Fed Expands Bailout Facility To Muni Bonds After Market Meltdown

In yet another expansion of The Fed's interventionary reach into 'markets', The Fed has decided to "expand its program of support for flow of credit to the economy by taking steps to enhance liquidity and functioning of crucial state and municipal money markets."

This is a move they never played during the Lehman crisis.

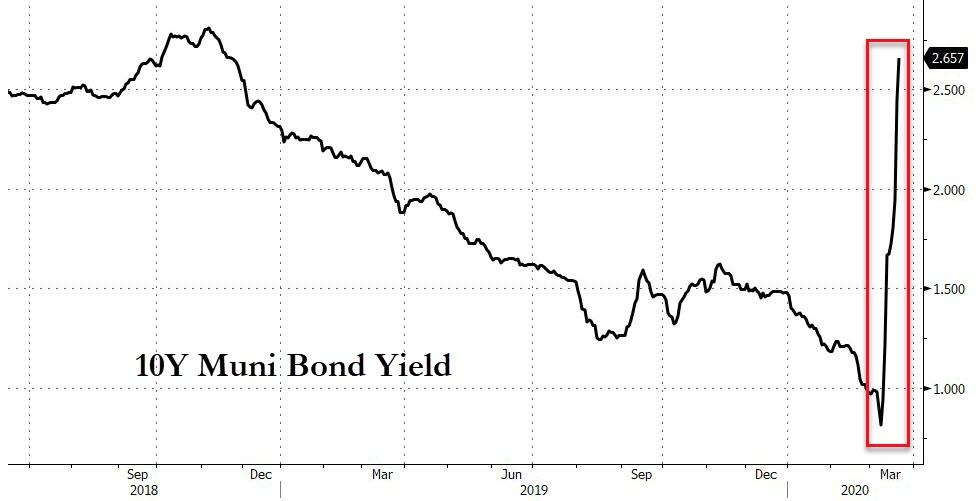

This is why - the Muni market is collapsing...

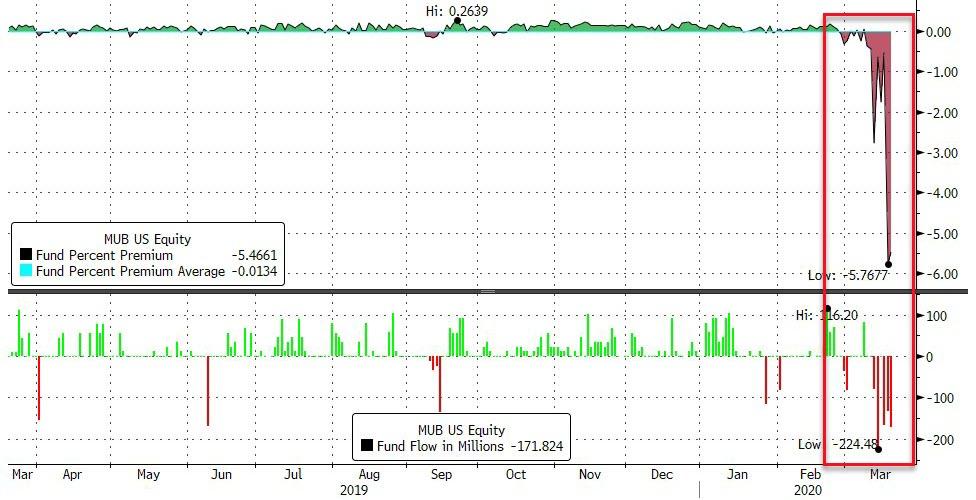

As a reminder, the Muni Bond market had 'broken' with investors desperately using the ETFs to hedge...

Completely decoupling the ETF from the underlying due to lack of liquidity...

Fed Statement:

The Federal Reserve Board on Friday expanded its program of support for the flow of credit to the economy by taking steps to enhance the liquidity and functioning of crucial state and municipal money markets. Through the Money Market Mutual Fund Liquidity Facility, or MMLF, the Federal Reserve Bank of Boston will now be able to make loans available to eligible financial institutions secured by certain high-quality assets purchased from single state and other tax-exempt municipal money market mutual funds.

Eligible Collateral: Collateral that is eligible for pledge under the Facility must be one of the following types:

1) U.S. Treasuries & Fully Guaranteed Agencies;

2) Securities issued by U.S. Government Sponsored Entities;.

3) Asset-backed commercial paper that is issued by a U.S. issuer, is rated at the time purchased from the Fund or pledged to the Reserve Bank not lower than A1, F1, or P1 by at least two major rating agencies or, if rated by only one major rating agency, is rated within the top rating category by that agency;

4) Unsecured commercial paper that is issued by a U.S. issuer, is rated at the time purchased from the Fund or pledged to the Reserve Bank not lower than A1, F1, or P1 by at least two major rating agencies or, if rated by only one major rating agency, is rated within the top rating category by that agency; or

5) U.S. municipal short-term debt that:

i. Has a maturity that does not exceed 12 months; and

ii. At the time purchased from the Fund or pledged to the Reserve Bank:

1. If rated in the short-term rating category, is rated in the top short-term rating category (e.g., rated SP1, MIG1, or F1, as applicable) by at least two major rating agencies or if rated by only one major rating agency, is rated within the top rating category by that agency; or

2. If not rated in the short-term rating category, is rated in the top long-term rating category (e.g., AA or above) by at least two major rating agencies or if rated by only one major rating agency, is rated within the top rating category by that agency.

How long until corporate bonds... and stocks... are added to the list?

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more