Global Markets On Edge Ahead Of Powell Speech, 2s10s Dips In And Out Of Inversion

Global stocks, US equity futures, and the dollar rose on Friday ahead of a much anticipated speech by Jerome Powell which the market hopes will provide clarity on whether the Fed will deliver another interest rate cut in three weeks, and whether it will be 25 or 50bps.

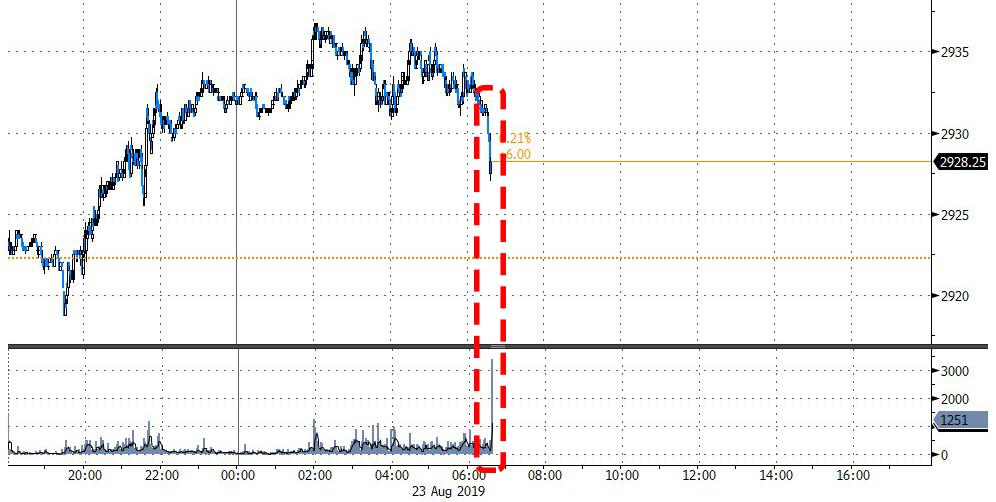

The levitation was hit, however, just after 630am when Global Times EIC tweeted that a Chinese retaliation to the latest round of US tariffs is coming.

Twitter trolling notwithstanding, the MSCI All Country World Index was up 0.1% and set to break a three-week losing streak.

European stocks rebounded from the previous day’s falls, with the European Stoxx 600 index gaining as much as half a percent in early deals, and were set for the best weekly gain since June, clearly indicating confidence that Powell would not reveal any hawkish surprise. Britain’s FTSE 100 index was up 0.64%.

Earlier in the session, the MSCI Asia index ex Japan rose 0.3% and was up 1.0% for the week, on track to break a four-week losing streak. Japan’s benchmark Nikkei advanced 0.4% and Australian stocks added 0.3%. Energy producers and utility companies led gains. Most markets in the region were up, with India and Thailand among the top performers. The Topix added 0.3%, supported by electronic firms and retailers. Japan’s highly manipulated and goal seemed CPI stayed unchanged in July amid speculation that the central bank will boost stimulus. The Shanghai Composite Index rose 0.5% for its best week since June, with Kweichow Moutai Co. and Jiangsu Hengrui Medicine Co. among the biggest boosts. China and U.S. deputies had a “productive call” on trade negotiations Wednesday, Larry Kudlow told Fox Business although that was rejected hours later when the Global Times said China is preparing for retaliation and the US "will feel the pain." India’s Sensex advanced 0.7%, driven by Reliance Industries Ltd. and Tata Consultancy Services Ltd. after an official said the government may soon reverse a planned tax on foreign investors

Volumes, as has been the case, were lethargic with traders unwilling to commit capital ahead of today's main event, when Powell is due to speak at 10am at Jackson Hole, Wyoming. While markets overwhelmingly expect the Fed to follow up its first rate cut in a decade with more stimulus at its meeting next month, a trio of policymakers sounded less than keen. On Thursday, Kansas City Fed President Esther George, who dissented against the decision to ease in July, Philadelphia Fed President Patrick Harker, who said he “reluctantly” supported the cut, and Boston Fed's Rosengren all said the U.S. economy did not need more stimulus at this point.

