3 Energy Stocks To Double When Crude Moves Higher

Tim Plaehn has just discovered a unique fact about the global oil industry. He believes that one small event, that is already starting to take place in the Middle East, could send oil prices skyrocketing. You do not want to miss out on these three investments that will soar when this event takes place.

A lot of energy company analysis and information about the state of the global crude oil situation has come across my desk over the last few days. In my opinion, much of the now accepted status quo about crude oil price could upend very quickly, leading to higher, much higher crude prices. What follows are some very interesting data points and a couple of investment ideas that would make you a lot of money if crude moved up by gains measured in tens of dollars per barrel.

There is a very big difference between the North American crude oil exploration and production (E&P) sector and the rest of the world. Over the last decade, the advent of horizontal drilling and fracking techniques has allowed North American E&P companies to double their output to over 16 million barrels per day, while the rest of the world is producing the same amount of oil it was a decade ago. The current one to 2.5 million barrels per day of excess production that has resulted in the steep drop in the price of oil is entirely due to the production growth in North America. Currently global crude demand is about 93 million barrels per day, growing at about 1 million barrels per day per year. Note that the excess production that is causing all of the turmoil in the energy sector is a very small number compared to total global consumption.

Here is a chart from a newly posted presentation by the largest MLP by market cap, Enterprise Products Partners (NYSE:EPD):

A few calculations on my handy calculator show that 12.3 million barrels per day of OPEC production are in the unstable Red category. It would just take a political or another type of oil disruption in one country such as Venezuela or Iraq to quickly turn crude from a production oversupply to a shortage. Just today I read this quote from the Wall Street Journal:

“Iraq is approaching a three-way division despite efforts such as those by Prime Minister Haider al-Abadi to strike a deal to share oil revenue with Kurds, Yaroslav Trofimov reports. The Kurds and the central government still disagree over the northern city of Kirkuk and adjoining oil fields, and the Sunni-Shiite conflict now involves U.S. airstrikes on Tikrit.

“If we decided to set up independent states, we would be engulfed in fighting over borders. How are we going to tackle the issue of water? What about gas and oil? They could fight for centuries over these issues,” said Hunain Alqaddo, a lawmaker from the ruling Shiite bloc.”

Also, don’t forget that the U.S. E&P companies have reduced their drilling budgets by 25% for 2015 and the forecast production growth has gone completely flat through 2016. These facts tell me that the current low energy commodity prices environment is very unstable, and it seems highly likely that a problem in one or more OPEC countries would quickly send the price of crude higher, much higher. Both Wall Street analysts and the herd of retail investors are taking current energy prices and projecting them out into the next several years with only a moderate increase in the crude benchmark prices. I think I have shown that these analysts are not correctly seeing how their projections may be very, very wrong.

As the income stock editor here at Investors Alley, my focus is on higher yield ways to play trends in the market. Here are three ways to play a significant increase in the price of crude oil in 2015 and/or 2016:

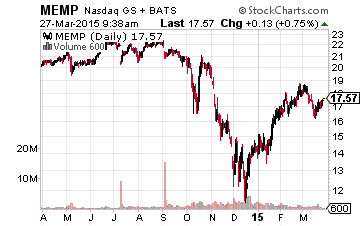

The best managed E&P master limited partnership is Memorial Production Partners LP (Nasdaq:MEMP). Memorial is one of just three upstream MLPs that has not been forced to reduce its distribution in response to falling energy prices and has a hedging program to support the current distribution rate even at in the current low price environment. MEMP yields 12.8% and the share price would climb 40% to bring the yield down to 9% if crude prices moved above $80 per barrel.

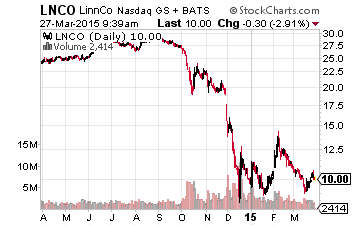

The shares of LinnCo LLC (Nasdaq:LNCO) are the Form 1099 tax reported version of the units of Linn Energy LLC (Nasdaq:LINE). The LNCO shares can be used to make shorter term trades with the MLP tax issues to profit from rising oil. While you wait, LNCO currently yields 12.3% with monthly dividends.

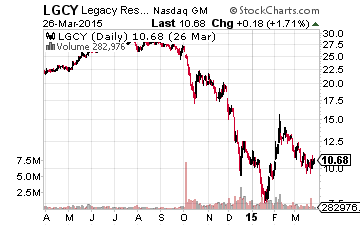

If you want an aggressive play on higher crude oil prices, consider Legacy Reserves LP (Nasdaq:LGCY). Legacy also has not cut its distribution rate. But management has acknowledged that the company must either make a major, low price asset acquisition or see higher energy prices to continue the current distribution rate. The market is betting on a distribution reduction and LGCY yields 23% with the most recent quarterly distribution rate. If Legacy is somehow able to maintain the distribution, the unit price could easily double.

REITs that raise their dividends, like the ones above, have been an integral part of the income strategy with my newsletter, more