Visa Stock: Good Quality And Reasonable Valuation

Visa (V) stock is on fire lately, shares of the payments leader have gained over 25% year to date on the back of rock-solid financial performance from the company. There is little discussion on the fact that Visa is a high-quality business, but even the best companies can be mediocre investments if the stock price is excessively high.

In that spirit, the following paragraphs will be taking a look at Visa stock through multiple points of view: valuation ratios, discounted cash flows, and multi-factor analysis.

Valuation is an art as much as a science, and the true value of the business will ultimately depend on the earnings and cash that the company generates in the future, which cannot be forecasted with certainty.

Nevertheless, based on current performance and reasonable expectations about the future, Visa looks fairly priced at current levels, especially since we are talking about a world-class business.

Exceptional Quality

In order to assess valuation, we need to begin with a discussion of the company's quality. In Warren Buffett's words, "price is what you pay and value is what you get", so price and value are two sides of the same coin when it comes to valuation.

Visa is the global leader in electronic payments, with a gargantuan scale of 3.36 billion cards in circulation as of the quarter ended in March of 2019. Brand recognition and massive acceptance are key sources of competitive strength and sustained market leadership for the company.

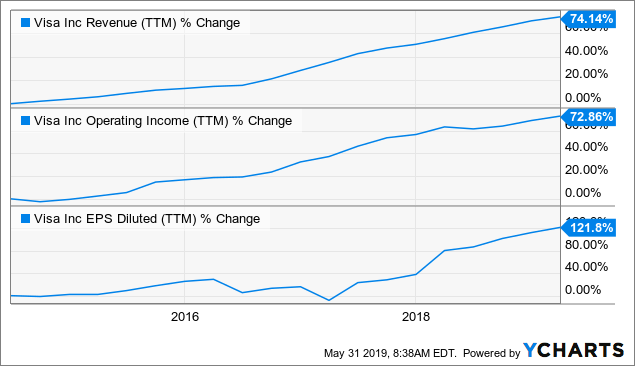

Consumers all over the world are increasingly replacing paper money with more convenient payments methods, and the online commerce boom is a major engine behind this transformation. Visa is doing a spectacular job in terms of transforming its growth opportunities into increasing sales and earnings for shareholders over the long term.

Data by YCharts

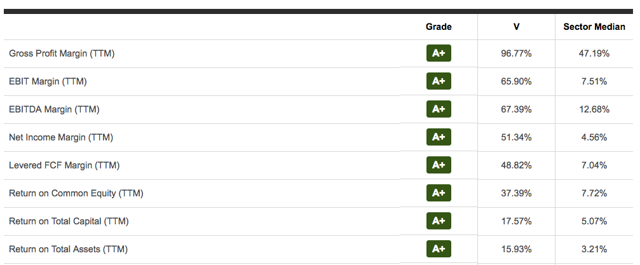

The company generates outstanding profitability levels. Looking at profitability as a percentage of revenue and also when measuring profitability on capital and assets, Visa is ahead of the average player in the sector by a wide margin.

Source: Seeking Alpha Essential

Valuation Ratios

Wall Street analysts are on average expecting Visa to make $6.21 in earnings per share during the fiscal year 2020 and $7.21 in fiscal 2021. Under these assumptions, the stock would be trading at forward price to earnings ratios around 26.2 and 22.6 respectively. These valuations are relatively expensive in comparison to the broad market but not necessarily excessive considering that Visa is a top-quality company.

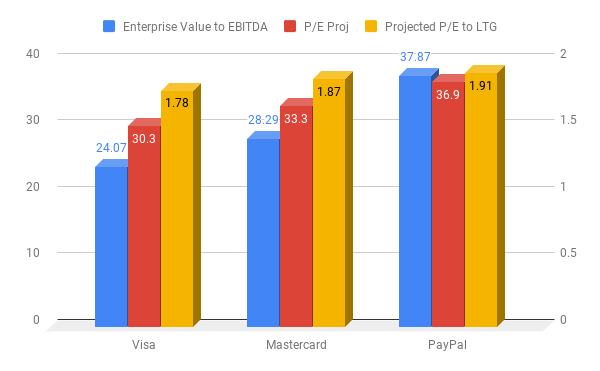

Successful players in the payments industry are trading at demanding valuation levels because the industry offers attractive growth opportunities and abundant profitability. In this context, Visa is not too expensive at all by industry standards.

The chart below shows enterprise value to EBITDA, projected PE, and projected PE to long-term growth expectations for Visa versus Mastercard (MA) and PayPal (PYPL). Visa is cheaper than both Mastercard and PayPal across the three indicators considered.

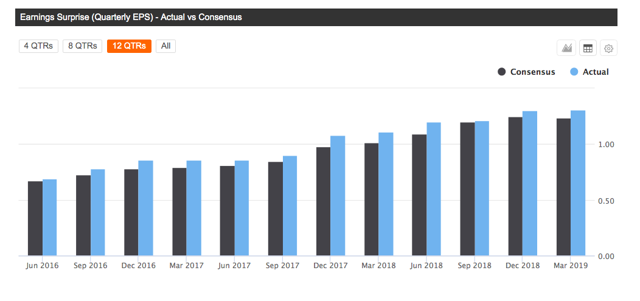

Importantly, valuation is a dynamic as opposed to a static concept. Visa has an impeccable track record in terms of delivering earnings numbers above Wall Street expectations over time. This level of consistency is exceptional because a high bar is hard to beat, and it's generally quite difficult for companies to keep outperforming expectations quarter after quarter.