This hawkishness was somewhat offset by Dallas Fed President Robert Kaplan who said businesses had become much more cautious due to surprises on trade policy and he was “going to at least be open-minded about making some adjustment” if he saw continued weakness. That has made Powell’s speech pivotal for markets as they look for any clues on future policy direction, according to Reuters.

“Judging by the minutes from the July meeting the central bank seems content to sit on their hands, but it is worth remembering the U.S.-China trade situation has intensified, and so has the unrest in Hong Kong, and that might prompt Mr. Powell to be a touch more dovish than he was in late July,” said David Madden, markets analyst at CMC Markets in London.

In the U.S. bond market, the 2-10 year yield curve briefly moved back into inversion territory overnight, a shift that also occurred yesterday and for the first time since the crisis, last week, and hit financial markets amid worries that it presaged a sharp global downturn.

“There’s been no jaw-dropping news this week but we have had incrementally less bond-friendly news - the FOMC minutes, the euro area PMIs, and Fed speakers in recent days that give the impression that July was an insurance rate cut,” said Standard Chartered FX strategist John Davies. "This has dragged the market away from speculating about 25-50 basis points rate cut in September to a discussion on a 25 bps cut to will they cut rates, so a bit more uncertainty has been injected into markets."

European bonds were rangebound, while Italian bonds fell after President Sergio Mattarella gives rival parties more time to put together a new parliamentary majority.

In FX, the euro eased marginally to $1.1073, while the pound fell half a percent to $1.2195, reversing most of the gains made on Thursday after traders interpreted encouraging comments on Brexit from German Chancellor Angela Merkel to mean a solution to the Irish border problem could be found before Britain leaves the EU on Oct. 31.

The closely watched Chinese yuan recovered some ground after hitting an 11-1/2 year low. Spot yuan slid to as low as 7.0992 per dollar, its weakest since March 2008. China’s central bank set the midpoint rate at 7.0572, its weakest level in 11-1/2 years but much stronger than traders had expected.

The kiwi led G10 currency gains after Governor Adrian Orr said New Zealand’s central bank can afford to wait and see before deciding on further steps to support economy.

Finally, the Bloomberg Dollar Spot Index held near year-to-date highs ahead of Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole. Perhaps more notable is that the broadly trade-weighted dollar just hit an all-time high, making the probability of a direct US intervention in the currency especially high.

In commodities, oil prices weakened, with both Brent crude and U.S. West Texas Intermediate down 0.1%. Brent crude traded at $59.89 per barrel and WTI crude at $55.31. Gold eased and was set for its worst week in nearly five months. Spot gold was down 0.2% at $1,495.60 an ounce.

Besides the Jackson Hole speeches (full schedule here) expected data include new home sales. Foot Locker reported poor earnings, and dismal same-store sales, sending its stock plunging.

Market Snapshot

- S&P 500 futures up 0.4% to 2,933.50

- STOXX Europe 600 up 0.5% to 376.29

- MXAP up 0.3% to 152.25

- MXAPJ up 0.4% to 493.20

- Nikkei up 0.4% to 20,710.91

- Topix up 0.3% to 1,502.25

- Hang Seng Index up 0.5% to 26,179.33

- Shanghai Composite up 0.5% to 2,897.43

- Sensex up 0.8% to 36,760.48

- Australia S&P/ASX 200 up 0.3% to 6,523.13

- Kospi down 0.1% to 1,948.30

- German 10Y yield rose 1.8 bps to -0.626%

- Euro down 0.09% to $1.1070

- Italian 10Y yield fell 2.5 bps to 0.96%

- Spanish 10Y yield rose 3.4 bps to 0.175%

- Brent futures down 0.2% to $59.81/bbl

- Gold spot down 0.1% to $1,495.91

- U.S. Dollar Index up 0.2% to 98.35

Top Overnight News from Bloomberg

- Italy’s center-left Democrats have until Tuesday to form a coalition with their long-time rivals, the anti-establishment Five Star Movement, after President Sergio Mattarella gave them more time to put together a new parliamentary majority.

