Is Bitcoin Pullback An Opportunity To Buy?

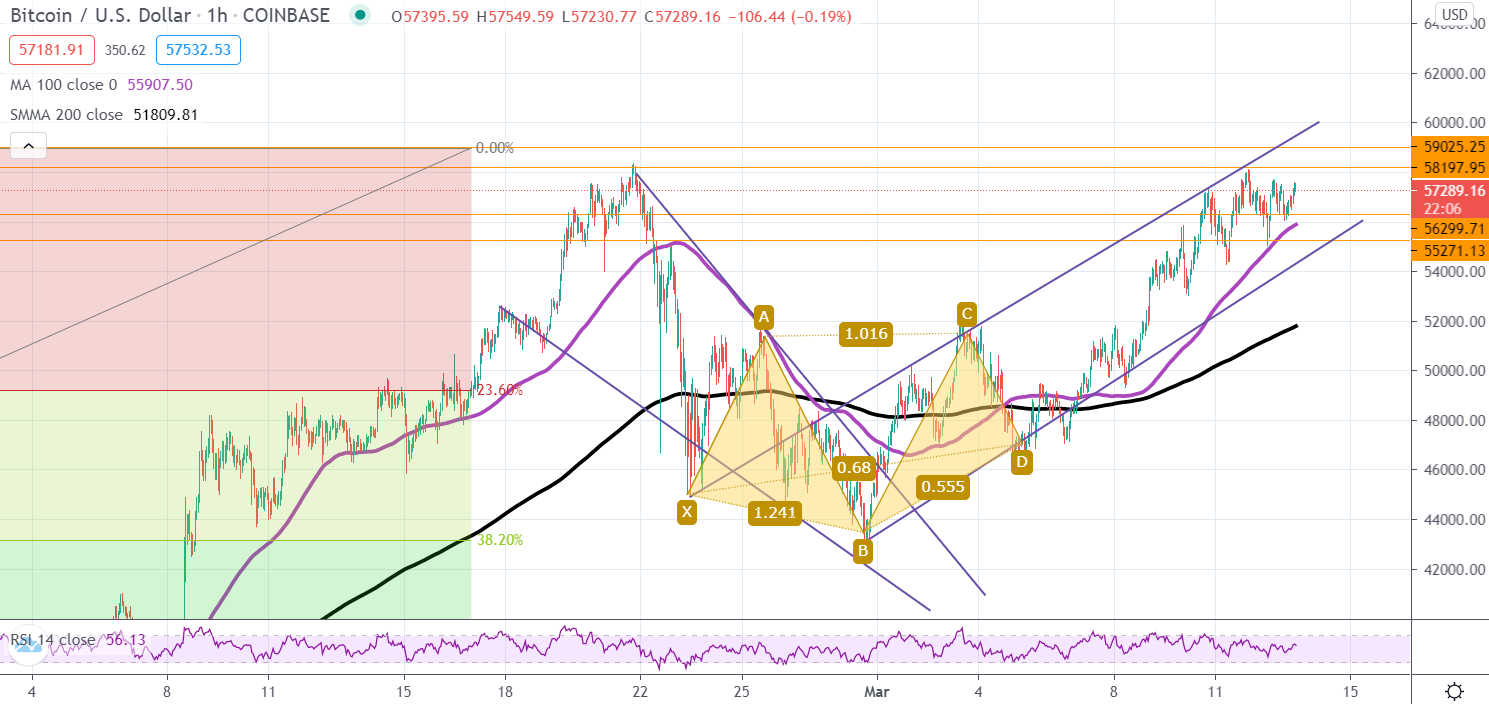

The price of bitcoin has pulled back to trade at around $56,000 after hitting a new historical high of more than $61,900. The pioneer cryptocurrency has demonstrated over the last few months its undoubted potential despite still facing a cloud of pessimism from anti-crypto investors.

However, crypto enthusiasts will be looking at the current pullback as an opportunity to buy bitcoin before the next bull-run begins. Nonetheless, the volatility exhibited by the BTC/USD alongside other cryptocurrencies suggests that there could more options to profit from bitcoin in 2021.

Image Source: Unsplash

Trade BTC/USD Volatility

Trading bitcoin may be a more viable option for traders looking to benefit in the short term. The BTC/USD has experienced highly volatile trading sessions, which means that there are opportunities to benefit from both sides of the trade. One of the ways to achieve this would be via crypto CFD trading platforms including online forex brokerages. However, margin trading is often a high-risk form of trading. As such, it may not be suitable for all traders. Novice traders would probably be better off investing in other assets like stocks or mutual funds.

Nonetheless, new trading technologies have emerged allowing inexperienced traders to make money by simply copying the trades of expert traders. Etoro has been the leading provider of copy-trading services over the last decade and has since inspired similar services to come through. So, is eToro legit for crypto trading via CFDs? Several reviews suggest it is. They introduced crypto copy trading services a few years back, which has demonstrated success. This could be an ideal avenue for novice crypto traders to make money in the highly volatile bitcoin.

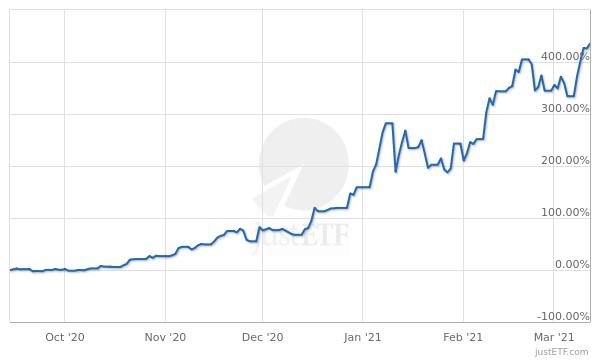

Buy BTC Crypto Funds

Another way would be to invest via crypto funds. Here a few stand out based on the performance over the last few months. The 21Shares Bitcoin ETP is up more than 178% over the last three months while counterparts HANetf BTCetc Bitcoin Exchange Traded Crypto and VanEck Vectors Bitcoin ETN have gained 181% and 171%, respectively over the same period.

The HANetf BTCetc Bitcoin Exchange Traded Crypto above has gained the most among the three bitcoin crypto ETFs over the last three months.

Crypto funds allow traders to benefit from the performance of the underlying crypto without buying the asset itself. They are a little different from investing via crypto CFDs because they do not involve margin trading. Therefore, this could be a low-risk option for investors that want to invest in bitcoin without having to own the asset or use a CFD broker.

Just buy and hold

The other alternative would be to buy and hold the world’s most popular cryptocurrency. This may be the smartest option, especially if you are a crypto enthusiast. Some analysts have suggested that bitcoin could easily surge to trade at around $300k within the next eight months. If you can withstand the short-term volatility, then HODLing (buy and hold) would be an ideal strategy to profit from bitcoin.

The drawback to this is that recent reports have painted a cloud of doubt over the long-term future of cryptocurrencies. Bitcoin critics in particular still believe that the price is primarily driven by speculation rather than tangible value— and when all chips begin to fall, things could go horribly bad for those with massive investments in bitcoin.

As such, this again explains why it might be more prudent to try to profit from the volatile of the pioneer crypto rather than holding for the long-term.

In summary, the price of bitcoin has skyrocketed to new historical highs making it one of the most valuable assets in the world. Bitcoin recently hit a market value of more than $1 trillion, which is more than 99% of the world’s publicly traded companies. It has since pulled back to the value of about $900 billion, but another rally could be on the horizon. Whether it can maintain this rally remains to be seen. The next few months will be interesting to watch.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more