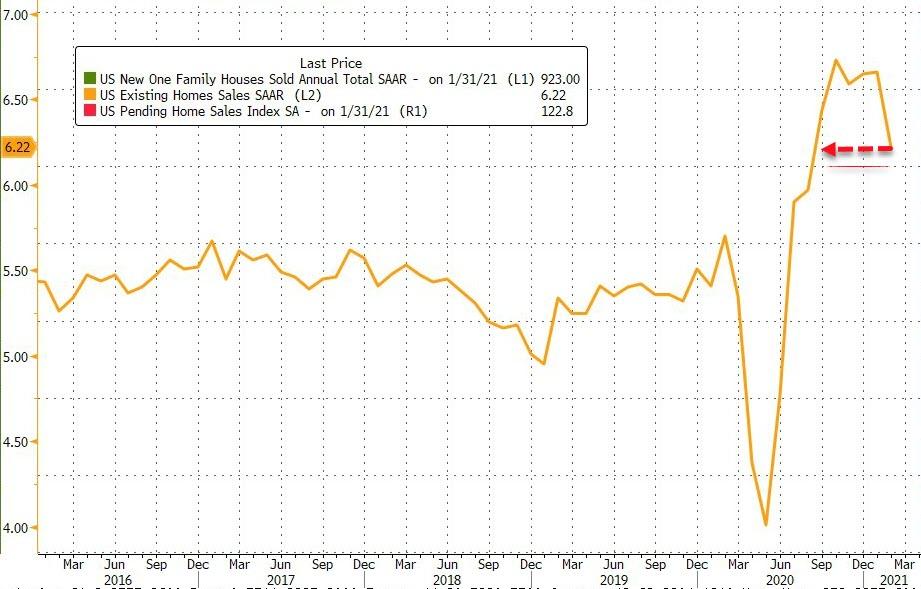

Existing Home Sales Plunge As Higher-Rate Impacts Accelerate

While pending home sales tumbled in January, Existing Home sales rebounded but were expected to slide in February as interest rates rose, and they did, dramatically. Against expectations of a 3.0% decline, existing home sales plunged 6.6% MoM in February (January's +0.6% rise was also revised down to a 0.2% rise).

(Click on image to enlarge)

Source: Bloomberg

And while year-over-year sales are still up, the pace has collapsed as SAAR drops to a six-month low...

(Click on image to enlarge)

Source: Bloomberg

The number of homes for sale declined by a record 29.5% in February from a year ago, helping explain a 15.8% jump in the median selling price to $313,000. That was the highest-ever median price for that month.

Purchases of all existing homes fell in three regions, including in the South and Midwest, where the month’s weather impacts were the most severe. In the South, contract closings declined 6.1% to an annualized 2.77 million, the slowest pace in five months. They dropped 14.4% in the Midwest to a 1.31 million rate, the weakest since June. Home sales fell 11.5% in the Northeast and rose 4.6% in West.

The NAR blames supply...

“The fact that even with the decline in sales, days on the market is swift, prices are rising strongly -- it’s implying that demand isn’t disappearing from the marketplace,” Lawrence Yun, NAR’s chief economist, said on a call with reporters.

“It really is a lack of supply.”

But, as Wolf Richter details in his latest report at WolfStreet.com, we suspect that these are the first signs that higher mortgage rates are impacting the housing market.

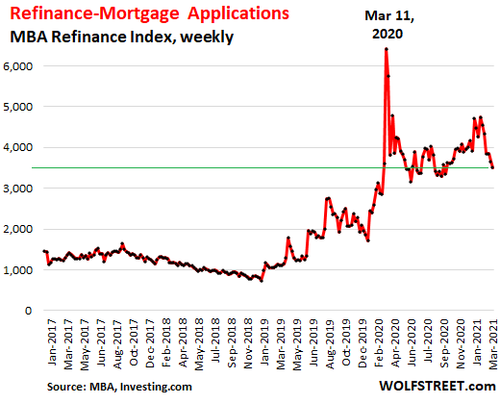

Mortgage refis have dropped since January, driven by a sharp drop in no-cash-out refis; cash-out refis have also dropped, but less so, for a reason we’ll get to in a moment. This chart shows the Mortgage Bankers Association’s mortgage refi index:

No-cash out refis “are already seeing large volume declines,” according to a report by the AEI Housing Center, which pointed out that due to the higher rates, fewer loans are “in the money.”

Cash-out refis are also down but only modestly, “as these borrowers are driven more by cash needs than rates,” the AEI report said.

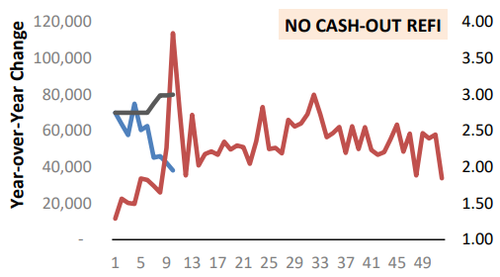

The chart by the AEI Housing Center shows the weekly no-cash-out refis in 2021 (light-blue line, left scale) heading south, and in 2020 (brown line); it also shows the median mortgage rate in 2021 (dark blue line). The time line indicates the weeks of the year:

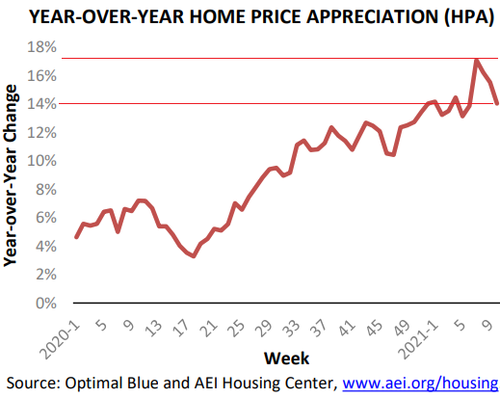

The AEI’s weekly Home Price Appreciation index, while still up a massive 14% year-over-year, has started to back off tad: at one point in early February, it was up over 17% year-over-year.

The “decreased buying power” due to the rising interest rates is “already having a limited effect in slowing HPA,” The AEI said. “The somewhat lower HPA in week 10 of 2021 looks to be the first sign of this trend.”

But the AEI added that “a loan rate of 4% might, due to severe supply constraints, still result in an unsustainable HPA rate of 8%-11%.”

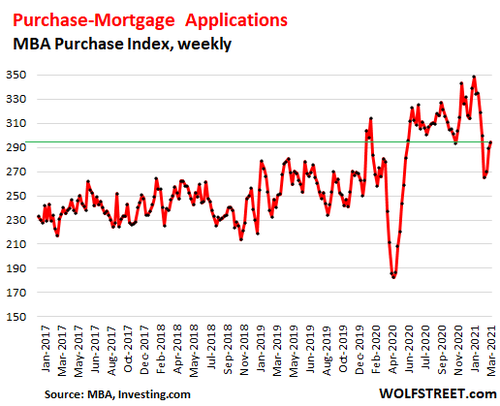

Mortgage applications for the purchase of a home have also declined from the peak in mid-January:

So it seems from this weekly data that the housing market remains red-hot, but the higher mortgage rates, which remain ultra-low by historical measures, have already started dialing down the heat.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more