JPMorgan Capitulates, No Longer Expects Rate Hikes In 2019

Taking a diametrically opposite stance to Morgan Stanley, which earlier this week forecast that as a result of a rebound in the economy in the second half, and an acceleration in inflation into 2020 and further, the Fed would hike rates once in 2019 (in December) followed by three more hikes in 2020, on Thursday JPMorgan's chief economist Michael Feroli published a report in which he changed his "Fed view" and as a result it no longer sees any more rate hikes in 2019 (it had previously predicted one in December), and just one more hike in 2020.

As Feroli writes in his preview of next week's key Fed meeting, the latest "dot plot" to be revealed in one week, will most likely indicate an expectation of zero hikes, and "irrespective of what happens with the dots, we now look for no hikes this year" as the Fed's "longer-run discussion of inflation “makeup” strategies is just getting going."

Feroli elaborates, noting that while the FOMC is almost certain to leave policy rates unchanged next week, "the more interesting development will be what the “dot plot” signals about their intentions for the rest of the year."

We suspect the median dot moves down from the two hikes they signaled in December to either no hikes or one hike for this year. We see somewhat higher odds of zero than one. Regardless of “which side of maybe” that decision falls, we are now inclined to think the Fed is on hold for the rest of the year (we still see one more hike late next year).

Following a brief discussion of how JPM expects the Fed's economic projections to change, Feroli notes that it believes the Fed is moving toward a framework that employs a “makeup” strategy, "most likely something that resembles average inflation targeting." He elaborates as follows:

Before moving on, it may be helpful to review the timeline of events that is informing this view. Last November the Fed issued a very brief press release stating its intention to review its strategies, tools, and communications in the coming year. In late February, Vice Chair Clarida elaborated on this, explicitly citing consideration of “makeup” strategies among the central issues to be explored. (In between the November announcement and the February speech, a number of research pieces were published throughout the Federal Reserve System highlighting the shortcomings of the current approach and the benefits of makeup strategies).

Looking ahead, on June 4 and 5 of this year the Fed will hold a conference in Chicago to further explore these ideas. This conference will be neither the beginning nor the end of this review, and will not be a market event (in our opinion), but will offer a chance to take stock of what has been learned about policy in a low interest environment. Finally, the Fed will produce its conclusions for the public in the first half of 2020.

And so, even with the outcome of this review at least nine months away, JPM thinks the spirit of the review will be permeating policy decisions in the interim. Here the bank notes that several Fed officials have already loosely affiliated themselves with some variant of a makeup strategy, the NY Fed’s Williams being the most prominent. Moreover, the current policy framework (as articulated in the Statement on Longer-Run Goals and Monetary Policy Strategy) gives policymakers considerable discretion in how they interpret optimal policy, "such that engineering an inflation overshoot could be seen as a desirable outcome even under the existing strategy."

Elaborating further, Feroli writes that one should also keep in mind that the intermediate goal of makeup strategies is to boost inflation expectations and "to the extent these have been drifting lower a more accommodative posture would be warranted under both the current framework and a makeup framework. Finally, the makeup strategy that emerges, in our opinion, is unlikely to have the precise, mathematical formalism of textbook price-level targeting. Instead we expect it will communicate a vaguer sense of a through-the-cycle inflation objective, and so the difference between that and current policy may not be as sharp-edged as one might think."

Finally, JPM says that it continues to look for a hike in late 2020. This reflects three judgments, in descending order of confidence:

- first, over time positive output gaps generate inflation,

- second, the nominal neutral funds rate is higher than 2.40%, and therefore

- third, growth will generally be above trend in the coming year and a half.

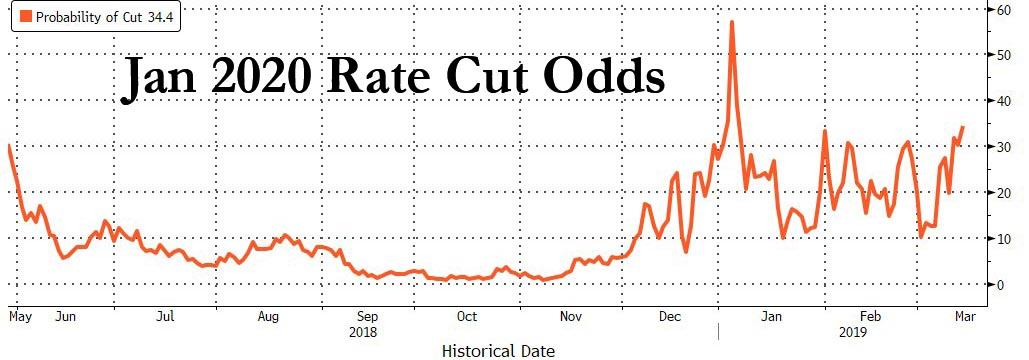

And even following JPM's dovish capitulation, which now leaves Morgan Stanley as the sole hawk on the street, expecting a total of 4 more rate hikes, the market appears to have made up its mind, and as of today, the Fed Funds' implied odds of a rate cut in the January 2020 meeting have risen to 34.4%, roughly 10% more than just earlier this week...

... and the highest since the December market crash, which is just a little odd considering the S&P is now over 500 points higher than where it was during the December crash.