Shareholder Value Maximisation & Executive Pay Hurting Real Returns, Says Paper

A radical new paper is doing the rounds of the analyst community, and it makes some strongly counter-intuitive assertions. It says the focus on Shareholder Value Maximisation (SVM), which has caught on since the ’90s, is the dumbest idea ever, and it is screwing up real returns. The paper presents some impressive data to support this claim.

It further claims the focus on SVM has also distorted executive pay structures, and the two together are throttling real economy.

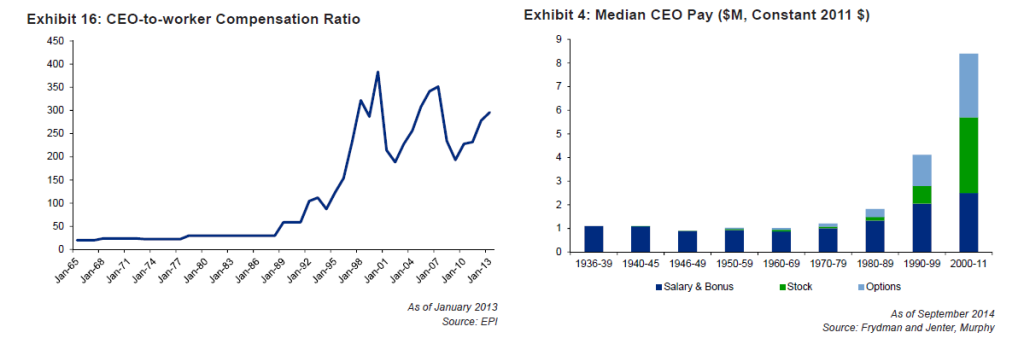

attached here are 2 interesting charts.

Out of control Executive Pay

The paper calls the pre-’90s era, the phase of ‘managerialism’. Quoting the paper – ‘During the era of managerialsim, the vast majority (i.e., over 90%) of the total compensation for CEOs came through salary and bonus. In the last two decades one can see the increasing dominance of stock-related pay. In the last decade some two-thirds of total CEO compensation has come through stock and options. This kind of compensation strucutre gives executives all of the upside and none of the downside of equity ownership. Effectively they create a heads I win, tails you lose situation.

Another reflection of the role of SVM in creating inequality can be seen by examining the ratio of CEO-to-worker compensation. Before you look at the evidence, ask yourself what you think that ratio is today and what you think is “fair.” A recent study by Kiatpongsan and Norton (2014) asked these exact questions. The average American thought the ratio was around 30x, and that “fair” would be around 7x.

The actual ratio is shown in Exhibit 16. It turns out the average American was off by an order to magnitude! If we measure CEO compensation including salary, bonus, restricted stock grants, options exercised, and long-term incentive Payouts then the ratio has increased from 20x in 1965 to a peak of 383x in 2000, and today sits somewhere just short of 300x!

The actual paper has lots more interesting stuff. For ex, as a pre-amble it trashes most holy cows of modern finance: CAPM, Efficient Market Hypothesis, Beta, VaR, Portfolio insurance, tail risk hedging, smart beta, leverage, structured finance products, benchmarks, hedge funds, risk premia, and risk parity to name but a few.