Banks Are Literally Begging Americans To Take Out Loans And Max Out Credit Cards

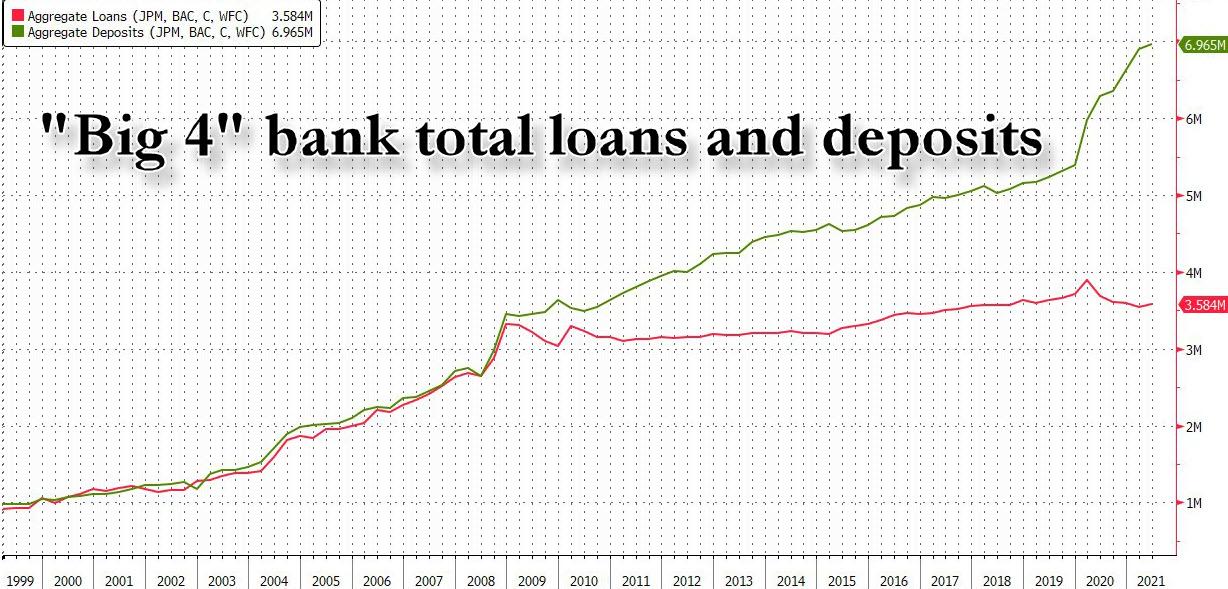

Last month when looking at the latest bank balance sheets, we showed that something was "terminally broken" in the US financial system: specifically, we showed that a "stunning divergence" had emerged between the total deposits at big banks which had just hit a record high courtesy of the Fed's QE (as the fungible reserves injected by the Fed end up as cash on bank balance sheets and offset the concurrent surge in deposits) and the stagnant loan books, which had barely budged since the Lehman bankruptcy as most US consumers have no pressing need to expand businesses and ventures, a startling confirmation of the woeful state of the US economy when one peels away the fake facade of the record high stock market.

In fact, looking at the chart below, one can see that all the Fed has done since the (first) financial crisis is to force bank balance sheets to grow ever larger not due to loan growth but to accommodate the trillions in reserves which alas earn next to nothing - unless they are invested directly in risk assets as JPMorgan's CIO "Whale" did back in 2012 with rather unfortunate results - and which screams that something is terminally broken with the entire financial system.

But while banks and financial analysts may pretend otherwise, everyone knows that such "growth" predicated on a reserve sugar high is hollow at best, and is why banks - whose entire net interest income depends on loan growth - are so desperate to hand out loans.

