In An Era Of Financialization, Who Really Owns The U.S. Corporation?

Why Do Corporations Buy Back Their Shares?

Since the advent of Quantitative Easing we have witnessed unprecedented levels of stock buybacks by US Corporations. Buyback volumes have surpassed $1 Trillion in five short years as corporate executives have been forced by financialization of the economy to flock to a buyback strategy.

Why the dramatic shift?

- Corporations have been experiencing top-line global revenue pressures and constraints for existing products since the Financial Crisis,

- They face excess corporate capacity and under-utilization while confronting a mounting global supply glut due to cheap global money and ready credit for all competitors,

- They see preferential tax treatment for increasing debt and leverage.

During times of low interest rates it is sound strategy to increase corporate leverage, as long as the debt is employed judiciously so that the incurred debt can be safely handled when rates eventually and often unexpectedly go up. Unfortunately, what is occurring is that debt is not being invested into productive wealth generating assets but rather into reducing the equity capitalization of the corporation. There are potentially major longer term economic, political and financial ramifications from this occurring.

By buying back shares, corporations blatantly promote better EPS (Earning per Share) for the same or falling earnings. This Wall Street-welcomed superficial 'sleight of hand' often has the effect of driving up share prices, which is the critical "currency" of the modern corporation that they employ for both acquisitions and maybe more importantly for protection from takeover raiders.

It's About Dividend Payout versus Dividend Growth

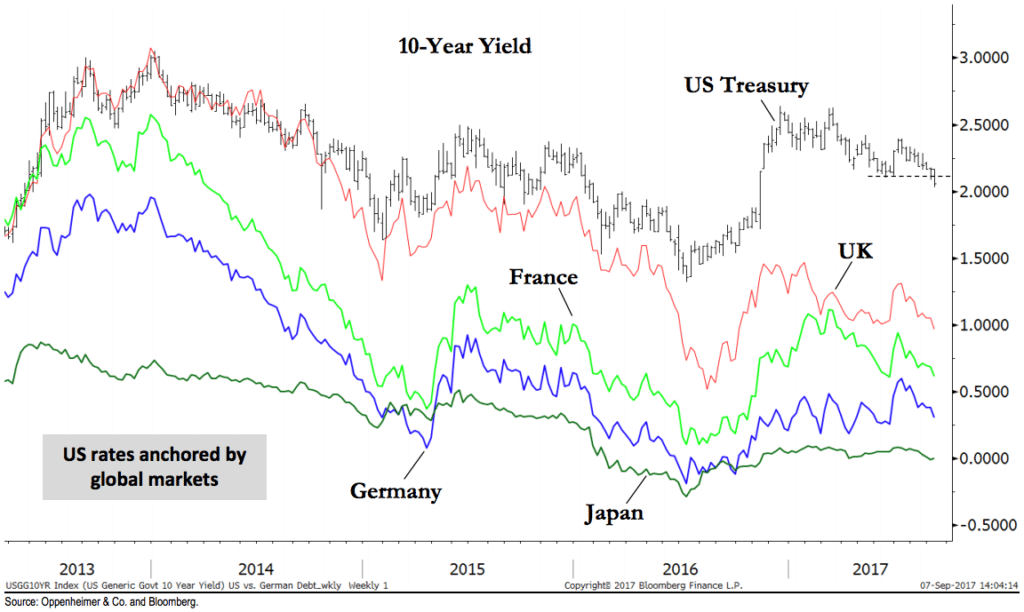

A critical element of corporate rationalization for the strategy adoption few investors appreciate is actually about the reduction of the cumulative amount of dividend payout while showing the dividend payout percent to be increasing on a per share basis. In a world starved for yield with over 70% of global bonds with negative yields, and almost all global bonds paying negative real bond yields, this can make US equities very attractive to global yield investors. The best performing Dow Industrial stocks have consistently been those with attractive dividend payouts. Through the use of complex derivative strategies, dividends are often economically stripped out by clever financial institutions so they have no exposure to the underlying equity price.

Today corporations have become so addicted to this strategy, as their free cashflows & EBITDA continues to fall, that more and more corporations are issuing bonds solely to buy back shares and pay the shareholder dividend.

Over the last 10 years, S&P 500 corporations have returned more money to shareholders via share buybacks and dividends than they have earned.

Who Makes the Risk-Free Money?

Some new investors may need to be reminded that all debt interest owed is paid before one cent of profit is ever earned. Interest is paid based on the corporate capital structure with Senior Secured Debt holders paid first, down the ladder to the Preferred shareholders. Debt holders are always paid unless bankruptcy protection occurs. They effectively "milk" debt-burdened corporations while equity investors "hope" for a rising stock price based solely on a perceived winning corporate strategy pumped out by the Wall Street marketing apparatus.

Who Really 'Owns' the Corporation in an "Era of Financialization"?

A question we need to ask today, is who is the real owner of the modern corporation in this new Era of Financialization? Shareholders assume all the risk and only make a positive total yield (after dividend payouts) if stock prices don't go down. Meanwhile increasing dividend yields drive stock prices up, market capitalization up and thereby further reduce the risk of the capital structure's loan exposure.

The secret winner in an Era of Fictionalization appears more and more to be the debt holder, not a shareholder!

