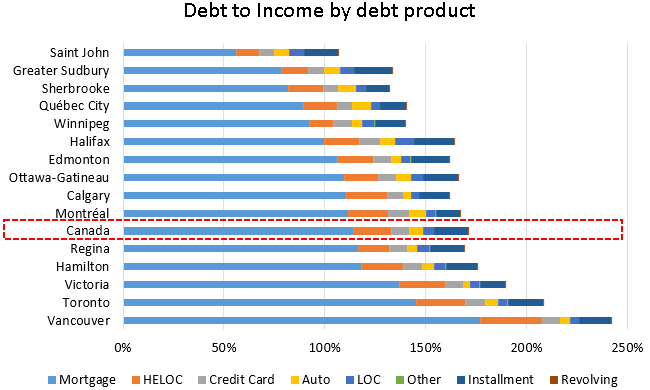

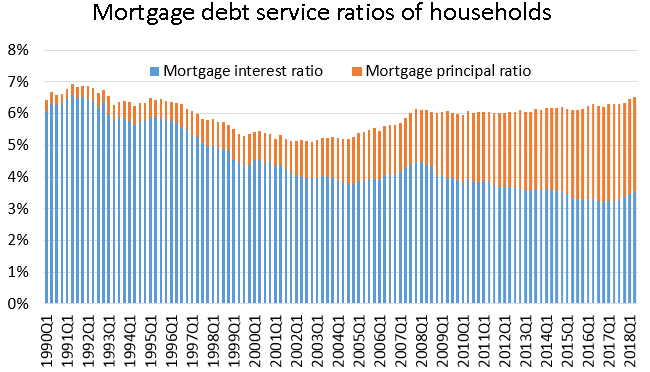

In late December, we reported that Canadian household debt to income levels were near record highs. In addition, we pointed out that principal repayment share has been increasing and that mortgages were the main contributor to Canada's total debt burden.