$10,000 Thursday – Hedging Pays Off – Again!

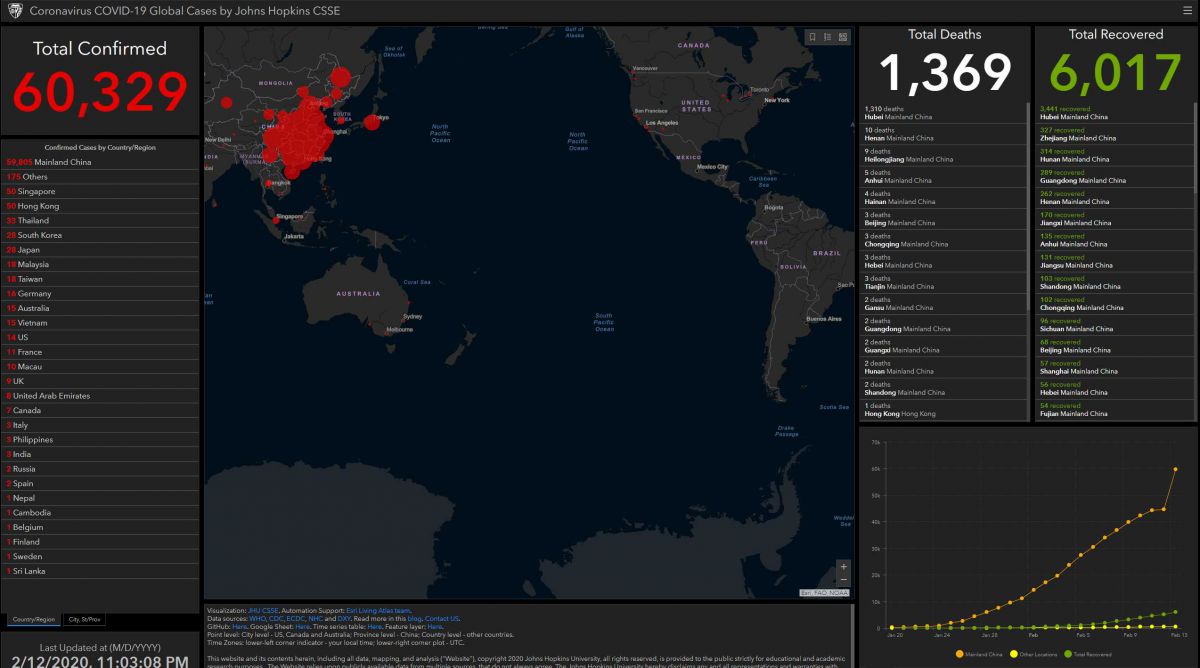

60,329 infected, 1,369 dead.

Yes, that's up 33% from YESTERDAY due to a "reclassification" of certain patients (from alive to dead?) or some would say it's the unraveling of a cover-up in China, where conditions are significantly worse than we have been led to believe by the Mainstream Media – whose primary goal is to keep us shopping at all costs...

Fortunately, our paranoia is paying off and the Nasdaq (/NQ) hedges we suggested in yesterday morning's PSW Report (and reiterated in our Live Trading Webinar, of course) are already up over $7,000 and the S&P 500 (/ES) hedges are up $4,550 as of 7:30 AM. We'll put a stop on the set at $10,000 (3,350 on /ES and 9,550 on /NQ) to lock in those gains and we'll just add it to our CASH!!! pile because, as I said in the Webinar – I don't want to run out and buy things until next week when we will hopefully have a clearer picture of what's going on in China.

Unfortunately, the picture we have today is NOT GOOD:

Let's just say that uptick on the chart is "disturbing" but I'm more disturbed by the very slow climb in recoveries (green) as that's a very long slope, between infection and recovery and 6,017 recovered and 1,369 dead is not the best survival percentage (81.5%). If the common flu was only 80% survivable – do you think you would change your habits? Again, I don't like to be an alarmist but no one else seemed to be alarmed this week so my concerns sounded alarmist – but I'm just being CONSERVATIVE – which I hear is quite in fashion these days…

