A Dip In Shipping Rates: The End Of The Nightmare, Or Just The Eye Of The Hurricane

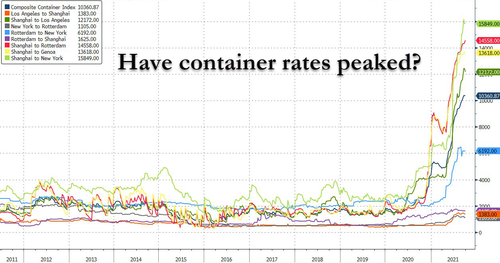

This year, spot ocean container rates have reached record highs and could be at a crucial inflection point this week. News of 40-foot container rates on the world's most important shipping lane, that is, China and the U.S., plunged amid a power crunch shutting down factories across multiple Chinese provinces leading speculators to sell their shipping spots, according to Chinese media outlet Caixin Global.

Caixin spoke with an executive at a Shanghai freight company Thursday who said 40-foot container rates from China to the U.S. West Coast sank this week, plummeting from $15,000 to just $8,000. For the same container, the spot rate for China to the U.S. East Coast dropped from $20,000 to around $15,000.

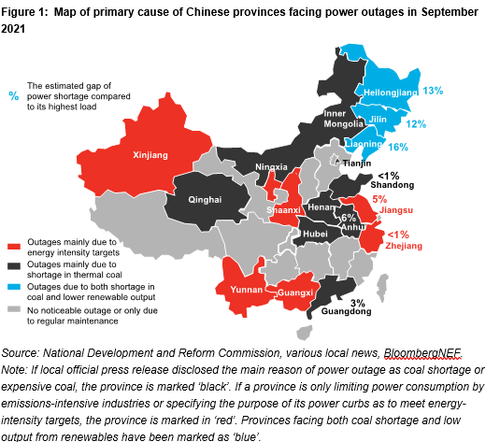

The decline in international shipping costs is primarily due to at least 20 Chinese provinces and regions making up more than 66% of the country's GDP have announced some form of power cuts in recent weeks, which has shuttered energy-intensive manufacturing industries and so their need for containerized shipping has diminished.

We have noted Foxconn, the world's biggest iPhone assembler and a key supplier of Apple and Tesla, halted production earlier this week. Another Apple supplier, Unimicron Technologies, suspended operations. There are countless reports of other energy-intensive companies that suspended operations.

An analyst at Tianfeng Securities Co. Ltd. said the decline in shipping rates was primarily caused by the imminent off-season and a reduction in manufacturing due to China's power crunch. The analyst said rates should decline as export growth in China will decrease in the fourth quarter, and seasonally ocean freight slows down.

A report by CSC Financial Co. Ltd. outlined rates will stay stubbornly high for the next two weeks as port congestion remains a problem in China and the U.S. But after that, rates may stall on slow growth from China.

We so far understand China's power crunch is having a sizeable impact on economic growth and has resulted in a slump for containerized shipping demand. What comes next is either shipping rates continue a downward spiral or bounce back as China will ultimately restart its manufacturing base near term.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more