A Perfect Storm Is Developing Over Container Shipping

The slowdown in global trade began many quarters before the Trump administration launched a trade war with China last May. The primary cause of the downturn is sharp declines in intra-Asian trade - mostly due to China's deteriorating economy. While equity markets around the world have soared in the last several months from "trade optimism," any deal between Washington and Beijing may not initially trough global trade and could leave the shipping industry in turmoil.

A rapid slowdown in global trade to rising marine fuel to capacity out of step with demand has generated new challenges for container-shipping operators in 2019, hurting the overall prospects for a global recovery in the near term.

The Wall Street Journal says that shipping companies will pass on $10 billion in extra expenses to cargo owners this year.

Container ships are essentially cargo ships that carry all of their load in truck-size intermodal containers, in a technique called containerization. These vessels move clothes, food, furniture, electronics and heavy-industry parts from emerging market countries to the developed world. Pre-2008 financial crisis, these ships fueled globalization, as demand for vessels rose as much as 8% annually and shippers spent billions to increase the size of their fleets.

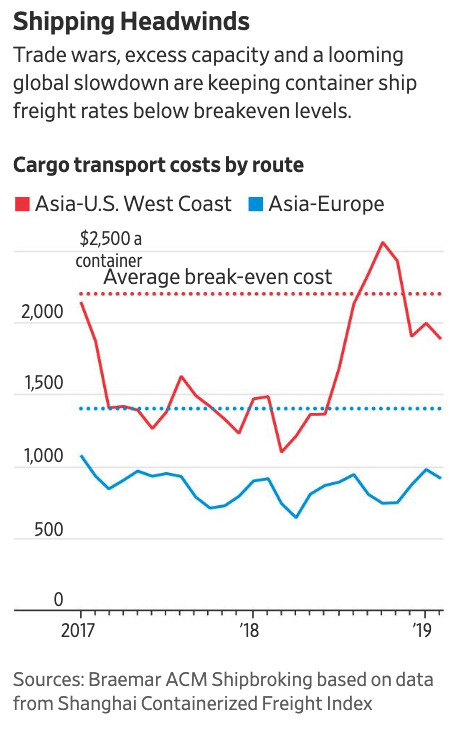

Now, the industry is plagued with excess tonnage and collapsing freight rates. It is likely that the trade war will continue to push rates below the break-even levels for many companies this year.

With China’s economy faltering and trade volumes declining from the evolving trade war between Washington and Beijing, operators are slashing their full-year forecasts.

“We see clearly a global economic growth that is declining,” Soren Skou, chief executive of A.P. Moller-Maersk AS, the world’s top container operator by capacity, told an investor conference call recently.

“We see weaknesses, in particular, in China and Europe. We expect container demand growth to fall to 1% to 3% this year from 3.7% to 3.8% last year.”

The world's largest shipper, Maersk (AMKAF), said 2019 would be a challenging year due to risks of further restrictions on global trade. It added that new regulations by the International Maritime Organization to cut emissions from ship stacks “will bring significant increases in fuel prices.”

“The fuel price increase is very significant and there will be a premium in freight rates,” Jeremy Nixon, CEO of Japan’s Ocean Network Express, told The Wall Street Journal in a recent interview.

“We are trying to pass on the fuel charge to customers, but we are not doing it very effectively.”

Consulting firm AlixPartners LLP. said in a recent report that ships traveling from Asia-to-Europe trade route would need to boost freight rates by 40%, and 33% for trans-Pacific trades to absorb the extra costs.

Shipping executives warn uncertainty over the availability of cleaner fuels makes freight rates this year little more than a guessing game. “It has turned the shipping market, the transportation market, into a casino,” said Andreas Hadjiyiannis, president of the Cyprus Union of Shipowners.

Freight rates soared in the second half of 2018 as US importers pulled orders forward to get ahead of tariffs. But by late August into September, rates collapsed after the importers were finished.

“We don’t believe a China-U.S. deal will be the last we have heard of trade tensions in 2019,” said Skou.

“There is also clearly an outstanding discussion between Europe and the U.S.”

Faltering global trade is a clear indication that container-shipping operators will have a challenging time in 2019. Compound that with marine fuel rising, new emission standards, and overcapacity in the industry, well, a perfect storm is brewing.