$60 Billion Opportunity Opens Up For Plastics Industry

150 businesses representing over 20% of the global plastic packaging market have now agreed to start building a circular economy for plastics with the Ellen MacArthur Foundation.

As a first step, Coca-Cola has revealed that it produced 3MT of plastic packaging in 2017 – equivalent to 200k bottles/minute, around 20% of the 500bn PET bottles used every year. Altogether, Coke, Mars, Nestlé and Danone currently produce 8MT/year of plastic packaging and have now committed to:

- Eliminate unnecessary plastic packaging and move from single-use to reusable packaging

- Innovate to ensure 100% of plastic packaging can be easily and safely reused, recycled, or composted by 2025

- Create a circular economy in plastic by significantly increasing the volumes of plastic reused or recycled into new packaging.

The drive behind the Foundation’s initiative is two-fold:

- To eliminate plastic waste and pollution at its source

- To capture the $60 billion opportunity to replace fossil fuels with recycled material

Encouragingly, over 100 companies in the consumer packaging and retail sector have now committed to making 100% of their plastic packaging reusable, recyclable, or compostable by 2025.

Perhaps even more importantly, they plan to actually use an average of 25% recycled content in plastic packaging by 2025 – 10x today’s global average. This will create a 5MT/year demand for recycled plastic by 2025. And clearly, many more companies are likely to join them. As I noted a year ago in Goodbye to “business as usual” model for plastics‘:

“The impact of the sustainability agenda and the drive towards the circular economy is becoming ever-stronger. The initial catalyst for this demand was the World Economic Forum’s 2016 report on ‘The New Plastics Economy’, which warned that on current trends, the oceans would contain more plastics than fish (by weight) by 2050 – a clearly unacceptable outcome. 2017’s BBC documentary Blue Planet 2, narrated by the legendary Sir David Attenborough, then catalysed public concern over the impact of single use plastic in packaging and other applications.”

PLASTICS INDUSTRY NOW HAS TO SOLVE THE TECHNICAL CHALLENGES

The issue now is around making this happen. It’s relatively easy for the consuming companies to issue declarations of intent. But as we note in the latest pH Report, it’s much harder for plastics producers to come up with the necessary solutions:

“The problem is that technical solutions to the issue do not currently exist. It is possible to imagine that new single-layer polymers can be developed to replace multi-layer polymer packaging, and hence become suitable for mechanical recycling. It is also possible to believe that pyrolysis technologies can be adapted to enable the introduction of chemical recycling. But the timescale for moving through the development stage in both key areas into even a phased European roll-out is very short.”

Already, however, Borealis and Indorama have begun to set targets for using recycled content. Indorama plans to increase its processing of recycled PET from 100kt today to 750kt by 2025. And as Dow CEO Jim Fitterling said last week:

“The industry needs to tackle this ocean waste and develop ways to reuse plastics. There are no deniers out there that we have a plastics-waste issue. The challenge is that the plastics industry has developed around a linear value-chain. A line connects the hydrocarbons from the wellhead to either the environment or to landfills once consumers discard them. The discarded plastic does not re-enter the chain.

“The industry needs to adopt a circular value-chain, in which the waste is reused. For this to be successful, some kind of value needs to be attached to plastic waste. Without this, consumers have little incentive to recover plastic waste in a form that would be useful to manufacturers.”

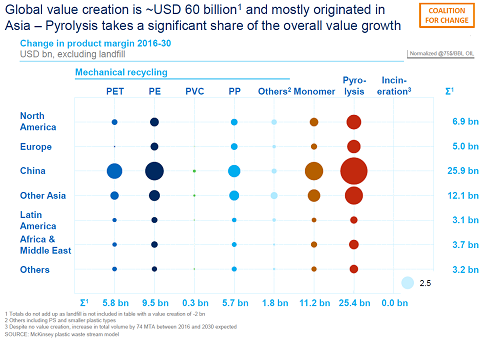

As McKinsey’s chart shows, this is potentially a $60 billion opportunity for the industry. It is also likely, as I noted back in June, that the ‘Plastics recycling paradigm shift will create Winners and Losers‘:

“For 30 years, plastics producers have primarily focused upstream on securing cost-competitive feedstock supply. Now, almost overnight, they find themselves being forced by consumers, legislators and brand owners to refocus downstream on the sustainability agenda. It is a dramatic shift, and one which is likely to create Winners and Losers over a relatively short space of time.”

The winners will be those companies who focus on the emerging opportunity to eliminate the physical and financial waste created by single use packaging. As the European Commission has noted, it is absurd that only 5% of the value of plastic packaging is currently retained in the EU economy after a single use, at a cost of €70bn-€105bn annually.

On a global scale, this waste is simply unaffordable, as the UN Environment Assembly confirmed on Friday when voting to “significantly reduce” the volume of single-use plastics by 2030.

The plastics industry now finds itself in the position of the chlorine industry 30 years’ ago, over the impact of CFCs on the ozone layer. The winners will grasp the opportunity to start building a more circular economy. The Losers will risk going out of business as their licence to operate is challenged.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more