Explaining Bitcoin’s Rise From $6k To $56k In A Single Year

One year ago — on March 12th, 2020 — bitcoin was trading at $6,131 per coin. It had been valued at more than $12,000 in June 2019. But markets everywhere were in a bit of a panic last March, and stocks were trading near the lowest level of the year. BTC sold off during the initial crash, just like almost everything else.

But it was pretty clear to me this would ultimately prove to be a great BTC buying opportunity. Because I knew how the Federal government and Federal Reserve were going to react. They were going to print and spend gobs of money, which would almost certainly drive further adoption of bitcoin.

Here’s what I wrote last March in “Bitcoin Was Made For Times Like These,” discussing the $6 trillion stimulus package. Bitcoin was trading at around $6,642 at the time.

I don’t see anything that can stop the money-printing tsunami that is coming. There’s too much debt in the system, too little savings and too little income with the economy being basically shuttered over COVID-19…

Bitcoin was created as a response to reckless government spending, bailouts and money printing. Despite incredible odds against the experiment working, it caught on.

Bitcoin’s purpose is to serve as a decentralized alternative to the existing fiat money system. I believe we’re about to see exactly why this is an important and worthy goal.

I finished that article by citing something I wrote in January 2019.

Bitcoin is in a fantastic place today. The world simply doesn’t understand what it is yet. It’s a monetary revolution in the making, and most people are still eyeing it like it’s a strange, speculative toy.

The general public will come to understand bitcoin with time and, unfortunately, this will accelerate as more financial crises arrive to sharpen its attention.

A Spike In Realization, Then Price

The broader public is finally starting to understand the bitcoin story. Why it was created. What it is trying to accomplish. And the implications all of that holds.

They are beginning to realize this due to the bloated state of our financial system. The debt, money printing, unfunded liabilities, etc. It has become too glaring to ignore. This is ultimately what’s driving bitcoin — and the broader crypto market — higher.

When so many people come to such a dramatic realization at once and want to hedge themselves against inflation and fiat issues, you get the sort of price action we’ve seen in bitcoin over the last year. Combine it with an institutional bitcoin investor boom and the halving that cut new BTC supply in half last spring, and you get explosive growth.

Sure, some new crypto buyers are just in it for a short-term trade. But savvier ones will stick around for the long run — especially the new institutional investors that are flocking in. So I believe this bull run still has significant upside. Sure, there will be gnarly corrections. But the fundamentals driving adoption aren’t going away anytime soon.

Stimulus Unending

The COVID-19 crisis was the catalyst for this current splurge in debt and stimulus. But I think if it wasn’t that, it would have been something else. America was already running $1T+ deficits in 2019, with $122T+ unfunded government liabilities. We were already well on our way to Modern Monetary Theory (MMT) before this all began, as I noted back in November 2019.

COVID moved up the monetary timetable significantly. And the response has been staggering so far. I suspect support/stimulus packages will continue and even increase over coming years. They cannot stop at this point. We need ultra-low interest rates, huge government spending and money printing just to maintain the status quo. There’s simply too much debt in the system.

If the Fed Funds rate rose from 0.25% to 3-4% (lower than the roughly 5% long-term average), the financial world would implode. We saw what happened in 2018 when the Fed tried to raise rates. Disaster. Companies and governments would start to drown in the interest costs alone.

Our nation’s financial situation is also dire at the personal level. More than half of Americans have less than $1,000 savings today. That number was as high as 70% before COVID in 2019! All the stimulus has actually helped increase personal savings. It’s “working” — but people in the U.S. will continue to require significant government benefits going forward to keep the economy afloat.

Further, I believe the U.S. will eventually move to a Universal Basic Income (UBI) model, where everyone is guaranteed a certain level of income. We’ve completed three rounds of stimulus checks now. I expect more will follow, then eventually UBI.

The nation will become increasingly dependent on government largesse. And as the late economist, Milton Friendman said “Nothing is so permanent as a temporary government program.”

But Where’s The Inflation?

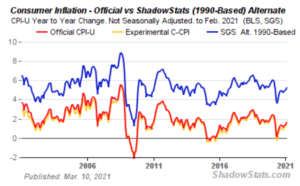

I do believe we will eventually see troubling levels of inflation. In fact, one could argue that we already have fairly high real inflation. Take a look at the research of Dr. John Williams — founder of ShadowStats — who calculates inflation using the old (official) Consumer Price Index (CPI) methodologies from 1990 and 1980. Using those methods, he comes up with alternate readings of around 5% to 8.5% real inflation, respectively. Needless to say the new, “modern” way inflation is calculated happens to make it look a lot lower than it used to.

Here’s what Williams’ alternate inflation measure looks like (in blue) compared to the official number (in red).

This “real inflation is higher than reported” notion is (slowly and reluctantly) becoming more widely appreciated. It’s now being discussed by major analysts such as Michael Every, Head of Financial Research in the Asia-Pacific region for Rabobank (Rabobank is a giant Dutch financial firm, one of the 30 largest in the world).

Every recently discussed some ways in which official inflation statistics are manipulated in “Inflation Is Being ‘Hidden’ Because Belief In Our Whole Fantasy System Is Collapsing.” Here’s an excerpt.

“…is inflation being ‘hidden’? If so, let’s not forget US CPI has long had ‘hedonic adjustments’ that presume goods such as clothing and books get “cheaper” as their price goes up because they are “better”; and since 1999 it has used a geometric not arithmetic mean to assume when beef goes up, consumers buy chicken, so inflation stays lower overall. Would they want to actively hide inflation though?“

To me, it seems clear that inflation is already a fairly serious problem — and that it’s likely to get worse over time. However… it is important to remember that the dollar remains the world’s reserve currency. And a LOT of people and nations around the world still rely on it for commerce and as a reserve asset.

So as we “debase” our money by printing and spending more, any “pain” is shared by everyone who holds dollars around the world. As a result, I believe MMT and debt monetization are actually going to work pretty well for a while. For a time, it will seem as if we are printing our way to prosperity. And those calling for an imminent dollar collapse will likely continue to be disappointed for many years to come. Eventually, it seems likely that other countries will begin to shift away from the dollar as it is slowly debased, but these things take a long time to play out.

Importantly, inflation could still get rather nasty over the next few years. I could easily see prices increasing more than 10% annually within a few years. That sort of inflation can quickly wipe out a big chunk of savings (and debt, which is more the goal).

This environment — rising inflation/prices combined with ultra-low interest rates and the resulting lack of yields — will continue to create demand for alternative assets like bitcoin, for the next decade I’d guess. And whenever inflation gets truly serious, bitcoin will likely go parabolic once again.

Some of us cranks have been ranting about this stuff for years. But for the averageinvestor, realization is just now dawning. Many more are still in denial. But eventually, everyone will have their own private epiphany. When they do, I suspect many will wish they had held onto some BTC. It’s shaping up to be the hedge to own for the next decade plus.

Disclaimer: Read our full disclaimer here.