- Emmanuel Macron said Group of Seven leaders gathering in Biarritz, France, Saturday must tackle head on the fires in the Amazon jungle, establishing the summit’s first flash point. "Our house is burning. Literally," the French president wrote in a tweet late Thursday. "It is an international crisis."

- Three Federal Reserve policy makers voiced their resistance to the notion that the U.S. economy needs lower interest rates

- Dallas Fed President Robert Kaplan said he supported the central bank’s move to cut its benchmark interest rate by a quarter-point last month -- and is open to another reduction in the months ahead, according to WSJ.

- New Zealand’s central bank will do “whatever it takes” to support the economy and will monitor the inflationary impact of this month’s unexpectedly large interest rate cut before considering further easing, Orr said

- Italy’s center-left Democrats have until Tuesday to form a coalition with the anti-establishment Five Star Movement after President Sergio Mattarella said he was giving parties more time to try and put together a new parliamentary majority

- Japan’s key inflation gauge remained unchanged in July amid increasing speculation that the Bank of Japan may ramp up its stimulus as early as next month

- Germany’s central bank doesn’t see a need for fiscal stimulus at this time, even though it expects the economy to shrink again this quarter, according to two people familiar with the Bundesbank’s stance

- Japan’s sovereign debt market is in danger of joining Germany with negative bond yields across all maturities

- Investors are starting to question the epic bond rally that’s driven global yields to new lows and fueled the U.S. Treasury market’s best performance since the era of quantitative easing.

- Volkswagen AG is exploring potential investments in Chinese automotive suppliers as it seeks to secure access to key technology in the world’s largest car market, people familiar with the matter said

- Donald Trump’s lawyers will be in a New York courtroom Friday trying to block Democrats’ access to financial records from Deutsche Bank AG and Capital One Financial Corp. -- and House Speaker Nancy Pelosi has much at stake over the outcome

Asian equity markets traded with cautious gains as participants await Fed Chair Powell’s looming speech at the Jackson Hole Symposium and after the lack of conviction on Wall St. where risk appetite was dampened by hawkish Fed rhetoric, as well as decade-low US Manufacturing PMI data. ASX 200 (+0.3%) was positive with stock news in Australia dominated by earnings including Goodman Group and Sims Metals which have surged due to profit growth, although upside in the index was limited by weakness in the commodity sectors especially gold miners after the precious metal slipped below USD 1500/oz level. Elsewhere, Nikkei 225 (+0.4%) was supported by favorable currency moves, while Hang Seng (+0.5%) and Shanghai Comp. (+0.5%) were higher despite early indecisiveness after China’s MOFCOM reiterated its threat to retaliate against the US in the trade dispute and amid mixed signals from the PBoC in which they conducted reverse repos but resulted to a net liquidity drain for the week and softened its reference rate, although not as weak as anticipated. Finally, 10yr JGBs were subdued amid similar weakness in T-notes and as stocks in the region eked mild gains, although downside was stemmed amid the BoJ’s presence in the market for over JPY 1.2tln of JGBs in 1yr-10yr maturities.

Top Asian News

- India May Roll Back Tax on Foreign Investors, Official Says

- Delinquencies Jump After Bangladesh Central-Bank Move Backfires

- A 203-Year-Old Trading Empire Faces China’s Wrath Over Hong Kong

European equities opened and remained on a somewhat firmer footing (thus far) [Eurostoxx 50 +0.3%] on the last trading day of the week which follows on from an initially cautious Asia-Pac session before sentiment turned for the better ahead of Fed Chair Powell’s opening remarks at the Jackson Hole Symposium at 1500BST/1000EDT. Sectors are mostly in the green with the exception of the energy sector which coincides with recent losses in the oil complex. Meanwhile, the IT sector outperforms as stellar earnings from US-listed Salesforce.com (+6.8% pre-market) provided tailwinds to DAX heavyweight SAP (+0.6%), which accounts for around 1.5% of the Stoxx 600 index. In terms of individual movers, Thyssenkrupp (+0.7%) opened higher amid source reports that it is planning to merge its steel unit with Klöckner (+8.3%). Also, it’s worth keeping in mind a report by Politico which stated that EU Officials are seeking to create a EUR 100bln wealth fund in order to bolster ‘European Champions’ against American and Chinese business rivals such as Apple (+0.6% pre-market), Google (+0.9% pre-market) and Alibaba (+0.9% premarket).