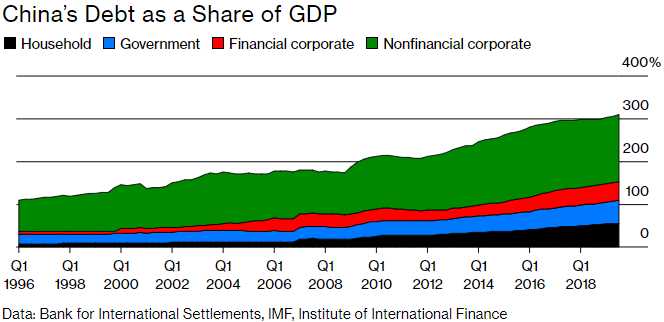

My other concern in China, as I noted yesterday as well, is their looming debt bomb and Bloomberg picked up on my theme and wrote a good article summarizing the situation but I think this chart says it all – WORSE THAN JAPAN!

300% of their GDP is debt and half of it has been added since the Financial Crisis (10 years) so we're talking about $23 TRILLION in debt added in 10 years, which is about 15% of China's GDP added in debt each year to hit their 7% growth targets. Is that sustainable? Sure, the same way you can take the family to Disney every week and stay in fancy hotels and eat in great restaurants – as long as your credit card companies don't cut you off and as long as you don't mind going home and seeing the bill.

Of course, Disney is closed in China and so are most movie theaters and malls and restaurants and schools… Yet we are all happily pretending that it will not have a big effect on their economy – let alone ours!

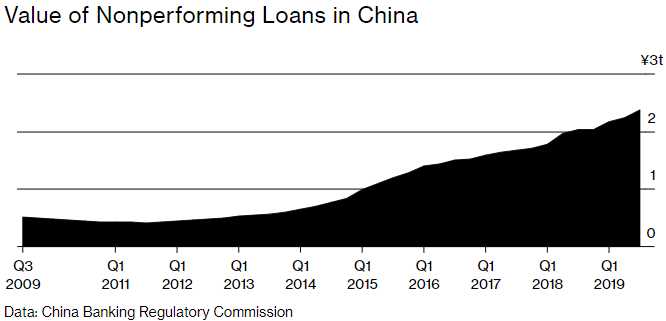

You're going to see that bad loan chart spike up like Corona cases very soon – over $500Bn in bad loans is more than enough to topple any banking system – enough to topple the global banking system, in fact. It's about the same as what Greece owed back in 2008 – and they never actually defaulted. At the moment, it is believed China will bail out all this bad debt but China's economy is half the size of ours and you know what it took for the US to arrange $700Bn in TARP funding back in the day – our entire economy was collapsing before the Government was willing to take that step – hopefully China acts this month or it may be too late.

Meanwhile, The virus risks further damping the outlook for European economic growth. The ECB is already on alert over the newly emerged threats. Spanish policy maker Pablo Hernandez de Cos added to the chorus of officials, saying the coronavirus is compounding risks for the region after some earlier signs of stabilization. Chief Economist Philip Lane said on Wednesday the economy could experience a “pretty serious short-term hit.”

World fuel consumption – which had previously been expected to grow by 800,000 barrels a day during the three-month period, compared with a year earlier – will instead contract by 435,000 a day, the IEA said in its monthly oil market report. Car sales in China plunged to fresh lows in January as the coronavirus kept buyers away from showrooms, intensifying the gloom hanging over the industry. Sales to dealerships fell 20% to 1.61 million cars last month, the China Association of Automobile Manufacturers said. That’s the biggest monthly drop since January 2012.

You can see from this chart that EVERYBODY is being affected by interruptions in deliveries of Chinese auto parts and you can build 99% of a car but YOU STILL CAN'T SELL IT WITHOUT THAT LAST PART – keep that in mind…

That's Shanghai, by the way, not Wuhan. 24M people live in Shanghai and there's just one guy on the street. Again, I don't want to be all doom and gloom but this is serious people and I know it sucks to miss a rally but I'd rather miss a rally than get caught in a massive sell-offs because it's the sell-offs that kill your lifetime portfolio performance – not the gains you miss out on. We had a whole decade of gains wiped out in 3 months in 2008 and here we are again, at the top of a rally that's "never going to stop" because "this time is different" and the Financial Media is playing the same old song:

If this nonsense sounds familiar to you when you are watching the Financial Media today – be afraid – be very afraid!

Click here to try Phil's Stock World free. Try PSW's ...

more