Are PayPal Shares Too Expensive At Current Prices?

↵

Paypal Holdings (PYPL) shares have made substantial gains during the last few months. After previously closing at $164.36, the stock has advanced by more than 3%, eventually closing at $170.26. This marks a new all-time high, so it seems that the March 2020 stock market crash did not have much of the effect on the company shares.

One of the main drivers of this uptrend is the company’s improving financial performance. Due to the outbreak of COVID-19 pandemic, followed by lockdowns and travel restrictions, many companies lost significant portions of their revenues and profits. As a result, investors lost confidence in those firms and as a result, their share prices dropped dramatically.

However, it has to be mentioned that the PayPal stock was indeed an exception to this dynamic. According to the first-quarter report, the company has added 20.2 million new accounts, including 10.2 million new ones as a result of the acquisition of Honey, for which the firm has paid $3.6 billion in cash. As a result of this change, the total number of active accounts has reached 325 million, 17% higher than during the first three months of 2019, when this number stood at 277 million.

This tendency for growth translated to higher total payment volume, which has increased by 19%, rising from $161 billion a year ago to $191 billion. The firm also achieved a 13% increase in its revenues, which has risen from $4.13 billion back in 2019 to $4.62 billion during the first quarter of 2020. Since the company weathered the storm of COVID-19 outbreak so well, it is well-positioned to increase its earnings in the years to come.

As the official quarterly report mentions, due to recent successes, the company management has returned $800 million to its shareholders by repurchasing 7.5 million shares of common stock. PayPal yet to pay any dividends. Yet, the basic law of supply and demand suggests that when a company purchases its own stock, it reduces the total number of shares in circulation and consequently, makes each of them more valuable. As a result, each shareholder owns a larger portion of the company and is entitled to a greater share of its earnings.

Recent Share Price Performance of PayPal Stock

source: cnbc.com

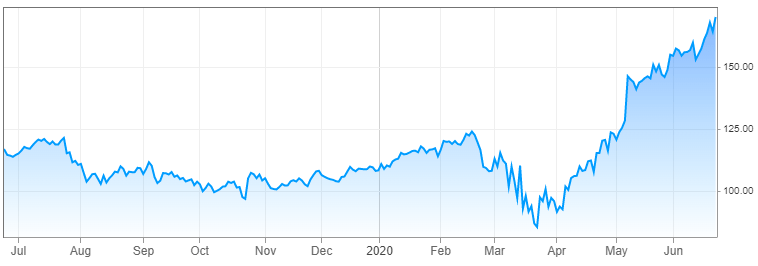

As we can see from the chart above, the PayPal stock price has gone through 4 stages. By late June 2019, PYPL was trading close to the $117 level. During the next 4 months, the stock was in a slowly moving downward trend, eventually falling to $97 by the second half of October 2019. This was followed by a steady appreciation during the following months, with the shares eventually reaching a peak at $124, during the middle of February 2020.

This is exactly the point where the outbreak of the COVID-19 pandemic started to have a major effect on the stock market, leading to a sharp correction, which lasted until the second half of March 2020. As a result of this process, the PayPal shares also dropped significantly, going all the way down to $85, a level not seen since December 2018.

However, this decline turned out to be very short-lived. The stock was quick to recover from this downturn. In fact, by early April PYPL erased all of its recent losses. Since then the uptrend continued without any major disruption and during late June 2020, the stock has already surpassed an all-time high $170 level, making the stock one of the best performers of S&P 100 during the first two quarters of 2020.

Current Valuations of PayPal Shares

It goes without saying that such steady appreciation is impressive for any stock, especially when this move comes during the economic downturn. However, this raises the question: have PayPal shares become too expensive?

In order to come up with an accurate answer, we need to take a look at some of the indicators. Firstly, as CNBC suggests, the Earnings per Share (EPS) indicator of the company currently stands at $1.58. This means that the Price to Earnings (P/E) ratio of the stock is near 107.76. This makes it very clear that despite its growing earnings and share buybacks, the PayPal stock is extremely overvalued. The stock was already overpriced at the beginning of the year and the recent surge has made its overvaluation even more extreme.

It is likely that at some point, the PayPal shares might face some sharp correction when the market finally decides to address this imbalance. However, it is very difficult to predict when this turn might take place. It can so happen that some disappointing quarterly reports might become a catalyst for the move, or alternatively the stock might fall a victim to a general bear market.

However, one thing is quite clear. This stock can not be a very useful addition to the growth portfolio since due to its extreme overvaluation, its upside potential is very limited. Therefore, investing in PayPal stock at such overpriced levels can be potentially very risky and could easily lead to significant losses.

It is true that the company still manages to expand its earnings with the double-digit percentages, however, those profits can not really catch up to the skyrocketing share prices. This is indeed a piece of good news for the current shareholders of PayPal. However, this process made the stock very unaffordable and expensive for new investors. So consequently, they might be better off looking for some decent value investments elsewhere.

PayPal shares are not likely to attract any income investors either since so far the company never paid any dividends and has not announced any intention of doing so in the near future. If at some point, the management decides to share some of its profits with shareholders in this way, the stock might become more attractive in that regard. However, at the moment, when it comes to decent income stocks, there are certainly much better alternatives.