Top European News

- Hasbro Agrees to Buy Producer of Peppa Pig Show for $4 Billion

- Woodford Raises About $800 Million Since Freezing Flagship

- Commerzbank Considers Cutting Up to 2,000 Additional Jobs

- Italian Bonds Fall as Positions Pared Ahead of Powell, G7 Meet

In FX, the Greenback has nudged up a bit further from post-US manufacturing PMI lows that saw the DXY skirt 98.000, and the index is now edging back up towards wtd peaks just shy of 98.500 posted on Tuesday within a 98.185-436 range. Relatively hawkish rhetoric from Fed’s George and Harker have underpinned the Buck ahead of Chair Powell’s keynote speech that is being eyed for clearer policy guidance given this week’s FOMC minutes highlighting divisions between voters beyond the 2 dissenters against July’s 25 bp insurance/mid-cycle rate cut.

- NZD/GBP - Not quite all change, but positions and roles have partially reversed for the Kiwi and Pound following supportive comments from RBNZ Governor Orr and less euphoria/hype about the prospect of formulating a plan for the Irish backstop that is mutually acceptable for the UK and EU. To recap, NZ’s Central Bank head indicated that the recent larger than expected OCR ease (1/2 point) affords some time for assessment before deciding whether more stimulus is needed in November and effectively signally a pause next month, while French President Macron and German Chancellor Merkel have both been receptive to PM Johnson and the notion that a resolution to the Irish backstop impasse can be reached before it’s too late, but the ball and onus to come up with something different is back in UK hands. In response, Nzd/Usd has rebounded towards 0.6400, with AUD/Nzd back under 1.0600 as Aud/Usd pivots 0.6750 amidst the ongoing, incremental rise Usd/Cny mid-point rates, while Cable has retraced more of its gains through 1.2200 at one stage.

- CHF/JPY - The Franc and Yen are both weaker vs the Dollar as US Treasury yields rise and the curve steepens, while safe-haven demand is also waning with global trade and geopolitical tensions still prevalent, but not escalating (at present). As such, Usd/Chf and Usd/Jpy are firmer around 0.9850 and 106.50 handles respectively.

- CAD/EUR - The Loonie and Euro remain relatively rangebound vs the Greenback circa 1.3315 and 1.1065, with the former looking for more independent inspiration from Canadian retail sales data after failing to glean any real or lasting impetus via firm CPI and other minor macro inputs this week (wholesale trade and manufacturing sales). Meanwhile, the single currency is hanging on above 1.1050 and the 2019 base (1.1029) awaiting insight from Fed’s Powell, September’s ECB policy meeting to see how much stimulus is delivered after minutes underlining heightened economic concerns and what happens next in Italy on the political front.

- EM - The Rand is outperforming and clawing back recent losses vs the Buck with a less downbeat/negative take from Moody’s on the SA fiscal outlook following extra financial assistance for Eskom helping alongside a less bearish technical backdrop as Usd/Zar reverses through 15.2500 and 15.1500 before basing around 15.1300.

