Bitcoin - Fail, Learn, Improve

The good news is that we still see Bitcoin (BITCOMP) to be the number one asset class for your wealth preservation portfolio. And this is paired with a good chance to see higher prices in the near future.

BTC-USD, Daily Chart, Whatever Works:

Bitcoin in US Dollar, daily chart as of May 3, 2021.

One healthy way for progress is to walk the road less traveled by and be independent of the opinion of others. Stacking odds means backtesting any and all ways to find probabilities in your favor. In Bitcoin, we found a high likelihood for specific trading patterns. On the daily chart, it isn’t atypical for Bitcoin to produce the pointed-out price movement series (A, B, C, D, E) in sequence.

When comparing our lines, you will find not only similarities in percentage moves, but also in the steepness of angles. In this case, our future projection is noteworthy because the distance between points C and D on the right side of the chart is much shorter than in the same white-lined picture to the left. This means a minor retracement – meaning a more aggressive step in of the bulls.

What is also essential is that Bitcoin might seem to be ranging and indeed has large retracements, but it is trading in a wide range up-sloping directional channel (yellow lines), which further indicates strength. We conclude that a progression of price to the upside has a higher likelihood than downward movement, and that the taking out of all-time highs is a possibility in store.

BTC-USD, Daily Chart, Don’t Trust Your Feelings:

Bitcoin in US Dollar, daily chart as of May 3, 2021.

Another glance at the daily chart illustrates another principle we follow: “Don’t trust your feelings.” The linear regression channel indicates the presence of short-term drift elements to the sideways/downside. When Bitcoin isn’t advancing, it has temporary sideways periods of a few days where stops are taken out.

When observing the market on these days, one has the feeling of continuous downward movement. These brief periods resolve when the overall “feel consensus” is discouraged.

Looking at “a,” you may find such a drift along the midline of the regression channel. We might see a few days following such a movement (similar to the past), but we advise you to look out for low-risk long entry opportunities so as to not miss a possible steep leg up. The higher probability, nevertheless, is an immediate rise of price towards all-time highs, as indicated in the prior chart.

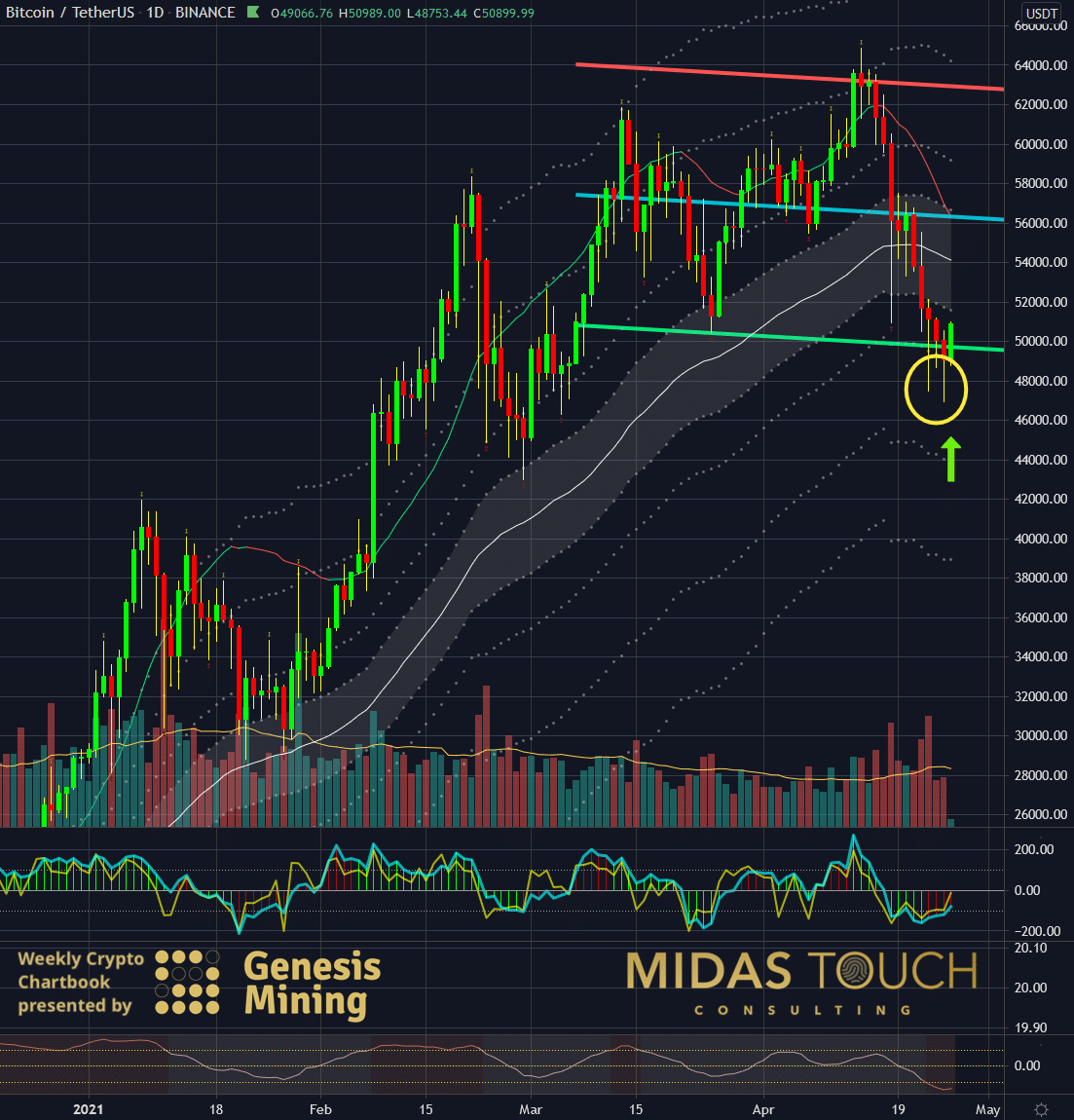

BTC-USDT, Daily Chart, Last Week´s Entry:

Bitcoin in US Tether, daily chart as of April 26, 2021.

We posted this entry chart in last week’s chartbook publication, and the trade matured nicely through the previous week’s price advances from our entry at $49,000, which is currently near $58,000. This leads us to the significantly larger weekly time frame observation.

BTC-USD, Weekly Chart, Bitcoin, Fail, Learn, Improve:

Bitcoin in US Dollar, weekly chart as of May 3, 2021.

Here the picture has significantly changed. A bullish engulfing pattern marked within the white square has turned the larger time frame more bullish. This candlestick price pattern states nothing more than all bear traders within the week of the red candle have now been proven wrong. They have either been stopped out or are underwater now. This is a reversal pattern that gives the bull traders an edge.

More importantly, the price now trades above a meaningful supply zone, marked in yellow, from a volume node analysis point of view. We are confident that all-time highs will be tested shortly; a spot where we aim to take partial profits and we expect a follow-through to see new all-time highs.

In a world changing more rapidly than ever since the start of the industrial revolution, one needs to keep on one’s toes if they want to be ahead of the curve and bet money on perceptions about the future. Statistical edges in isolation or a purely fundamental approach are just not enough. A flexible mind is required the most to accept failure, and an immediate process is needed to learn from one’s mistakes and implement the gained wisdom.

The times of “set it and forget it” are from a past long gone. “Adapt or die” comes to mind. And as much as this might seem extreme, markets are very unforgiving, and wealth preservation is key to ensure a profitable future. Each extra step taken might create that additional edge necessary to beat the game of finance.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more