All Eyes On Aussie Dollar During Easter Week

With China’s Q1 GDP forecast within government range and RBA meeting minutes to reiterate central bank’s wait stance, AUD/USD could rise higher.

This week will be a short week, with major financial markets closing on Friday for the start of the Easter holidays. We usually see a burst of activity in the first three days of Easter week followed by consolidation. However, with major data releases on Thursday from Australia, volatility could extend till Thursday.

China’s Q1 GDP is expected to slow to 1.4% q/q and 6.3% y/y

China’s economy is forecasted to have cooled in Q1 according to an AFP survey of analysts. Coming in at 6.3% y/y, this would mark the slowest pace of quarterly growth in almost three decades. However, the figure is still well within the range target by the government of 6.0% to 6.5% for 2019, downgraded from 6.6% last year.

China has undertaken measures in recent months to combat the tepid global demand by announcing massive tax cuts and other fees reduction to help struggling companies. Last month Premier Li Keqiang acknowledged "downward pressure" but vowed not to let the economy "slip out of a reasonable range." We feel that growth could pick up once the fiscal policies translate into greater economic activity in the near future. This could cause Aussie dollar to rise as China is Australia’s biggest trading partner, so yuan and Aussie dollar are correlated.

US-China trade talks closing in on a deal

After nine rounds of high-level talks between the world’s two biggest economies, all signs are pointing towards a possible resolution. US Treasury Secretary Steven Mnuchin said Wednesday, “We’ve pretty much agreed on the enforcement mechanism," which is a good sign of a breakthrough in trade talks. However, no date has been set for President Trump and President Xi to meet for a deal signing. A closure in trade tensions between the two economic giants could increase risk sentiment and push Aussie dollar higher.

RBA meeting minutes and labor data

Australia’s central bank’s meeting minutes and its labor data are the two major releases this week. RBA meeting minutes could reveal more of what the RBA is closely watching after it hinted that it is keeping an eye on risks. The central bank has not favored an easing bias unlike its peers such as the Reserve Bank of New Zealand. We believe that it could retain its “watch-and-wait” stance on future interest rate moves.

The pressures from weak household income growth, weakening house prices and high household debt are the RBA’s central concerns. But in the central bank’s Financial Stability Review released last week, the RBA mentioned that risks of a broad-based decline in global asset prices remain elevated. They also mentioned, “Overall, the financial system appears much better placed to respond to a range of challenges than it was a decade ago.” This points towards RBA’s confidence in coping with the added pressure mentioned above.

Labour data will be the key focus as the only reason RBA held a neutral stance during their last meeting was largely due to stronger labor data. Figures from the Australian Bureau of Statistics are expected to show a 10,000 gain in employment and a rise in unemployment back to 5%. The more important figure will be the annual growth rate in new jobs and if there are no signs of weakening, this could justify RBA’s confidence in its economy.

Lastly, US March quarterly earnings will also be released on Wednesday, to include major banks and corporations. If the earnings show modest growth similar to what we saw last Friday, this could increase risk appetite and boost Aussie dollar higher.

Our Picks

EUR/USD: This pair may rise towards 1.1400 if bank’s earnings on Wednesday surpass expectations.

S&P 500: This index may rise towards 2935 if US bank earnings show modest growth.

AUD/USD: This pair may rise towards 0.7280, boosted by a potential stocks market rally, China’s Q1 GDP and hawkish RBA meeting minutes.

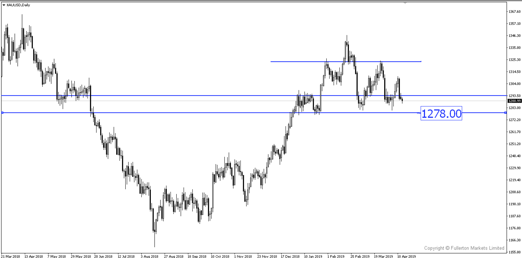

XAU/USD: This pair may fall towards 1278 this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more