Morgan Stanley's $150BN Investment Arm May Soon Buy Bitcoin

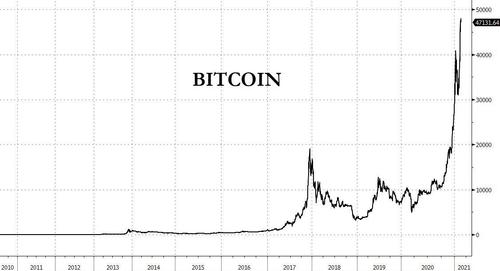

One month ago, when few people believed that it was only a matter of weeks before institutions flooded into bitcoin (BITCOMP) as Tesla (TSLA) unleashed a feverish adoption of the cryptocurrency, we predicted that not only would Elon Musk buy billions in bitcoin (as Tesla confirmed last week) and thus spark a cascade of institutional copycats (including financial giants as Mastercard (MA) and BNY (BK) this week), but that it would be none other than Morgan Stanley (MS) that would hint as to what is coming.

We said that while many institutions want to obtain bitcoin without having exposure to the Grayscale Bitcoin Trust (GBTC), which trades at a sizable premium to fair value, one option is to do what Morgan Stanley's investment management arm did: not buy GBTC, but invest directly into the bitcoin proxy that is MicroStrategy (MSTR).

Clearly happy with the company's "pro-bitcoin" strategy, Morgan Stanley boosted its stake by a whopping 455% in the fourth quarter, from 142.9 thousand shares to a record 792.6 thousand shares, representing more than 10% of MSTR's total outstanding shares.

We rhetorically asked "what can explain Morgan Stanley's enthusiasm for MicroStrategy, which has emerged as the best publicly-traded proxy for the world's best performing asset?" Which we answered with "as Coindesk notes, 'Morgan Stanley views its investment as a way to benefit from bitcoin's historic run without actually being a HODLer.'"

We concluded that "in short, Morgan Stanley's aggressive expansion of its MicroStrategy holdings may be the catalyst that unlocks Bitcoin's door to rapidly crossing the psychological $100,000 level next."

We were correct, because not only did Tesla's purchase send bitcoin above $49,000, but it is the purchases by copycat investors that will soon push it to $100,000, and eventually even higher. And while we wait to see how many more companies will convert cash to bitcoin in the footsteps of MSTR and Apple (AAPL), it appears that Morgan Stanley is about to make waves in cryptocurrency again.

As Bloomberg reports this morning, citing "people with knowledge in the matter," Morgan Stanley's $150 billion investing arm - Counterpoint Global - which is a unit of Morgan Stanley Investment Management and has racked up wins in mutual-fund rankings thanks to its "prowess in picking growth stocks," is considering adding Bitcoin to its list of possible bets.

Morgan Stanley’s latest affirmation of bitcoin as an asset class, one which even BofA has now included to its list of best performing assets YTD, would put "the heft of an almost-century-old marquee Wall Street name behind a volatile asset class that’s still struggling to win acceptance in much of the traditional financial industry." But Bitcoin's four-fold jump in four months has "stoked customers’ interest," making investing in bitcoin harder to ignore.

According to Bloomberg:

"Counterpoint Global, led by Dennis Lynch, has expanded with a simple-sounding mantra of betting on unique companies whose market value can increase significantly. Enthusiasts would argue that approach fits well with Bitcoin.

"The group oversees about 19 funds, of which five delivered gains in excess of 100% in 2020. Its mutual funds have consistently made the top tier of rankings in recent years. Last year’s unusually high returns were aided by bets on companies benefiting from the pandemic, such as e-commerce and streaming entertainment. Prominent investments included Amazon.com Inc., Shopify Inc., Slack Technologies Inc., Zoom Video Communications Inc., and Moderna Inc.

"Despite its size, the group relies on concentrated investments and has stakes in just about 200 companies."

To be sure, it's not a done deal yet as "the review could ultimately result in Morgan Stanley opting to stay away from Bitcoin." However, with the widespread institutional adoption of bitcoin, the likelihood of growing support hitting critical mass means that it is only a matter of time before either Morgan Stanley or someone else, most likely Bridgewater, opens the asset management floodgates.

As Bloomberg notes:

"Much of the industry’s skepticism centers on Bitcoin’s unpredictable price swings and the lack of things it can buy more than a decade since its creation. But faithful followers have felt vindicated this year. Billions of dollars have been pouring into the cryptocurrency through vehicles including the Grayscale Bitcoin Trust.

"Even institutional investors, barred by the rules of their funds from holding Bitcoin directly, have turned to such trusts. For Wall Street firms, an inability to offer Bitcoin to those clients raises the risk of losing them to other managers. That may spark fresh discussions in the industry about opening up to the asset."

And while Morgan Stanley may or may not bid up bitcoin, we are certain that the next big catalyst will be the announcement by Ray Dalio that Bridgewater has bought a $2-3 billion stake in the cryptocurrency. As a reminder, this is what Ray Dalio said just two weeks ago:

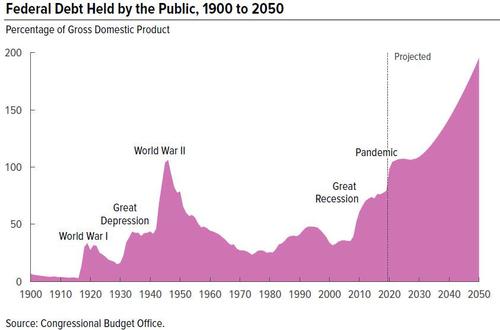

“I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets and expect Bridgewater to soon offer an alt-cash fund and a storehold of wealth fund in order to better deal with the devaluation of money and credit that we consider to be a major risk and opportunity, and Bitcoin won’t escape our scrutiny.

"It seems to me that Bitcoin has succeeded in crossing the line from being a highly speculative idea that could well not be around in short order to probably being around and probably having some value in the future. To me, Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn't mind losing about 80% of."

What we find most amusing is that none other than Morgan Stanley's Wall Street competition - JPMorgan (JPM) - last week tried to slam the crypto again (for the fourth consecutive time), predicting that no institutions would follow Tesla in buying bitcoin. However, we don't expect JPMorgan to issue a mea culpa shortly, and instead it will keep on telling its clients how this is as high as bitcoin gets, when the path to $100,000 is now much clearer.

Finally, the simplest reason why bitcoin is just getting started is the following chart from the CBO predicting the trajectory of US debt, which is very similar to the bitcoin price chart above.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Could this possibly be a "pump and dump" scam of epic proportions?