Get Greedy With These Three High-Yield Dividend Stocks While Everyone Else Is Fearful

Six weeks after the Chinese government verified its existence, the investing world has become fearful that the spread of the coronavirus will negatively affect business results. History shows us that fear-driven stock market sell-offs will soon look like great buying opportunities in the rearview mirror.

After decades of experience in the market, I developed my Dividend Hunter strategy as a path for investors to be successful in the stock market through unexpected declines in stock prices. It’s easy to make money when the markets are going up. It’s impossible to predict big declines and how far they will fall. My goal for my subscribers is to get them to focus on building an attractive dividend income stream.

When the goal is to increase the amount and yield of your dividend income, it becomes easier to be willing to add shares when the investing public is gripped by fear. If you buy shares of a high-yield stock that has fallen, you average down your cost basis and average up your yield on cost.

Commercial mortgage real estate investment trusts (REITs) are one high-yield stock group that should hold up well through the current, coronavirus driven scare. These are companies that originate and own mortgages on commercial properties.

Compared to residential mortgages, commercial mortgages have lower low to values and are usually adjustable rate. The commercial mortgage REITs pay very attractive dividend yields with moderate amounts of leverage for their loan books.

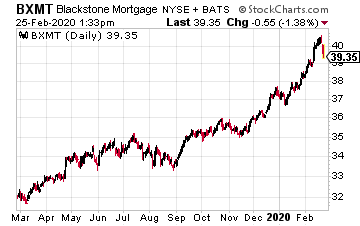

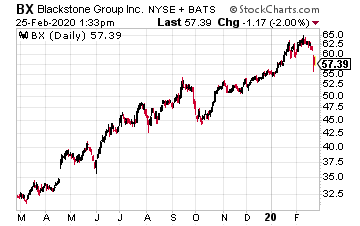

Blackstone Mortgage Trust, Inc. (BXMT) is a pure commercial mortgage lender. The REIT receives high-quality mortgage lending leads from its sponsor, The Blackstone Group L.P. (BX).

As of its 2019 third-quarter earnings, BXMT had a $16.4 billion portfolio of senior mortgage loans. In the quarter, the company originated $3.7 billion of new senior loans and received about $3 billion of principal paybacks.

94% of the portfolio is floating rate. The loans were at 62% loan to the value of the underlying properties. Leverage is 2.8 times debt to equity.

The stock currently yields 6.2%.

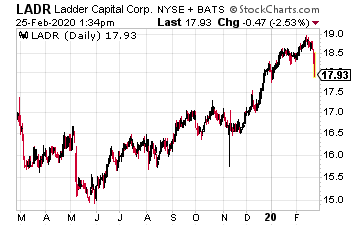

Ladder Capital Corp (LADR) uses a three-prong approach to its investment portfolio. The three legs are commercial mortgage loans, with a current $3.4 billion portfolio of floating and fixed-rate loans, commercial real estate equity investments, valued at $981 million, and commercial MBS bonds, worth $1.9 billion.

The business plan is that the three groups cycle to more or less attractive through the commercial real estate cycle, each being more attractive at different phases of the cycle. Leverage is a comfortable 2.6 times.

Since it paid its first dividend for Q1 2015, Ladder has steadily increased the quarterly payout at an average 5% annual growth rate.

The shares currently yield 7.3%.

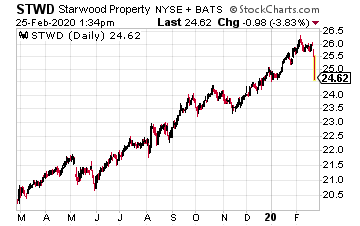

Starwood Property Trust, Inc. (STWD) is one of the largest commercial lenders of any business type – including banks. The company currently has an $8.0 billion loan portfolio with a 65% loan to value.

Since launching in 2009, the company has deployed over $40 billion in loans and investments with zero realized losses. In recent years, Starwood has acquired the largest commercial mortgage special servicer. This acquisition has led to growth in CMBS origination and investments.

The company also owns a $2.7 billion equity commercial property portfolio that generates 9% to 12% cash on cash returns. Recently Starwood has invested in non-agency residential MBS.

The $1.2 billion RMBS portfolio has a 68% loan to value. Management constantly looks for investment opportunities both in and out of the commercial mortgage business.

STWD current yields 7.4%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more