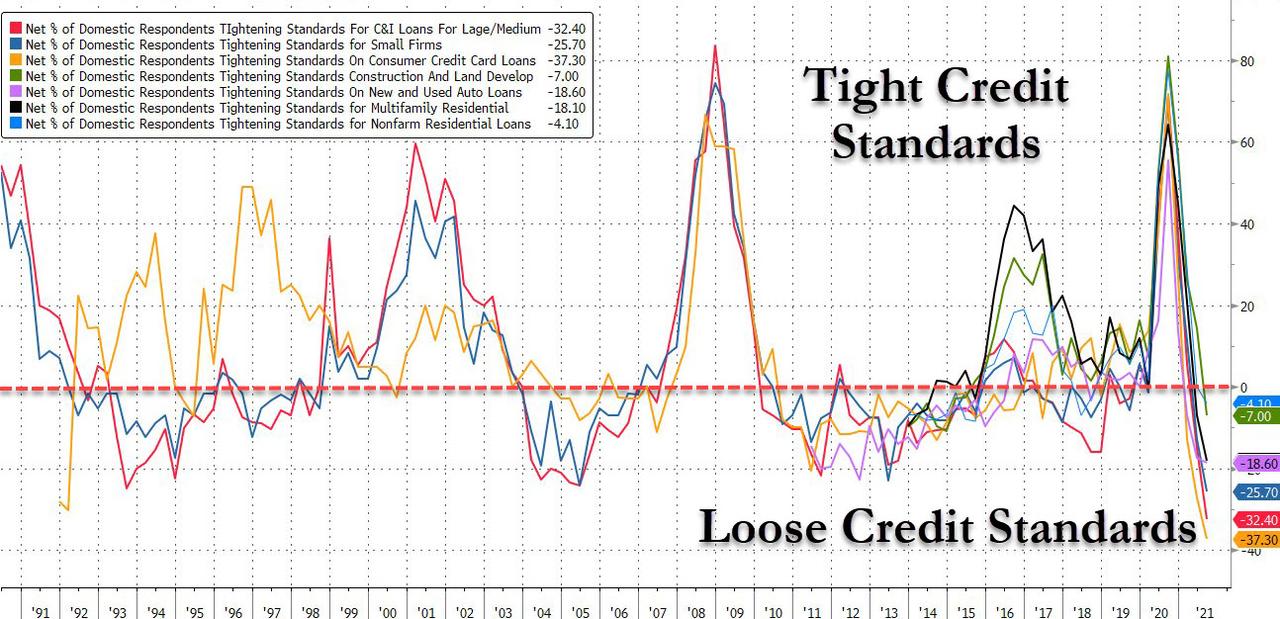

How desperate? We got the answer yesterday with the latest, July, Senior Loan Officer Opinion Survey conducted by the Fed. We won't waste readers' time going over the specifics - we have done that frequently in the past most recently here - suffice it to say that all this survey measures is how tight - or alternatively, loose - bank lending standards are in anything from C&I loans to auto loans, to residential loans, to multifamily loans, all the way to that American staple: credit cards. A positive net number means standards are tight - as they were in the second quarter of 2020 - while a negative number means standards are loose. Or as the case may be right now, the loosest they have ever been.

Presenting: a visual representation of the latest SLOOS report.

The chart is self-explanatory, but here are a few observations - not a single type of loan was on the "tight" side; instead every single type of loan tracked by the Fed was extremely loose by historical standards and when it comes to some loan types such as credit cards, C&I loans and small firm loans the lending standards have never been looser: when it comes to those categories of debt, banks - so desperate to grow their loan books - are literally begging Americans to take the money. Oh and one final note: not even at the peak of the 2005 housing bubble was it this easy to take out a loan!

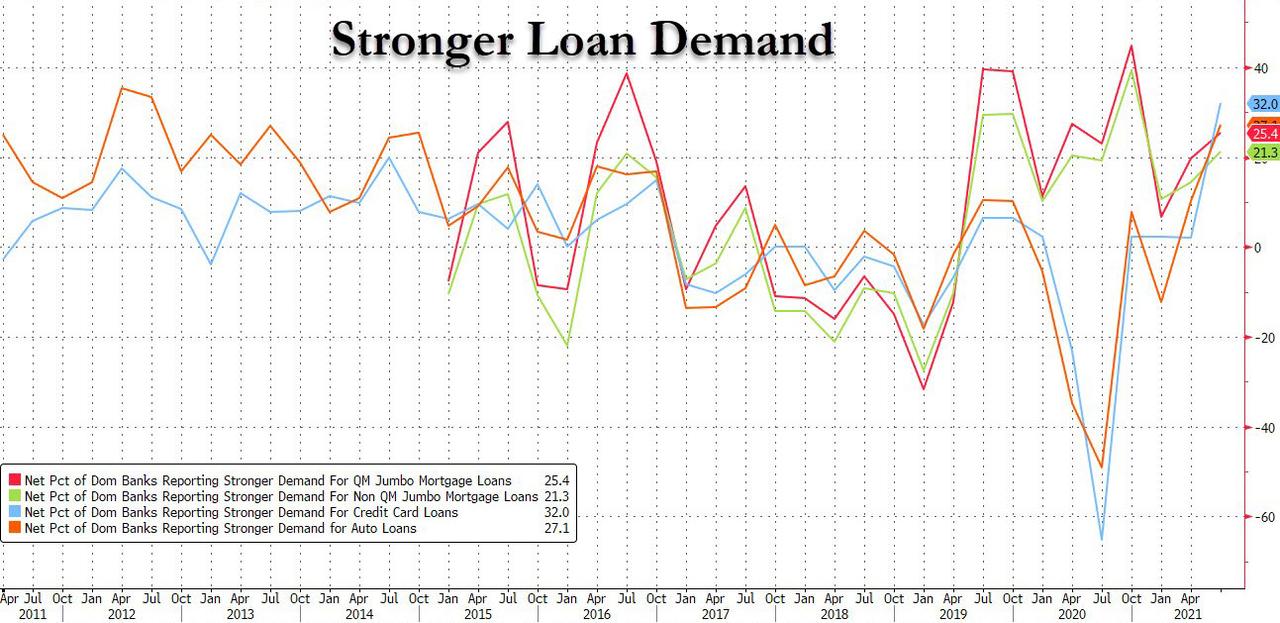

There is just one problem: the supply of consumer debt may be at all-time high but the demand is at best tepid, and as the next chart shows, while it did tick up modestly, the percentage of banks reporting stronger loan demand is well within the historical range.

Of course, this may well be a temporary state, and sooner or later banks may get just what they have wanted, and demand eventually soars. It's then - when the perfect storms of record easy loan supply and record-high loan demand finally collide - that the truly runaway inflation the Fed has been hoping for the past decade.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more