MicroStrategy Buys Another $50 Million In Bitcoin At $19,427; Bringing Total To Half A Billion

Last week, just after Bitcoin (BITCOMP)'s first modest correction since the start of its March rally, we reported that one of the world's biggest fixed income asset managers, Guggenheim Partners (GOF), jumped on the bitcoin bandwagon. It announced that it was reserving the right for its $5.3 billion Macro Opportunities Fund to invest in the Grayscale Bitcoin Trust (GBTC), whose shares are solely invested in Bitcoin, and track the digital asset’s price fees and expenses.

Guggenheim's (partial) embrace of Bitcoin was followed by PayPal (PYPL)'s announcement that it had enabled crypto transactions for all its clients, sparking the latest leg higher in bitcoin. It also came following glowing endorsement from legendary investors, such as Paul Tudor Jones and Stan Druckenmiller, and in the aftermath of Jack Dorsey's "other" company, Square (SQ), which said in October that it bought 4,709 bitcoins, worth approximately $50 million, about 1% of Square’s total assets.

“Square believes that cryptocurrency is an instrument of economic empowerment and provides a way for the world to participate in a global monetary system, which aligns with the company’s purpose," the company said in a release. Square founder Jack Dorsey has been an advocate of the digital currency, saying in 2018 that the cryptocurrency will eventually become the world’s “single currency."

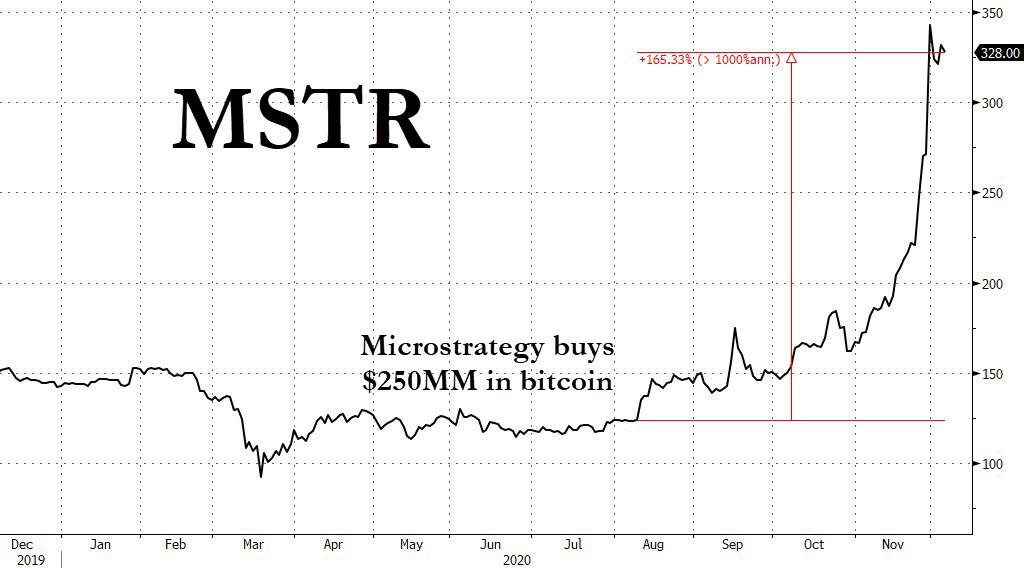

For others, the payback from investing in bitcoin has come far sooner. The publicly traded business-intel firm, MicroStrategy (MSTR), sent a shockwave around the globe on August 11 when it announced it had poured all $250 million of its planned inflation-hedging funds into the digital currency. Not content with the 100% return its stock has generated since then, MicroStrategy announced on Friday, December 4 that it has bought even more Bitcoin.

In an 8-K, the company announced that it had purchased "approximately 2,574 bitcoins for $50.0 million at an average price of approximately $19,427 per bitcoin." As a result, as of December 4, 2020, the company held approximately 40,824 bitcoins that were acquired at an aggregate purchase price of $475.0 million. Microstrategy CEO Michael Saylor confirmed as much in a subsequent tweet:

MicroStrategy has purchased approximately 2,574 bitcoins for $50.0 million in cash in accordance with its Treasury Reserve Policy, at an average price of approximately $19,427 per bitcoin. We now hold approximately 40,824 bitcoins.https://t.co/nwZcM9zAXZ

— Michael Saylor (@michael_saylor) December 4, 2020

And since the current market value of the company's bitcoin holdings is currently $770 million, or a 60% return in just a few months, one can see why the stock price of MSTR is up 165% since the day it announced its first Bitcoin purchase.

In September, Saylor told Bloomberg that the purchase were being done because he sees the cryptocurrency as less risky than cash or gold. On Monday, Bitcoin surpassed its December 2017 record high of $19,511. Even though it neared $20,000, it wasn’t able to crack that key level, and after peaking at $19,914, it has bounced around in a range between $18,500 to $19,500 since.

This brings us to a question we asked last weekend: "Whereas in 2017, it was all the rage to pivot to 'blockchain,' we wonder how long before every public company converts some (or all) of its cash and equivalents into bitcoin, similar to MicrosStrategy and Square, in hopes of reaping a quick surge in its stock price."

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more

While Blockchain is a system for security, BitCoin is an alternate currency, and so the comparison is FAR OFF indeed. investing in a security technology is vastly different than gambling on funny money.

And I am wondering if anybody else sees any possible problems with a very much "for profit"entity controlling the currency. Or am I the only one to have such a thought.

There is only 18.5 million supply on market for #Bitcoin, your wording says different. $BITCOMP $BTC.X