3 Reasons To Buy Visa Stock Now

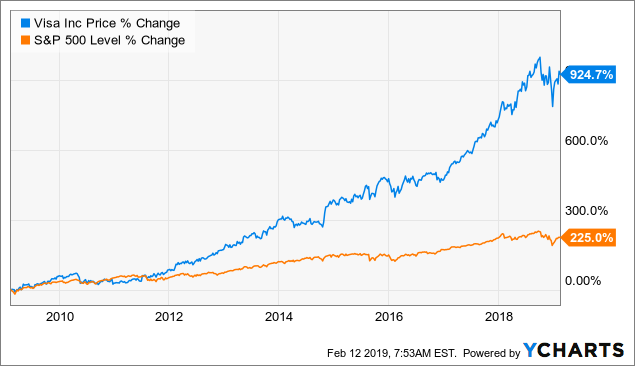

Visa (V) stock has delivered massive gains in the past decade, rising by more than 900% and obliterating the S&P 500 index in the process. However, that does not mean that the best is already in the past. On the contrary, winners tend to keep on winning in the stock market, and Visa is well positioned for market-beating returns going forward.

Data by YCharts

1. A High-Quality Business

With a massive network of 16,800 financial institutions, 44 million merchants, and 3.27 billion cards in circulation, Visa is the global leader in electronic payments. Brand recognition and scale are key sources of competitive strength in the industry, especially because customer trust is such a crucial success driver in payments.

In addition to this, the network effect provides a self-sustaining virtuous cycle of growth and increased competitive strength for a dominant player such as Visa. Customers want to have cards that are accepted everywhere, and merchants need to accept the cards that provide access to more potential customers.

This means that customers and merchants attract each other to the leading payments networks, and Visa becomes stronger as it gets bigger over the years.

The business model offers some remarkably attractive characteristics. Most of the company's operating costs are relatively fixed, because a large share of those costs is related to building the technological infrastructure necessary to process payments.

This means that profit margins tend to expand as revenue grows, and Visa generates stratospheric profitability levels. Operating profit margin is around 66% of revenue, with return on equity reaching 32%.

2. Outstanding Financial Performance

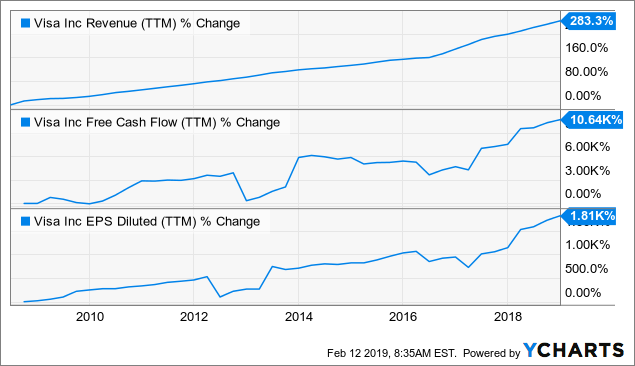

The chart below shows how key financial metrics such as revenue, free cash flow, and earnings per share have evolved over time. Visa has clearly created a lot of value for shareholders in the long term.

Data by YCharts

The company reported better than expected sales and earnings for the fourth quarter of 2018, which is the first quarter of the fiscal year 2019 for Visa. Net operating revenue amounted to $5.5 billion, growing by 13% year over year. Adjusted earnings per share jumped by an impressive 21% year over year during the quarter.

The main performance indicators are all moving in the right direction:

- Total payment volume amounted to 2,196 billion during the quarter, growing by 11% in constant currency terms.

- Visa registered 49,962 million transactions in the quarter, a year-over-year increase of 11%.

- Service revenues grew 9%, to $2.34 billion

- Data processing revenue reached $2.47 billion, growing 15%

- International transaction revenue grew 11%, to $1.85 billion.

Visa has delivered impeccable financial performance in terms of revenue growth and profitability over the years, and there is no slowdown in sight when looking at the company's most recent earnings report.

