Global Economy Slowing In 2022 – Why And How Much

The war in Ukraine has triggered a costly humanitarian crisis that is crying out for a peaceful resolution. At the same time, economic damage from the conflict and other factors will contribute to a significant slowdown in global growth in 2022 and add to inflation.

Today, we’ll look at the reasons why worldwide economic growth is expected to slow this year and how much global GDP is expected to contract based on the latest forecasts from the International Monetary Fund (IMF).

The International Monetary Fund is an international financial institution, which lends money to mostly developing countries around the world. The IMF consists of 190 countries and is headquartered in Washington, D.C.

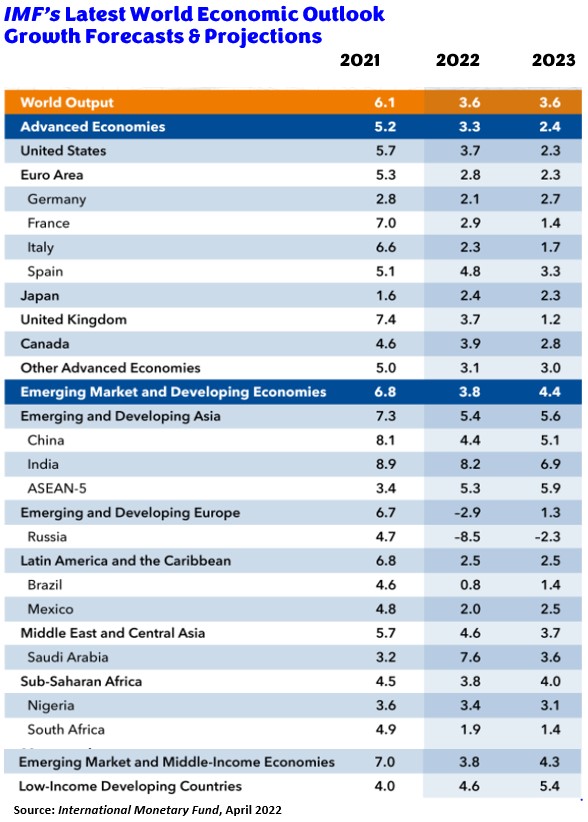

Based on the latest projections from the IMF, global growth is projected to slow from 6.1% in 2021 to only 3.6% in 2022 and 2023. This is a huge reduction from what the IMF was predicting late last year. Below are their latest forecasts from late April of this year by country and region compared to real growth achieved in 2021. Some of the numbers are eye-popping.

You will notice that the global slowdown predicted by the IMF will affect some countries and regions more than others. The IMF attempts to tailor its country-by-country projections to reflect how each nation will be affected in 2022 and 2023.

And the newly predicted slowdown doesn’t stop there. Beyond 2023, global growth is forecast to decline to about 3.3% over the next several years. Here are just some of the reasons the IMF cites for its latest significant downward reductions.

Global growth is expected to slow significantly in 2022, largely as a consequence of the war in Ukraine. A severe double-digit drop in GDP is expected in Ukraine due to the heavy cost of the war. At the same time, a deep contraction is projected for Russia due to sanctions and European countries’ decisions to scale back energy imports from Russia.

The economic costs of the war are expected to spread farther afield through commodity markets, trade, and – to a lesser extent – financial interlinkages. Fuel and food price rises are already having a global impact, with vulnerable populations – particularly in low-income countries – most affected.

War-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7% in advanced economies and 8.7% in emerging market and developing economies – 1.8 and 2.8 percentage points higher than projected last January. As noted above, fuel and food prices have increased rapidly, hitting vulnerable populations in low-income countries hardest.

The IMF also points out that multilateral efforts to respond to the humanitarian crisis, prevent further economic fragmentation, maintain global liquidity, manage debt distress, tackle climate change and end the pandemic are all essential but won’t be cheap, further weakening the global economy and adding upward pressure on inflation.

The IMF also warns that the world has taken on unprecedented debts to fight the COVID pandemic. Soon after the pandemic hit, exceptional measures were deployed to maintain private access to credit, staving off a deeper recession in 2020 and 2021. While highly effective in supporting the global economy, these policies also led to a surge in consumer and business indebtedness.

The IMF believes this greatly increased borrowing will affect the global recovery’s pace. I agree. Plus, empirical analysis based on macro- and micro-level data reveals that aggregate private debt figures do not tell the whole story, and the recovery could be weaker in some countries depending on how much debt they took on and a slew of other factors.

The IMF goes on to discuss these other factors in detail in its latest WORLD ECONOMIC OUTLOOK REPORT published in late April. You can download the full report for FREE and examine all of the IMF’s latest forecasts and analysis.

At that same link, you can download a host of other interesting commentaries and analyses from the economists and researchers at the IMF which are free as well.

I must warn you, however, that the IMF is quite liberal in its overall view of the world, so you probably won’t agree with some of their proposed solutions to the world’s problems. Nevertheless, they put out some very detailed analysis which is usually accurate regardless whether you agree with their solutions.

The bottom line is, world economic growth is expected to slow over the next several years and perhaps beyond. I agree with this forecast. Yet while this is disappointing, world economic growth is expected to continue to expand, just at a slower rate than we’ve seen in recent years. It’s not the end of the world as the gloom-and-doom crowd would have us believe.