Kiwi Bulls After Governor Orr Showed Optimism

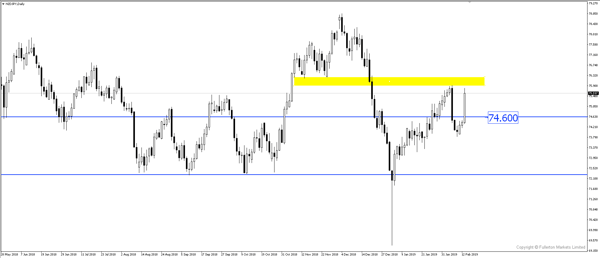

Governor Orr’s optimism may be short-lived as New Zealand’s economy is still weak, and he does not rule out a rate cut. Short NZD/JPY?

Reserve Bank of New Zealand Governor Adrian Orr left interest rate unchanged at 1.75% which was widely expected. He said that interest rate will be on a pause through 2019 and 2020. What caused kiwi to surge was that RBNZ was not as dovish as the market expected them to be. While the RBNZ pushed back when it expected the cash rate to rise, seeing an increase as probable by the March quarter of 2021 rather than Q3 2020 previously, that view has come as a surprise to markets which were nearly fully priced for a rate cut by the end of this year.

Furthermore, Orr said he still expects an economic pickup this year as low interest rates and continued employment growth support household spending and business investment. Even though Orr maintained the same view that bank’s inflation outlook was both to the “upside and downside,” he believed that inflation could rise faster if firms pass on cost increases to prices to a greater extent.

Similarly to RBA, Orr said that the US-China trade tensions and slowing global growth continue to pose as a risk to its economy. The odds of a rate reduction by RBNZ in November fell to 52% today versus 90% before RBNZ policy statement this morning.

All in all, we feel that a rate cut is still highly possible and the rise in the New Zealand dollar should be short-lived. This is due to softer labor data, GDP and a sharp slowdown in household spending.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more