3. Reasonable Valuation

Visa stock is currently trading at a forward P/E ratio around 26.5, this is a material premium versus the broad market, but not excessive at all for such a high-quality business.

The chart below shows how ratios such as price to earnings, price to free cash flow, and enterprise value to EBITDA have evolved in the past three years. Based on these metrics, Visa stock is fairly reasonably priced by historical standards.

Data by YCharts

Importantly, proper valuation is not just about looking at the company's valuation metrics in isolation. The valuation numbers should always be interpreted in their due context, incorporating other quantitative metrics in areas such as financial quality.

In other words, price is what you pay and value is what you get. Valuation is about comparing value versus price as opposed to looking at the price tag alone.

The PowerFactors system is a quantitative algorithm available to members in my research service, "The Data-Driven Investor." This algorithm ranks companies in the market according to a combination of quantitative factors that includes: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

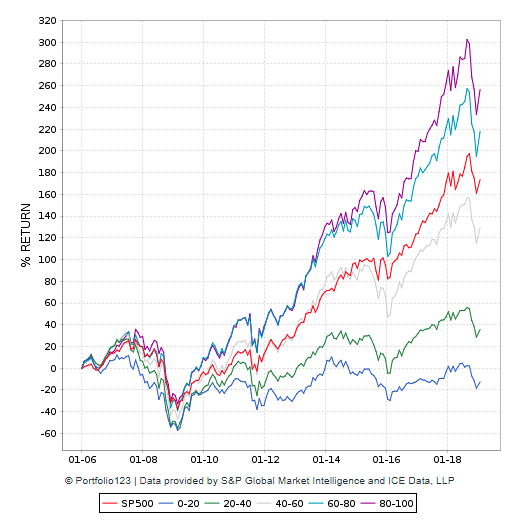

The algorithm has delivered outstanding backtested performance over the long term. The chart below shows backtested performance numbers for companies in 5 different PowerFactors buckets over the years.

Data from S&P Global via Portfolio123

Companies with higher rankings tend to produce superior returns, and stocks in the strongest bucket materially outperform the market in the long term.

Visa is in the top segment, with a PowerFactors ranking of 91.59. The company is particularly strong in quality (99.32) and it has elevated rankings in value (74.65) and relative strength (78.65). Fundamental momentum is also above average, but not too impressive, at 57.88.

It's important to keep in mind that past performance does not guarantee future returns. The backtesting data for the PowerFactors system shows that a broad group of companies with strong quantitative attributes tends to outperform the market in the long term. However, that doesn't tell us much about how Visa will perform in a particular year.

Like all quantitative systems, the PowerFactors algorithm is based on past and present data, as well as expectations about the future. If Visa's financial performance deteriorates going forward, then the quantitative system is hardly a valid guide for the future.

Nevertheless, the fact remains that the numbers look good for Visa stock if the company continues delivering in accordance with expectations.

The Bottom Line

No investment proposition can be free from risk. In this particular case, regulatory uncertainty is always an important consideration for a company with a dominant position in payments processing. Visa is the top player in debit and credit cards, and the company makes massive amounts of money. This makes Visa an easy target for politicians and lawyers trying to impose limits and new regulations on its operations in different countries.

The competitive landscape is also evolving, with companies such as Apple (AAPL), Google (GOOG) (GOOGL), PayPal (PYPL), and Square (SQ) making big inroads in payments. Besides, blockchain technologies could have a disruptive impact on the payments industry in the years and decades ahead.

Companies in the sector seem to be inclined to making profitable alliances as opposed to savagely competing for customers and earnings. Visa is also proving to be smart enough to adapt to the emerging trends in the market and to continue thriving in a changing industry landscape.

Nevertheless, it’s important to monitor the industry in case competition becomes more aggressive, which could have a negative impact on revenue growth and profit margins.

Those risks being acknowledged, Visa is an exceptional company, generating outstanding financial performance and trading at reasonable valuation levels for such a high-quality stock. Those are three clear reasons to consider buying Visa stock with a long-term horizon.

Disclosure: I am/we are long GOOG, PYPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business ...

more