- RBNZ Governor Orr reiterated a rate cut earlier reduces the likelihood of having to do more later and stated they will do whatever it takes to support New Zealand economy but can afford to wait and observe what is happening, while he added that they will see what the situation is like in November and will cut if necessary. (Newswires)

In commodities, WTI and Brent futures are choppy in a relatively tight parameter as all eyes turn to Fed Chair Powell for any hint on the magnitude of the widely anticipated Fed rate cut in September against the backdrop of some recent hawkish Fed rhetoric. WTI futures remain contained in a 55.20-60/bbl range whilst its Brent counterpart straddles on either side of 60/bbl. Elsewhere, gold is marginally softer intraday and remains below the 1500/oz mark, largely weighed on by a firmer Greenback, in anticipation for the Fed Chair’s speech. Copper, on the other hand, is rebounding off recent lows, albeit prices remain below 2.6/lb with desks citing US-China optimism as a driver, although a retracement of recent losses/some profit-taking may also be factors. Meanwhile, Dalian iron ore surged over 3% overnight following the ruthless sell-off in recent days, also potentially due to profit-taking heading into a risk-packed weekend. Finally, ING notes that the recent surge in Nickel prices seem to be running out of steam after prices declined around 4% this week. “The speculated supply disruptions from Indonesia have not materialized yet, whilst the demand-side continues to face pressure as margins for stainless steel producers take a hit” the analysts state.

US Event Calendar

- 10am: New Home Sales, est. 647,000, prior 646,000

- 10am: New Home Sales MoM, est. 0.16%, prior 7.0%

- 10am: Annual Federal Reserve Policy Symposium in Jackson Hole

DB's Craig Nicol concludes the overnight wrap

The annual spotlight on the tiny Wyoming resort of Jackson Hole is once again upon us today with the big event being Fed Chair Powell’s speech at 10 am EST/3pm GMT. Given that we haven’t heard much out of the Fed in recent weeks and that since the last FOMC meeting we’ve had another round of trade war tensions, global growth slowdown fears and further steep drops in bond yields, the event couldn’t come soon enough. All those concerns are crystalizing today after the 2y10y curve closed in negative territory last night for the first time since 2007. As we know, the symposium has had its fair share of moments, most notably in 2014 when Draghi laid the groundwork for QE and in 2012 when Bernanke hinted at QE3. However, with the market pricing in 57ps of cuts this year and a further 47bps in 2020, the dovish bar is already set fairly high for Powell.

As a reminder, the topic of this year’s event is the sufficiently vague “Challenges for Monetary Policy”. The immediate focus of Powell’s speech will likely be whether he affirms that the current easing is a ‘mid-cycle adjustment’ as per the FOMC minutes or align more closely to market pricing. In his note from two days ago (see here ), DB’s Alan Ruskin believes that if Powell sticks to the old language as is most likely, it would affirm that he is still confident that the strength of consumption, in combination with modest Fed easing, will be sufficient to keep the recovery broadly on track. Alan believes that while this is implicitly slightly more hawkish than the market, pricing will not shift dramatically given it has already moved in that direction after the FOMC minutes on Wednesday.

The agenda for the event was released last night and other potentially interesting agenda items to keep watch for apart from Chair Powell’s speech include a panel on “monetary policy divergence” and one on “monetary policy spillovers.” So today’s sessions will focus on the international angle to central bank policy, followed by another panel on “what does it mean to be a data-dependent central banker?” The panels on Saturday look a bit less impactful, with sessions on “commodity price shocks,” “financial markets,” and an economic overview from IMF chief economist Gita Gopinath.

Fed officials already descended on Jackson Hole yesterday, and we got an interesting trickle of comments from some regional presidents. Overall, the tone was on the hawkish side of expectations. Kansas City’s George said that she is not ready to provide more policy accommodation, Dallas’s Kaplan said “I’d like to avoid having to take further action,” and Philadelphia’s Harker said “I think we should stay here for a while and see how things play out.” And yes, he was talking about interest rates, not the beautiful resort in Wyoming.

Markets were in something of a holding pattern yesterday going into Powell’s speech with the main talking point being the PMI releases in Europe and the US. We’ll come to those shortly however in terms of markets, the S&P 500 finished -0.05% last night, with the NASDAQ lagging -0.36% and the DOW outperforming +0.19%. Markets in Europe ebbed and flowed before the STOXX 600 ended -0.40%. Meanwhile, in rates Treasuries continued to weaken slightly, with 10y yields up +2.2bps while the 2s10s curve finished below zero at -0.1bps. That marks the first close below zero and in inversion territory of this cycle. European bond yields were higher, mostly as a result of the ECB minutes from the meeting last month which at the margin were slightly hawkish. There appeared to be broad agreement to reintroduce the rates easing bias however “nuances were expressed” with regards to how the design and individual elements of a possible policy package could look. There was also a reference to how the risk of an unwarranted tightening of financial conditions was higher at the short end than the long end of the yield curve while there was also talk of concerns about possible “unintended consequences” with regards to tiering. European banks did, however, benefit from the move higher in yields, rallying +1.32%.

