Foundations Of ESG Investing: How ESG Affects Equity Valuation, Risk, And Performance

- Guido Giese, Linda-Eling Lee, Dimitris Melas, Zoltán Nagy, and Laura Nishikawa

- Journal of Portfolio Management

- A version of this paper can be found here

What are the research questions?

We have done a fair amount on the investment merits of ESG investing, but the question of how ESG affects the fundamental performance of a firm (in a causal fashion) is addressed in this study. For example, this paper askes questions such as, “Are high ESG scoring firms more adept at managing their risks, thus leading to higher valuations? Or is it the reverse: are firms with higher valuations better able to manage and improve ESG activities, thus leading to higher ESG scores?”

Instead of using a correlation-based analysis, the authors of this study attempt to derive an understanding of the causal relationship of ESG by examining the transmission channels found in discounted cash flow models, specifically between cash flow, risk and valuation channels, and ESG scores.Certainly, this is an interesting approach grounded in firm fundamentals with the goal of producing evidence explaining the economics that underlies the performance of high and low ESG scoring firms.

- Is there convincing evidence for the cashflow channel as proposed by Gregory, Tharyan, and Whittaker (2014)?

Source: Lasse H. Pedersen, Shaun Fitzgibbons, Lukasz Pomorski, Responsible Investing: The ESG-Efficient Frontier, October 10, 2019

2. How well do High ESG scoring firms manage business and operational risks (idiosyncratic tail risk) as described by Godfrey et al. (2009); Jo and Na (2012) and Oikonomou et al. (2012)?

Source: Lasse H. Pedersen, Shaun Fitzgibbons, Lukasz Pomorski, Responsible Investing: The ESG-Efficient Frontier, October 10, 2019

3. Does a strong ESG profile lead to higher valuations as delineated by Eccles et al. (2014); El :Ghoul et al. (2011) and Gregory et al. (2014)?

Source: Lasse H. Pedersen, Shaun Fitzgibbons, Lukasz Pomorski, Responsible Investing: The ESG-Efficient Frontier, October 10, 2019

4. What about causality?

5. Given the results of causality tests, is there a link between changes in ESG ratings and future return performance between highest and lowest ESG scoring firms?

What are the Academic Insights?

- YES. The cash flow channel works something like this: firms with strong ESG profiles are more competitive because they use resources more efficiently, are better at developing human capital and managing innovation, better long term planning and have better incentives for senior management.This leads to the ability to generate excess returns, higher profitability, and ultimately higher dividends.Empirical evidence presented here supported parts 2 and 3 of the cash flow channel.Highest ESG scoring firms were more profitable and had higher dividends than the lowest ESG scoring firms.

- VERY WELL. The risk channel is geared to the incidence of negative tail risk events. Firms with ESG scores have better risk management and better compliance standards.This leads to a lower incidence of extreme events like fraud, corruption, and litigation along with the consequent negative impact on the firm value or tail risk.A lower incidence should lead to fewer stock-specific downside moves in the firm’s stock price (i.e. tail risk).The authors report a significantly lower incidence of tail risk events for high ESG scoring firms than the lowest ESG scoring firms. Measured as the frequency of large negative idiosyncratic movements in the stock’s price, the number of stocks that realized at least a 95% cumulative loss over a 3 year period was calculated for high ESG scoring firms (.719 firms) and low scoring firms (2.180 firms). This result was robust to the size of the drawdown (25%, 50%, 95%) and drawdown periods (3 and 5 years). Residual volatility of CAPM-style returns was also calculated and exhibited significantly lower specific (idiosyncratic risk) for the highest ESG scoring firms.

- YES. The valuation channel is governed by a firm’s exposure to systematic risk.Following the CAPM argument, high ESG scoring firms will have less vulnerability to market shocks, lower betas and ultimately lower expected returns and costs of capital.In the DCF model, a higher valuation is the result.The authors argue this channel is consistent when multifactor costs of capital are assumed.High ESG scoring firms exhibited lower volatility in terms of exposure to common factor risks, lower betas and lower recent 5-year volatility of earnings when compared to low scoring firms. Consistent with lower costs of capital, ratios of book-to-price and earnings-to-price exhibited higher market valuations for high ESG scoring firms.

- Three tests of causality were conducted: for changes in the volatility of common factor risk, changes in beta, and changes in valuation–all relative to 3 buckets: decreases in ESG scores, increases in ESG scores and no change. The changes in financial variables were observed over a 3-year time period after the change in ESG rating occurred. Results were presented across the 3 rating change buckets. Upgrades in ESG ratings were associated with declines in a firm’s systematic risk profile and declines in beta compared to neutral or downgraded companies. Upgrades in ESG ratings were associated with increases in valuation as measured by relative declines in earning-to-price ratios. One CAVEAT: Significance tests were not reported in the article.

