From Whatever It Takes To Retiring Transitory – The End Of The Post-COVID-19 Bubble

On Monday, March 23, 2020, before the market opened – in the midst of the COVID-19 panic – Chairman Powell essentially told financial markets that he would do whatever it took to support financial markets:

"The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions." – FOMC Statement March 23, 2020

On Tuesday, Nov. 30, 2021 – in testimony before Congress – Powell effectively announced the winding down of this period of unprecedented monetary stimulus when he said that it was time to retire the word “transitory” with respect to inflation. On Wednesday, Dec. 15, 2021, Powell and the Fed followed through on their newfound concern with inflation, doubling the pace of their asset purchase tapering to end in March 2022.

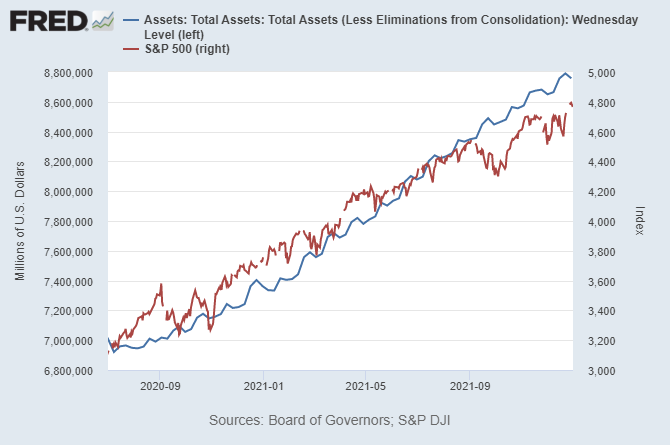

As you can see in the chart above comparing the increase in the Fed’s balance sheet with the rise in the S&P 500, there has been an almost one to one correlation for at least the last 18 months. This is no accident as it is not correlation.

The Fed’s enormous purchases of treasuries and mortgage backed securities have flooded the financial markets with cash, and much of that cash has found its way into stocks. As the Fed decreases its asset purchases in 2022, it’s all but inevitable that the pace of stock market gains will slow – and likely reverse.