Gaming The System

Today, Private Equity controls more than 60% of S&P 500 companies. The first thing they have notoriously done when they take over a company is to load-up the takeover corporation's balance sheet with debt. This often places the taken-over corporation in a lose position, especially as productive assets are typically stripped out. What is left is a "dead cadaver" with debt sucking out the remaining wealth.

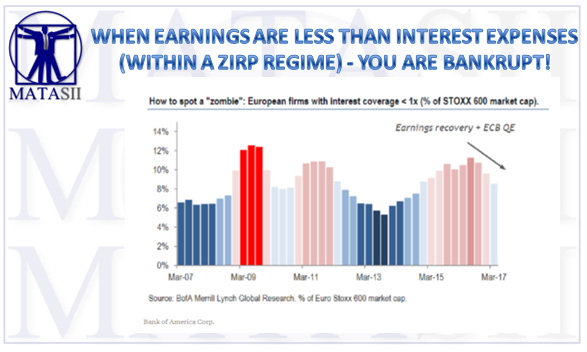

A whopping 72% of all US businesses are presently NOT profitable. 9% of all European firms have sub-par interest coverage. Specifically, interest coverage is more than earnings.

We are now however witnessing Private Equity exiting, as these burdened companies stocks have been lifted by a historically high stock market.

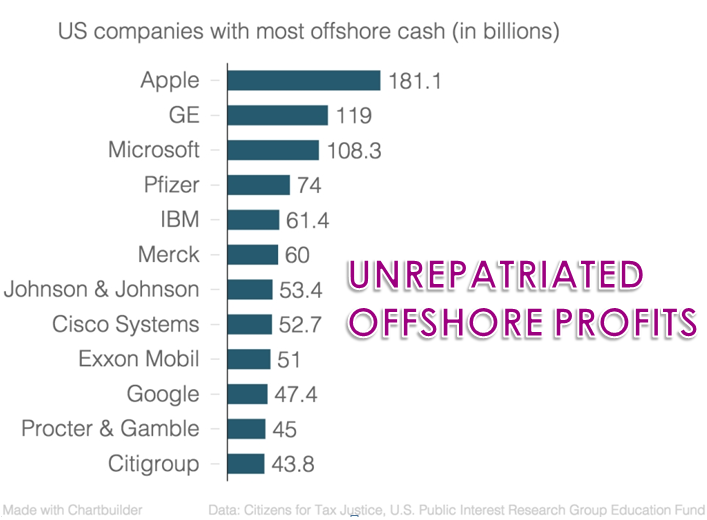

Though I have no proof of this I often wonder what corporations are doing with their billions of offshore, unrepatriated profits. With international banks commonly charging corporations to hold large deposits and real bonds rates being negative outside the US, what is a corporate CFO to do?

A clever Board of Directors in my estimation would demand offshore profits be moved through an offshore investment entity to buy their US issued corporate bonds. The new bond issues as I mentioned above would be used to drive up EPS, Dividend Percentage and reduce total dividend payout; yet still pay a rate on my issued bonds. It's almost like free counterfeited money??

If this possibility doesn't scare you about the viability of the sustainability of the current markets, then you need to have your pulse checked!

What Financialization means?

What we have in reality is the giant sucking sound of corporate profits and most importantly, Capital being pulled from the hands of those who 'produce' into the hands of those who 'consume' and those who don't produce - Investment is not Production!

It is pretty clear to anyone who truly wants to understand what is happening in our world, that decades of poor political governance resulting in unfundable social entitlements has driven government Debt-to-GDP to crippling, destructive and unsustainable levels. Financialization of the global economy has effectively taken control of the incentives behind Capital Investment. Meanwhile, Macroprudential Monetary policy of financial repression has been implemented to prevent debt from effectively imploding. Debt today now consumes most of the productive capital being created.

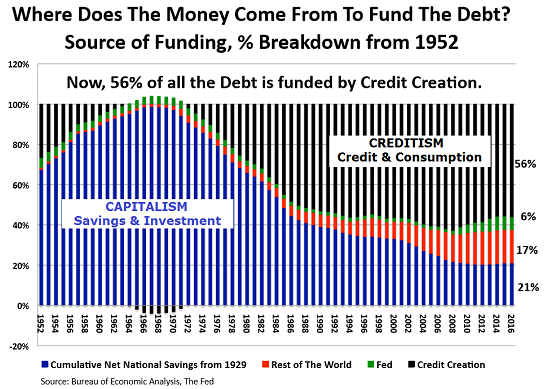

In our new world of Financialization, CREDIT growth now drives Economic growth. LIQUIDITY FLOWS now drive Asset Price direction.

Particularly troubling is that governments through their central banks are now attempting to control both. Markets are no longer the primary driver!

You can call it Financialism, Creditism, Fascism, a mutated form of Socialism or whatever - but you can no longer call our economic system Capitalism!

Capitalism is about SAVINGS being invested into Productive Assets to produce SAVINGS. Today Credit is created to produce consumption which produces debt - not wealth and savings.

Real capitalism results in: Increasing Worker Productivity which historically shared with workers (no longer occurring) results in an increasing Standard of Living. Standards of living are falling to the vast majority of American Middle-class families!

Watch this 34-minute video between Gordon T Long and Charles Hugh Smith for a fuller understanding.

Video Length: 00:34:05

Disclaimer: Information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any ...

more