Amsterdam Housing: Falling Investment Returns Put Downward Pressure On Prices

Lower rental income, increasing property prices, and increased taxation levels are all decreasing expected returns for Amsterdam's residential property investors, decreasing the relative attractiveness compared to alternative investment opportunities. Expect all of this to put further pressure on residential property prices in Amsterdam.

Downward pressure on Amsterdam residential property prices

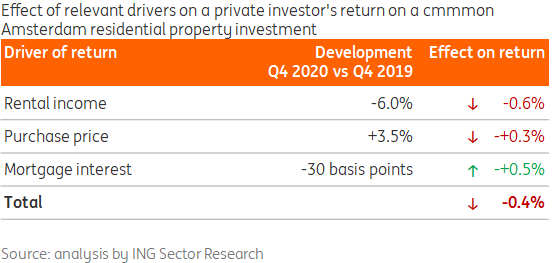

The expected direct returns of private investors on a typical Amsterdam residential investment property declined between 4Q19 and 4Q20 due to lower rental income and higher residential property prices.

The decline in returns is comparable to the fall in government bond yields in the same period but considerably smaller than the fall in the expected earning yields on shares (-170 basis points).

Private residential property investors are likely to adjust the price they're willing to pay for residential property in Amsterdam as they now expect lower returns

The higher transfer tax for residential property investors introduced on 1 January 2021 has further reduced the direct return by about -40 basis points, which means private residential property investors are likely to adjust downwards the price they're willing to pay for residential property in Amsterdam as they expect lower returns.

Rents in Amsterdam drop in 2020

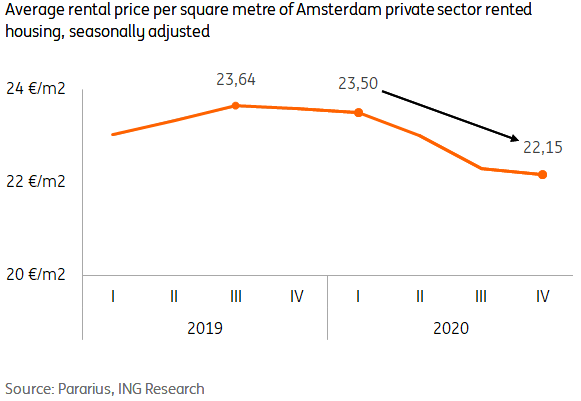

Amsterdam private sector rents fell by 6% in 2020

Between 2014 and 2019, rents in Amsterdam's private sector rose by nearly 26%. This substantial increase slowed down the demand for rental properties, putting downward pressure on rents.

But since the peak in the second half of 2019, rents have been dropping. After the peak seen in 3Q19 (€23.6 per m2), average rents have fallen for five consecutive quarters. In 4Q20, the average rent was €22.2, or 6.1% lower than in 4Q19.

The pandemic has added fuel to the fire

In 2020, the pandemic further increased the downward pressure on Amsterdam's private sector rents too. This is due to the sharp decline in the inflow of foreign immigrants - including expats and knowledge workers - to Amsterdam, reducing the demand for private sector rental housing in the past year.

In 2020, the net migration balance was almost 50% lower than in 2019, which to an extent explains why the population growth rate in Amsterdam fell from around 9,800 persons in 2019 to 165 in 2020.

Drop in return on Amsterdam residential property investment in 2020

Return on Amsterdam residential property investment down 40 basis points in 2020

The direct return for private investors (1) on a typical Amsterdam residential property investment fell from 3.9% in 4Q19 to 3.5% in 4Q20 (2).

Falling rental prices in 2020 is the main culprit for lower returns - a decline of 60 basis points, but an increase in residential property prices have reduced returns too. On the other hand, falling interest rates actually had a positive effect on returns.

1. Lower rental income led to returns falling by 60 basis points

Falling private sector rents in Amsterdam have reduced expected rental income for investors and in response to the reduced demand, landlords have adjusted rents downwards to avoid temporary vacancies.

2. Increasing property prices caused returns to fall by 30 basis points

In 4Q20, the average price of an Amsterdam residential property was 3.5% higher than a year earlier. This has increased the investment costs for Amsterdam's private residential property investors and has reduced the expected return for investors further.

3. Plummeting interest rates improved returns by 50 basis points

In 2020, interest rates for residential and commercial mortgages fell to historic lows and on average rates on investment mortgages declined by about 30 basis points. Lower interest rates reduce the funding costs of residential property improving expected returns for investors.

The decline in the expected return from a residential property investment puts downward pressure on Amsterdam property prices,

Given the relative importance of private investors for the housing market (on average 13% in the last decade). Private investors will, on average be willing to offer less if they expect returns to fall. A lower purchase price means lower investment costs, which somewhat compensates investors for lower rental income.

Higher property transfer tax puts even more pressure on returns in 2021

The increase in the property transfer tax from 2% to 8% for investors as of 2021 increases the downward pressure. Higher taxes mean higher investment costs, and this hurts expected returns too.

Assuming a typical Amsterdam residential property investment of €450,000 - the extra costs would be €27,000. As a result, the return from a residential property falls further from 3.5% to 3.1% and will be a total of 80 basis points lower than at the end of 2019.

On top of this, more policies are being considered to discourage private investors further, such as allowing municipalities to offer protection against buy-to-let investors in specific neighbourhoods. Rent regulation has also increased in the run-up to the elections. For example, a maximum rent increase of 2.4% for private sector rental housing will be introduced in 2021.

If investors factor in these downward risks, it will further increase the pressure on residential property prices in Amsterdam.

A less attractive option?

Investors compare their return to that from other investments and weigh the risk involved.

Investing in Amsterdam residential property has therefore become relatively less attractive compared to most alternatives

While the expected return on the Amsterdam residential property market fell by 40 basis points between 4Q19 and 4Q20, the interest rate on savings remained the same, but the return on 10-year European government bonds declined just as sharply (about -43 basis points). The expected earnings yield on European shares based on expected earnings in 2021 fell more significantly in this period (-170 basis points).

The pressure on the expected return from the Amsterdam residential property market is causing property investors to shift their attention to other regions.

Investing in Amsterdam residential property has therefore become relatively less attractive compared to most alternatives. We expect this to put pressure on residential property prices in Amsterdam.

(1) A calculation of the expected return on equity of a private residential investor in the first year, based on the expected rental income (direct return). The return from a higher sales price (indirect return) is not included. We hereby assume mortgage funding of 70% of the value when rented. The remaining part of the purchase price is funded with equity. In our analysis, we focus strictly on private residential property investors in the Amsterdam residential property market. An analysis of the return for institutional investors requires different basic assumptions. Formula applied: (Rental income -/- interest costs -/- maintenance costs and management) / (Purchase price + transfer tax + notary, valuation and estate agent costs).

(2) Calculation example assumptions:

Disclaimer:

This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more