Which Industry Boasts The Most Billionaire Wealth?

(Click on image to enlarge)

The Briefing

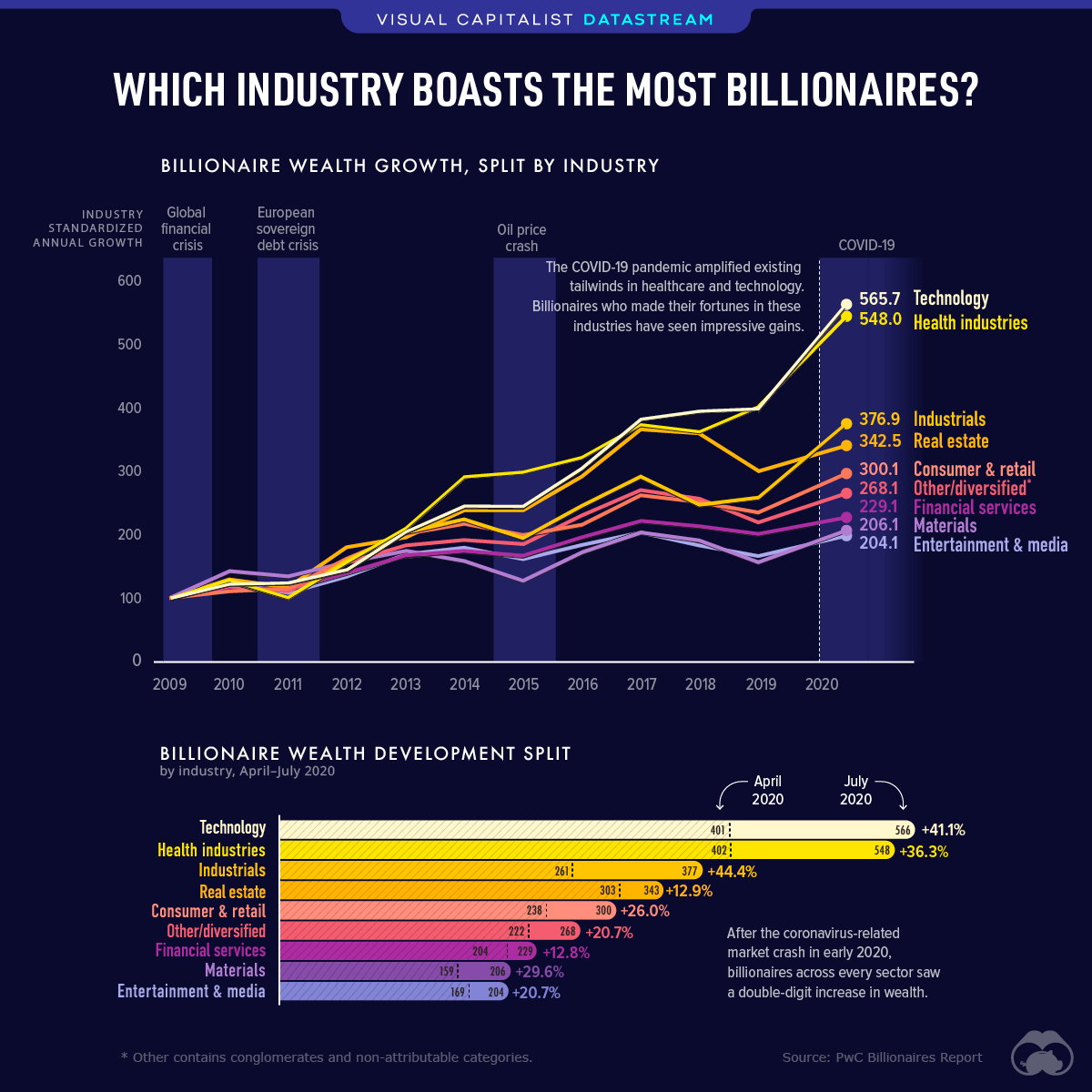

- In every single sector, billionaire wealth saw positive growth from 2019 to 2020

- Billionaire wealth in technology reached $566 billion after growing 41%, while healthcare reached $548 billion, growing 36%

It’s a Billionaires World

During the pandemic, billionaire wealth has shot up an average of 27% across various industries. Concurrently, the middle and working class have struggled, U.S. unemployment reached record highs, and millions of Americans are worried about facing eviction or foreclosure in the near future.

Tech and Healthcare Pull Ahead of the Pack

The industries that historically promote wealth creation for billionaires have undergone a number of changes in recent times.

Technology and healthcare have surged ahead of the pack, as companies in these industries possess qualities that have made innovation a huge value and growth driver. Innovative factors include AI, big data analytics, and a digital and cloud footprint.

| Industry | Wealth Per Industry ($ Billions) | Growth Rates between April-July 2020 |

|---|---|---|

| Technology | $565.7 | 41.1% |

| Health industries | $548.0 | 36.3% |

| Industrials | $376.9 | 44.4% |

| Real estate | $342.5 | 12.9% |

| Consumer & retail | $300.1 | 26% |

| Other/diversified | $268.1 | 20.7% |

| Financial services | $229.1 | 12.8% |

| Materials | $206.1 | 29.6% |

| Entertainment & media | $204.1 | 20.7% |

The pandemic enabled those well equipped to pivot towards the new environment and business landscape, while those without these advancements were forced to haphazardly adjust.

As a result, billionaires in these two industries have reaped great rewards. Between April-July 2020 they generated $164.8 billion and $145.7 billion in wealth between technology and healthcare respectively.

Playing Catchup

The graphic shows the two leading industries building a considerable spread between them and those lagging behind. As these innovative technologies take the mainstream, it may suggest the other industries will have the chance to catch up.

In real estate, for instance, the wave of innovation is least prevalent according to the original report, yet disruption and innovation are already on their way. Consider two stocks in Zillow and Redfin: the first operates in residential real estate services exclusively through web and mobile, while the latter is a digital real estate brokerage that has the potential to undercut real estate agents.

Could these industry wealth results in a post-pandemic world look very different?

Disclosure: None.