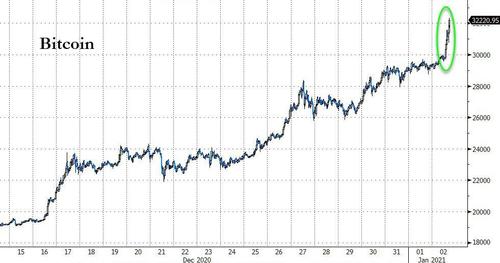

Bitcoin Explodes Above $33K As Supply Squeeze Continues

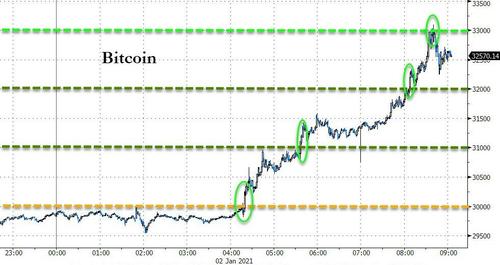

Well, that escalated quickly. Less than an hour after first breaking above $30,000, Bitcoin (BITCOMP) has spiked beyond $31 thousand, then $32 thousand, and more recently, $33 thousand.

Source: Bloomberg

Source: Bloomberg

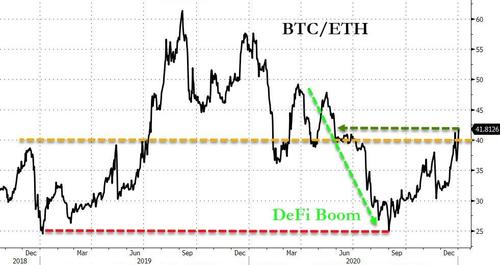

Ethereum (ETH-X) is also extending gains, nearing $780, but BTC has been trading at almost 42x ETH - its highest since May, erasing much of the decentralized finance boom's effects on Ethereum.

Source: Bloomberg

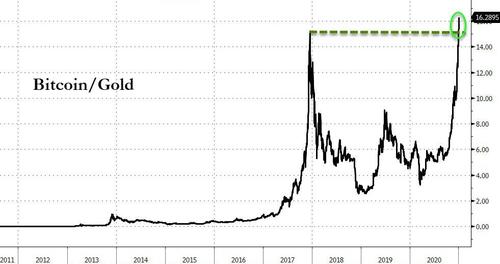

But while the cryptocurrency is rising in value against the dollar, Bitcoin price claimed another all-time high, this time against gold, offering further confirmation that demand for digital assets is on the rise.

Source: Bloomberg

Bitcoin’s biggest proponents believe the digital currency is eating away at gold’s market cap as investors opt for the efficiency, portability, and proven scarcity of the asset. Astonishingly, that view is also shared by JPMorgan Chase analysts, who believe bitcoin’s digital gold narrative is drawing capital away from precious metals.

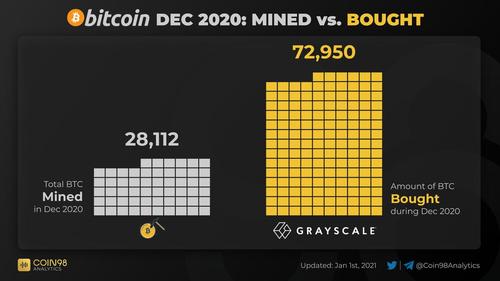

Additionally, as CoinTelegraph notes, some believe that Bitcoin’s supply squeeze could send prices higher over the course of 2021. Specifically, digital asset manager Grayscale (GBTC) bought up nearly three times the BTC mined in December. Demand from PayPal (PYPL), Cash App, and others has also contributed to an apparent supply shortage of BTC.

It's official: Miners can't produce enough bitcoin

Last month, the company added a total of 72,950 BTC ($2.132 billion) to its assets under management (AUM). During the same period, miners generated just 28,112 BTC ($821.7 million) — 38.5% of Grayscale's buy-in. The figures underscore what many have described as an ongoing liquidity squeeze in bitcoin, where large buyers suck up any available supply and remove it from circulation, sending it to cold storage for long-term holding.

As Cointelegraph reported, the phenomenon was already visible in November 2020, but December 2020 saw a clear increase in demand from Grayscale and other institutional entities.

BTC mined vs. bought by Grayscale in December 2020. Source: Coin98 Analytics/ Twitter

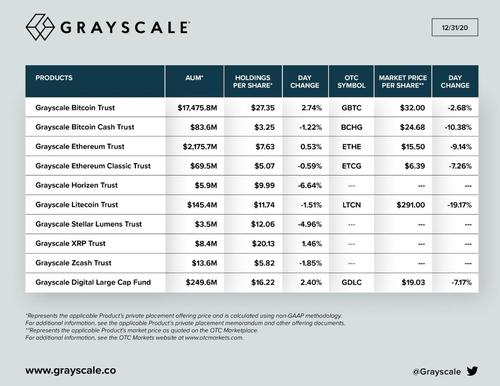

Grayscale now controls $20 billion in crypto

As the clock chimed midnight on New Year's Eve, Grayscale CEO Barry Silbert celebrated bringing the company's total AUM across its various crypto funds to over $20 billion. Just one year ago, the figure stood at a mere $2 billion.

Grayscale crypto assets under management as of Dec. 31, 2020. Source: Grayscale/ Twitter

The company remains the largest institutional player on the Bitcoin scene, with its $17.475 billion in BTC far outstripping any other market participant. Newcomer MicroStrategy (MSTR), while not an investment business, now controls 70,470 BTC ($2.06 billion).

Going forward, analysts predict that more demand for the fixed supply of "new" bitcoin from miners will only serve to create a bidding war and push up the price. Sellers already faced stiff resolve from buyers in December 2020, when new all-time highs failed to produce significant long-lasting pullbacks.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more