Alimentation Couche-Tard: Invest In Electric Vehicles Growth Without Picking An EV Constructor

Electric vehicles are coming in strong. A world without car running on fuel? There’s a convenience store that already thought about it. Alimentation Couche-Tard (ANCUF) is a Canadian company that operates a network of convenience stores mostly across North America. While its yield is very low, it is an interesting addition to any kind of portfolio, even retirees’.

With its stock price appreciation potential, its proven recession-resiliency business model, its growth by acquisition strategy, and its electric vehicles superchargers, ANCUF has everything an investor needs. Let’s discuss this company more in details with this stock analysis.

Business Model

Alimentation Couche-Tard Inc. operates a network of convenience stores across North America, Ireland, Scandinavia, Poland, the Baltics, and Russia. The company primarily generates income through the sale of tobacco products, groceries, beverages, fresh food, quick-service restaurants, car wash services, other retail products and services, road transportation fuel, stationary energy, marine fuel, and chemicals.

In addition, the company operates more stores under the Circle K banner in other countries such as China, Egypt, and Malaysia. Its operation is geographically divided into U.S., Europe, and Canada. Revenue from external customers falls mainly into three categories: merchandise and services, road transportation fuel, and other.

Investment Thesis

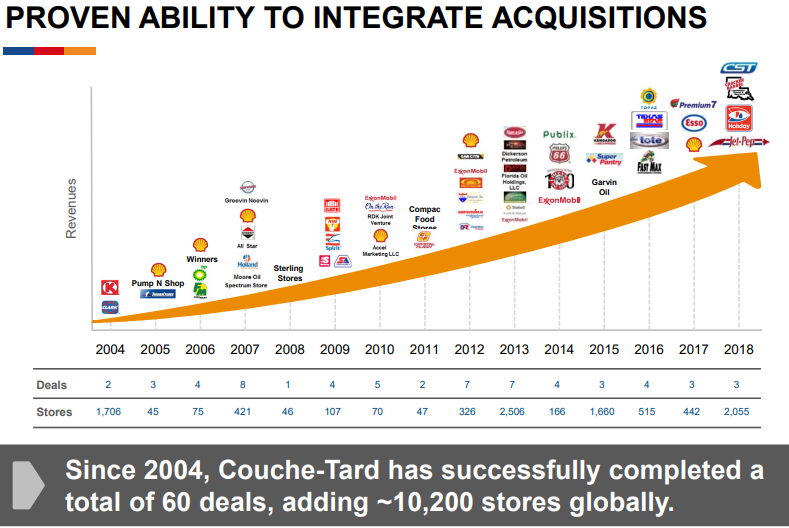

An investment in ANCUF is definitely not for an income-producing stock. However, if you are looking at the long-term horizon, your dividend payouts will grow in the double digits for a while and you will enjoy a strong stock price growth. ANCUF’s potential is directly linked to its capacity to acquire and integrate more convenience stores. Management has proven its ability to pay the right price and generate synergy for each deal.

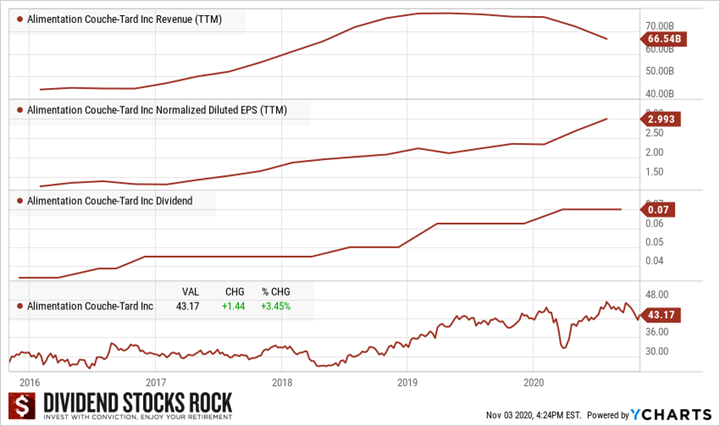

ANCUF shows a perfect combination of the dividend triangle: revenue, EPS, and strong dividend growth. With the coronavirus’s impact on the economy, ANCUF may be able to acquire more chains at attractive prices.

In the video below, I’ve discussed recent news about the company getting into electric charging stations and how Alimentation Couche-Tard is set to become a dominant player in the electric vehicles growth.

00:14:57

Potential Risks

Growers by acquisition are all vulnerable to occasionally making a bad purchase. While ANCUF’s methodology to acquire and integrate more convenience stores has been proven, it is important for them to not grow too fast or become too greedy and possibly overpay in the name of growth.

Still, it doesn’t seem like this is an issue with the current management team. The economic slowdown will negatively affect its sales (notably fuel sales) in 2020 and 2021. The stock price may go sideways for a while.

Dividend Growth Perspective

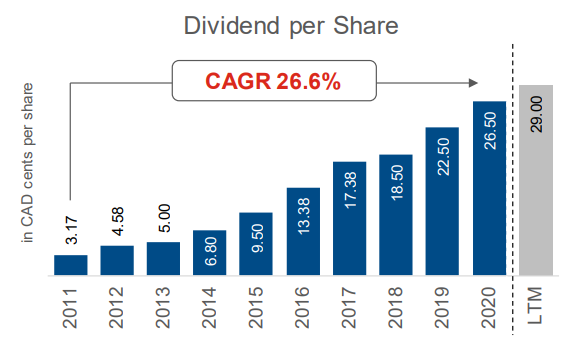

The mediocre 0.70% dividend yield is so low that ANCUF shouldn’t even be considered as a dividend grower. However, the dividend payout has surged in the past five years (+154%) and the stock price jumped by over 55% (including the stock price drop in early 2020).

The only reason why the dividend yield is so low is because ANCUF is on a fast track for growth. ANCUF will continue steadily increasing its payout while providing stock value appreciation to shareholders.

Final Thoughts

It’s almost the end of 2020 and it has been a year filled with lots of ups and downs. Since this holiday season will be very unique and we will not have as many parties, you might want to take this time to look at your portfolio and get it ready for the New Year. Alimentation Couche-Tard can certainly help you get inspired.

Disclaimer: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to have full access to 12 real-life portfolio models, readers can also ...

more