Source: Seeking Alpha Essential

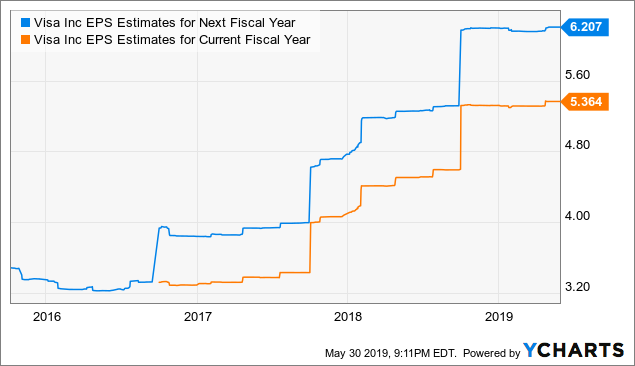

The chart below shows how earnings estimates for Visa in both the current year and next fiscal year have significantly increased over time.

Data by YCharts

Fundamental momentum can be a pervasive force in the market, and companies that outperform expectations tend to continue doing so more often than not. If Visa keeps delivering better than expected numbers in the future, this would mean that the stock is actually cheaper than what current valuation ratios are indicating.

Discounted Cash Flows

The discounted cash flow valuation is based on the following assumptions:

- Sustainable free cash flow is $11.5 billion

- Free cash flow is expected to grow at 14% per year over the next 5 years

- Free cash flow growth will slow down to 9% annually for 5 more years

- The terminal growth rate is 3%

- The required rate of return is 9%

Based on these calculations, we reach an estimated fair value of $176 per share for Visa stock, representing a modest discount of 8.21% versus current prices.

| Sum of Present Value of Cash flows (Millions) | $137,868 |

| Perpetuity Value of Final Cash flow (Millions) | $247,045 |

| Equity Value (Millions) | $384,913 |

| Implied Share Price | $176.13 |

| Discount/Premium to Current Price | 8.21% |

This valuation exercise is not intended to accurately estimate free cash flow generation over the coming decade because these kinds of forecasts necessarily carry a high degree of error.

The idea is not trying to reach a precise estimate of the company's true intrinsic value, the main point is working with the numbers in order to assess if Visa stock is moderately priced based on reasonable assumptions about cash flow generation going forward. Looking at these numbers, the stock looks in fact fairly reasonably priced.

Multi-Factor Analysis

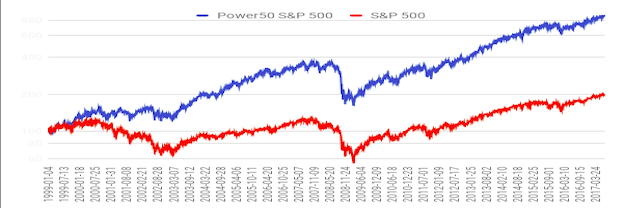

The PowerFactors system is a quantitative algorithm available to members in The Data-Driven Investor. This algorithm ranks companies in the market according to a combination of quantitative factors that includes: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

Data from S&P Global via Portfolio123

The backtested performance data indicates that companies with a high PowerFactors ranking tend to deliver superior returns over the long term. Visa is in the top 3% of stocks in the market according to the PowerFactors ranking, with a score of 97.03 as of the time of this writing.

The value factor ranking is reasonable but not particularly attractive at 68.56. However, the stock ranks remarkably well across the other indicators considered: quality (99.21), fundamental momentum (82.99), and relative strength (90.96).

The data is showing that Visa is not too cheap at current prices, but the stock is still priced at reasonable levels, and the company is remarkably solid across the other quantitative factors considered.

Risk Factors And Final Considerations

Visa is a market leader in a highly concentrated market, and the company makes massive amounts of money. This means that Visa is always an easy target for regulators in different countries.

Besides, the competitive landscape is also evolving, with companies such as Apple (AAPL), Google (GOOG) (GOOGL), PayPal, and Square (SQ) making big inroads in payments. Blockchain technologies could also have a disruptive impact on the payments industry over the long term.

The leading players in the payments sector tend to make profitable alliances as opposed to savagely competing for customers. However, it's important to monitor the industry landscape in case competition becomes more aggressive or regulatory pressure produces some damage to the company's business.

Those risks being acknowledged, Visa is an exceptional company, generating outstanding financial performance and trading at reasonable valuation levels for such a high-quality stock. Valuation is no bargain at current prices, but Visa is strong enough to continue delivering solid returns for investors from these levels.

Importantly, Visa is a great candidate to watch closely and consider buying on any pullback because short-term price weakness in a world-class business such as Visa is generally a buying opportunity for long-term investors.

Disclosure:I am long PYPL and GOOGL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more