Overnight, markets in Asia have nudged higher with the Nikkei (+0.26%), Hang Seng (+0.48%), Shanghai Comp (+0.48%) and Kospi (+0.05%) all making advances. In FX, the New Zealand dollar is up +0.39% this morning after the country’s central bank governor said he could afford to wait before deciding whether to add more support for the economy. All other G-10 currencies are trading a bit weaker. Elsewhere, futures on the S&P 500 are up +0.33%. In terms of overnight data releases, Japan’s July CPI came in one-tenth lower than expected at +0.5% yoy while core CPI came in line with expectations at +0.6% yoy and core-core CPI came in one-tenth above expectations at +0.6% yoy.

Back to those PMIs yesterday, where although much was made of the beat at the headline level in Europe, the underlying details, particularly in Germany, were less than encouraging. Indeed composite readings in France (52.7 vs. 51.8 expected; 51.9 previously), Germany (51.4 vs. 50.6 expected; 50.9 previously) and the Euro Area (51.8 vs. 51.2 expected; 51.5 previously) all bettered expectations and rose from the month prior. It was a similar story for the services and manufacturing components with Germany’s manufacturing print coming in 0.4pts higher at 43.6 (vs. 43.0 expected) and the services reading at 54.4 (vs. 54.0 expected). That being said, it’s hard to ignore the fact that this is still the eighth contractionary manufacturing print for Germany in succession, while the details of Germany’s PMIs also revealed deterioration in total inflow of new business (for the third month in a row), new orders from abroad dropping across all sectors and for the first time in five years, a majority of firms expecting output to fall over the next twelve months. In addition, the decline in the order backlog accelerated some more and while the gap between manufacturing and services narrowed slightly, the dichotomy still very much remains.

All-in-all the data implies around +0.2% qoq GDP growth for the Euro Area in Q3, low +0.3% qoq in France and barely positive growth for Germany which fits with our economists view of a potential contraction in Q3 and therefore a technical recession. Staying with Europe it’s worth noting that the data was also less than encouraging in Sweden yesterday where the unemployment rate ticked up notably in July to 7.1% on a seasonally adjusted basis – and the highest since August 2016 - from 6.7% in June. That was after expectations were for a drop to 6.5%.

In the US the PMIs were also disappointing. That was especially the case for the manufacturing print which fell into the contractionary territory at 49.9 (vs. 50.5 expected) for the first time since 2009. The services reading also fell, to 50.9 (vs. 52.8 expected) from 53.0 last month which put the composite at 50.9 and matching the lows from May this year. As for what that means for growth, that corresponds to near 1.5% GDP growth in Q3 and Q4. Prior to that, the latest jobless claims data showed no signs of softness following a lower than expected 209k reading – which was the lowest in four weeks. Meanwhile the July leading index printed at 0.5%, up 0.6pp for the biggest increase since 2017, and the August Kansas Fed manufacturing survey fell to -6 from -1.

Meanwhile, Brexit headlines continued to flow, with the pound rallying +1.02% versus the dollar. Apparently headlines from Chancellor Merkel saying there is still time to find a solution to the backstop to avoid a no-deal Brexit sparked optimism. We remain skeptical that her comments signaled any change in position, and indeed President Macron said later that “we are not going to find a new withdrawal agreement that is far from the original.” Nevertheless, the pound did hold its gains.

Looking at the day ahead, the obvious focus will be on Fed Chair Powell’s speech at Jackson Hole this afternoon, with the only data due being July new home sales numbers in the US.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more