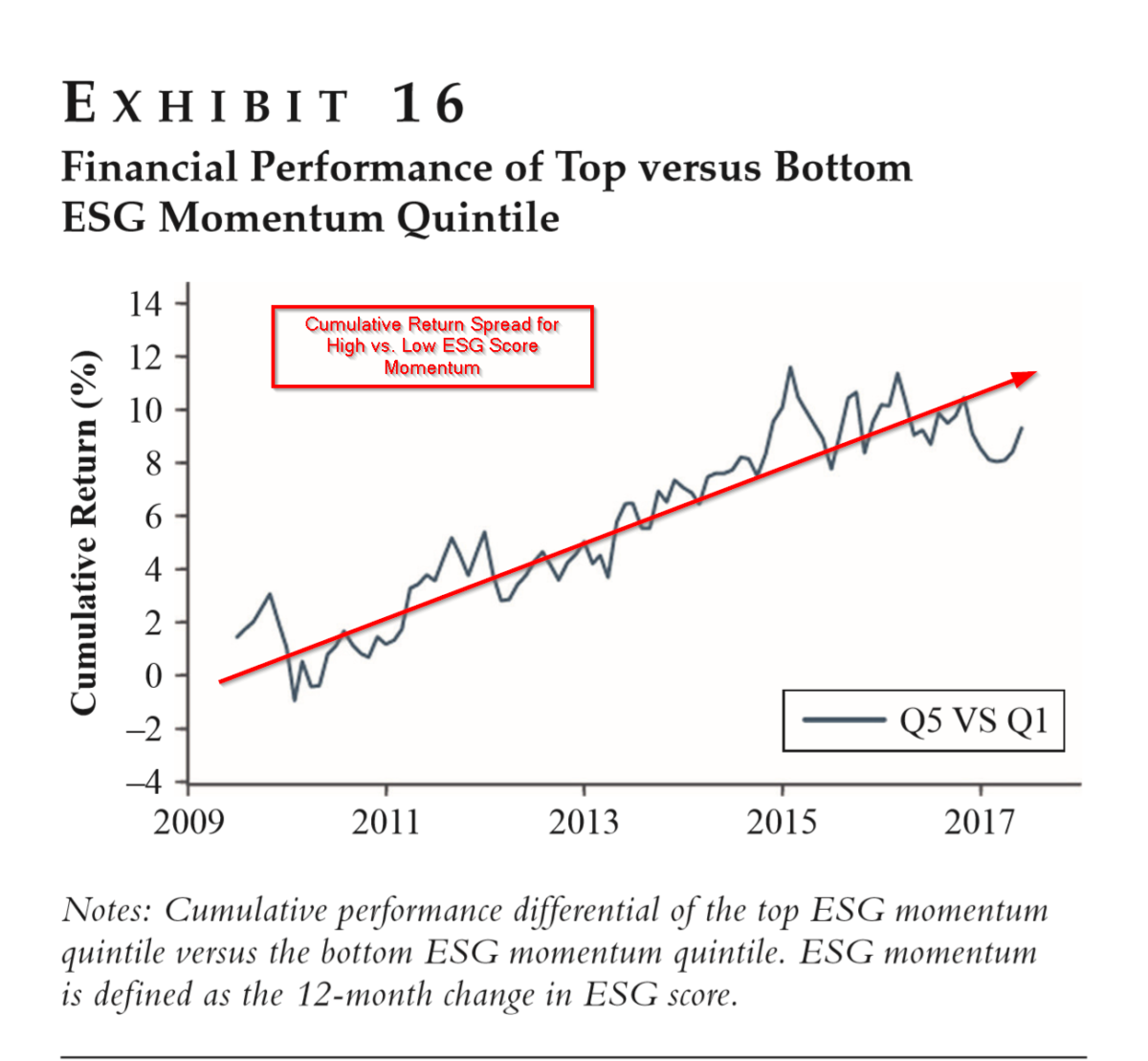

- YES. Presented in Exhibit 16 is the cumulative return spread for stocks included in the highest and lowest ESG momentum quintiles. ESG momentum was calculated as the year-to-year change in industry-adjusted ESG scores. It appears that improvement in ESG scores result in improved valuation as mediated by declines in systematic (lower costs of capital) and specific risk (reduced incidence of tail risk events) profiles, via the transmission channels discussed previously.

Why does it matter?

The existence of “ESG momentum” has been documented elsewhere (Khan, Serafeim and Yoon, 2015) and is robust to numerous competing variables including size, market-to-book ratio, leverage, profitability, R&D intensity, advertising intensity, institutional ownership, and sector membership. However, this article ties the phenomenon to fundamental valuation (DCF) models, making a powerful argument for using ESG momentum not only as an addition to the use of ESG ratings in portfolio strategies but also as a standalone signal. 1

The most important chart from the paper

Source: Lasse H. Pedersen, Shaun Fitzgibbons, Lukasz Pomorski, Responsible Investing: The ESG-Efficient Frontier, October 10, 2019

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained.Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Many studies have focused on the relationship between companies with strong environmental, social, and governance (ESG) characteristics and corporate financial performance. However, these have often struggled to show that positive correlations—when produced—can in fact explain the behavior. The authors of this article provide a link between ESG information and the valuation and performance of companies, by examining three transmission channels within a standard discounted cash flow model—which they call the cash-flow channel, the idiosyncratic risk channel, and the valuation channel. They tested each of these transmission channels using Morgan Stanley Capital International ESG Ratings data and financial variables. This showed that companies’ ESG information was transmitted to their valuation and performance, both through their systematic risk profile (lower costs of capital and higher valuations) and their idiosyncratic risk profile (higher profitability and lower exposures to tail risk). The research suggests that changes in a company’s ESG characteristics may be a useful financial indicator. ESG ratings may also be suitable for integration into policy benchmarks and financial analyses.

Notes:

- Editor Note: An open question is whether or not ESG scores/factors will produce excess returns in the future. Assuming one believes in the results in this paper, one might expect lower expected returns in the future, as ESG seems to increase free cash flows and decrease the cost of capital. Of course, this is under the assumption that the market is reasonably efficient and there are no limits to arbitrage associated with investing in ESG stocks.

Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. Past performance is not ...

more