The Longer Inflation Sticks Around, The Bigger The Problems Are For Investors

Inflation Remains Resilient in the U.S. Economy

The Federal Reserve continues to say inflation in the U.S. economy is going to be transitionary. This argument makes perfect sense at the moment. The rate of price increases in the U.S. will eventually come down. However, one really has to question how long this transitionary inflation period will be.

Inflation impacts investments, income, wealth, and everything around them. Mark my words: the longer the period of higher-than-normal inflation, the bigger the problems for investors.

How does inflation look at the moment?

According to the official measure of U.S. inflation, the Consumer Price Index (CPI), in August, prices increased by 0.3% month-over-month. Over the previous 12 months, prices in the U.S. economy increased by 5.3%. (Source: “Consumer Price Index Summary,” U.S. Bureau of Labor Statistics, September 14, 2021.)

Higher Prices Might Not Be Going Anywhere

Where’s inflation headed?

It’s likely that prices will remain elevated in the U.S. economy for a bit. You see, inflation appears when the general price level in an economy increases. This occurs when there’s an increase in demand for goods and services, and there are shortages of those goods and services. It means a lot of money is chasing a few things.

That said, consider the following chart. It plots the amount of inventory at U.S. retailers as of July 2021.

(Click on image to enlarge)

(Source: “Retailers Inventories,” Federal Reserve Bank of St. Louis, last accessed September 22, 2021.)

Prior to the COVID-19 pandemic, retailers in the U.S. economy held inventories of about $660.0 billion. As of July 2021, retailer inventories stood at $602.7 billion. That represents a decline of close to nine percent.

Here’s the thing: the supply chain around the globe still seems relatively tight, and it’s possible that the retail inventories in the U.S. won’t be replenished anytime soon. And remember, the holiday shopping season is fast approaching.

You have to ask: If retailers have lower than normal inventories, a demand surge is around the corner, and there’s a possibility that supply will be limited, what will happen to the prices of goods? Economics 101 suggests that prices could soar.

Don’t Forget the Sky-High U.S. Money Supply

But retailer inventories are just one thing. There’s a large money supply out there, and that makes a case for higher than normal inflation for an extended period.

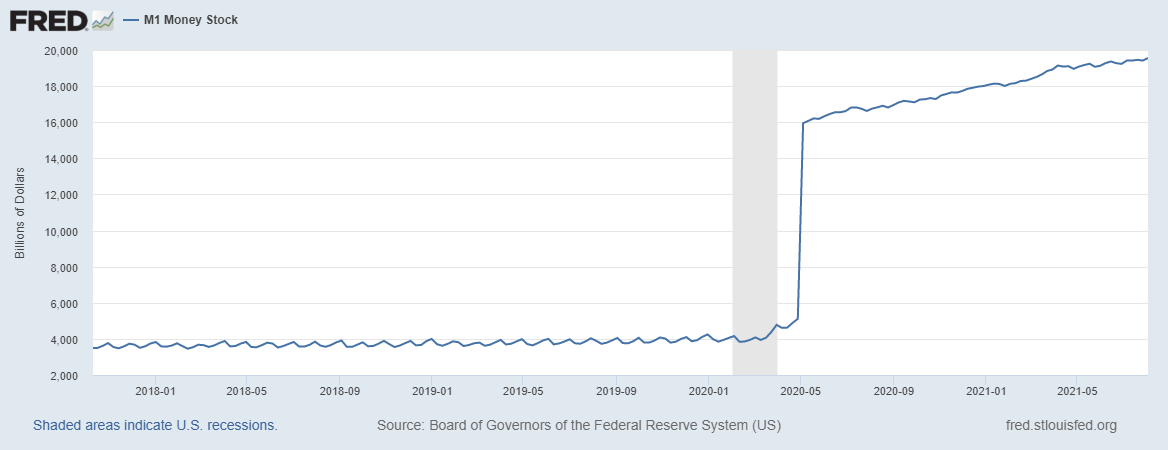

For some perspective, take a look at the following chart of the M1 Money stock. It includes the supply of coins, notes, and demand deposits.

(Click on image to enlarge)

(Source: “M1 Money Stock,” Federal Reserve Bank of St. Louis, last accessed September 22, 2021.)

The U.S. money supply has only increased since the pandemic started, and it continues to rise. As it stands, there’s roughly $19.6 trillion of money in circulation in the U.S. economy. For comparison, consider this: the U.S. gross domestic product (GDP) for the entire year of 2020 was about $21.0 trillion. So, there’s almost a similar value of money in circulation as the value of the U.S. economy.

How Inflation Impacts Investors & How to Protect Wealth

Dear reader, I can’t stress this enough: inflation is like a tax on wealth.

At its core, inflation is the deterioration of buying power. In other words, it’s a decrease in the value of money. An inflation rate of five percent per year means the value of your money is declining by five percent.

Say you have $100.00 and the inflation rate is five percent. A year from now, your money will be worth just $95.00 in real terms. Your $100.00 will only buy $95.00 worth of goods and services.

Inflation also impacts investment returns. Say the inflation rate is five percent and the rate of return on a particular investment is four percent. At the end of the year, on paper, it may look like the investment is doing well. But in real terms, the investment is actually losing about one percent. High inflation could also lead investors to take on higher risks.

I will end with this: in times of higher than normal inflation, assets like gold and silver tend to do well. Those precious metals provide a hedge against inflation. It may not be a bad idea to have some exposure to them in case the transitionary period of inflation is long.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more