Argentine Peso Soars Amid Zero Liquidity Despite "Very Concerning" Capital Controls Plan

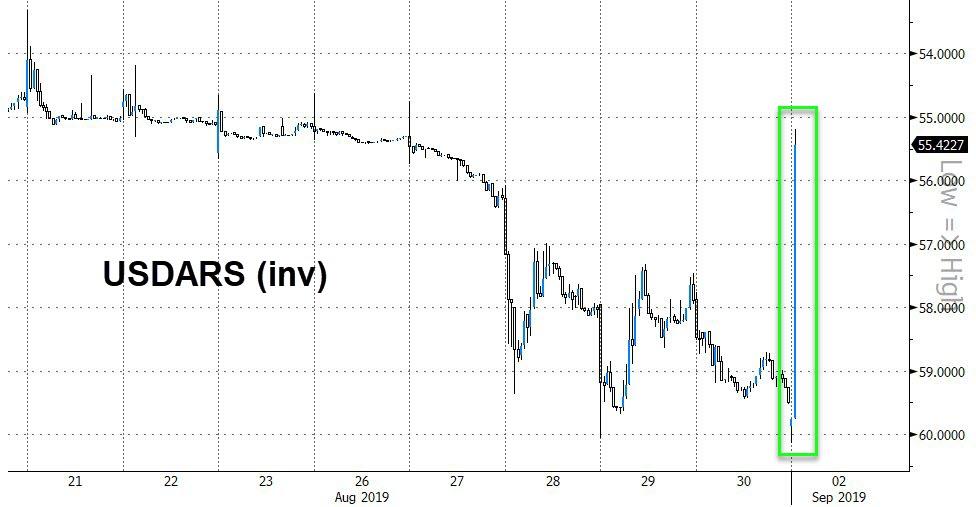

Thanks to zero liquidity (US holiday) and some repo'd reserves, the Argentine Peso has exploded higher this morning (biggest jump in over 17 years) after unveiling a new capital control plan over the weekend to stall its collapsing...everything.

As Bloomberg's Jorgelina do Rosario and Philip Sanders note, Sunday’s move shows how the crisis has moved beyond international bond investors to affect ordinary Argentines, who may choose to save in dollar bank accounts.

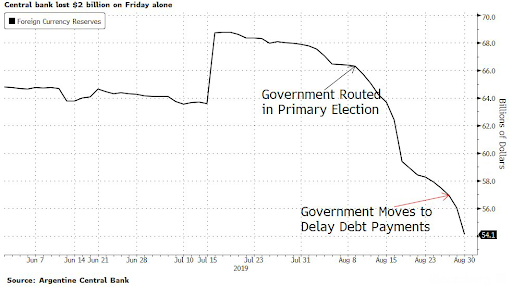

In the aftermath of the Aug. 11 primary elections that showed Fernandez on course for victory in October, Argentine depositors withdrew hundreds of millions of dollars from their accounts - cash the central bank counts as part of its gross foreign reserves. These withdrawals, coupled with policy makers’ sale of dollars to shore up the peso, has led to a dramatic fall in the country’s stock of reserves.

Around $3 billion drained out of the foreign-currency reserves on Thursday and Friday alone after the government changed the terms for its short-term debt. The country risks exhausting its net reserves, which stand at under $15 billion, within weeks if it keeps losing money at this pace.

Source: Bloomberg

Having lost so much last week trying to stabilize the currency, we wonder how much today's move took...

Source: Bloomberg

But while the currency is panic-bid, bonds are getting dumped... The 2022 bonds are down another 5 points in early trading!

Source: Bloomberg

The return of populism in Argentina is scaring the “dickens out of emerging-market investors,” said Stephen Innes, an Asia-Pacific market strategist at AxiTrader in Bangkok.

If the resurgent currency surprises you, you're not alone as insiders tell us that black-market USDARS is trading around 64/USD - a new collapse to a new record low.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more