Friday Consolidates Gains For The Week

There wasn't a whole lot to say about Friday's trading. The solid move made over the course of the week across indices was maintained with either small losses or doji. Part of this is because indices are now approaching multi-year highs which will see increased resistance.

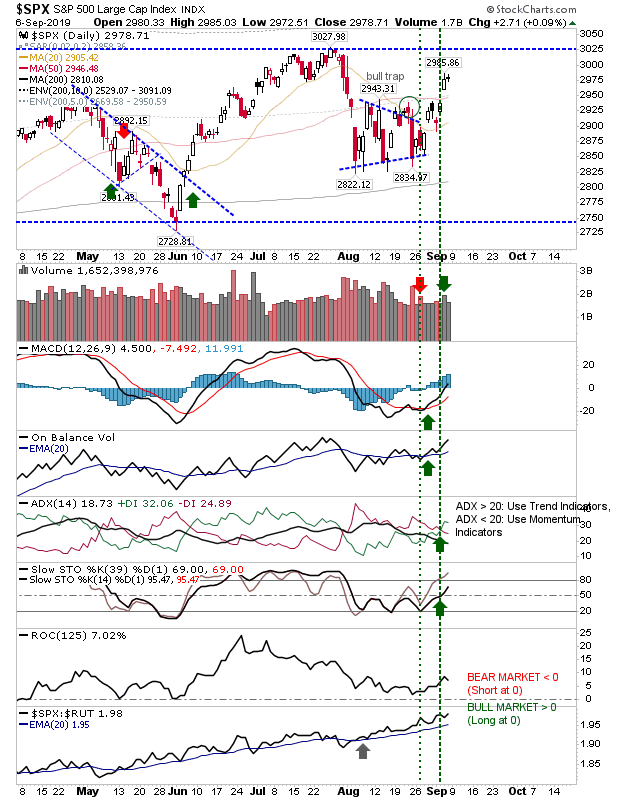

The S&P posted a small doji as technicals remained net bullish.

The Nasdaq posted a small loss which was enough to stall a net bullish turn in technicals. However, another one day gain would probably be enough to reverse the 'sell' trigger in On-Balance-Volume and turn technicals net bullish.

While the Nasdaq experienced a small loss, the Semiconductor Index looks to keep control of bullish momentum with it only finishing on a doji.

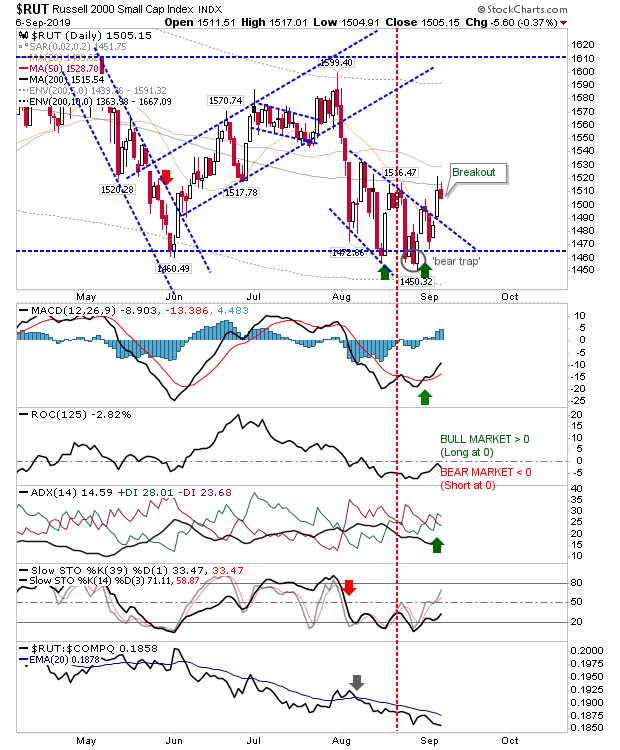

The Russell 2000 also took a small loss. Key for this index will be for it to hold the consolidation breakout; it does have a long way to go to make up lost ground on other indices.

The relationship between Discretionary and Staples had consolidated for most of 2018 and 2019, but this relationship is in the process of breaking down, which would be bearish for the market.

Likewise the relationship between the Dow Indices and Dow Transports has accelerated lower, which is another tick in the bear market column

Monday will be about pushing the advantage of last week in the indices and improve the secular picture which is edging in favor of bears.