Europe’s Week Ahead (April 27-May 1): Virus Infects Sovereign Credits

Market participants in the week ahead will be bracing for further updates on the European Union’s bleak economic picture, as the coronavirus crisis continues to batter the perceived creditworthiness of nations across the continent.

While European leaders continue to hammer out a budget to best support the economies of its area’s countries, business activity and labor markets have increasingly shown signs of marked deterioration.

Measures taken to contain the COVID-19 outbreak has riled industrial productivity and employment to record lows in April, with the IHS Markit Eurozone Composite PMI plummeting to an all-time low of 13.5 from 29.7 in the prior month – worse than the 36.2 level reached in February 2009 during the global financial crisis.

(Click on image to enlarge)

Unsurprisingly, service sector companies, including hospitality, restaurants, travel, and tourism, were especially rattled, while manufacturing output also staged a significant decline.

IHS Markit noted that “the unprecedented scale of the collapse was broad-based, with composite flash PMI output indices hitting all-time lows of 17.1 and 11.2 respectively in Germany and France (down from 35.0 and 28.9 in March), while the rest of the region saw the composite PMI slide from 25.0 to 11.5.”

Chris Williamson, the chief business economist at IHS Markit, said that the latest data “suggests that the April survey is indicative of the eurozone economy contracting” at an estimated quarterly rate of 7.5%.

He continued that while hopes are “pinned on containment measures being slowly lifted to help ease the paralysis that businesses have reported in April,” any progress towards that end “looks set to be painfully slow to prevent a second wave of infections.” Williamson added that in the event of “a prolonged slump in demand, job losses could intensify from the current record pace and new fears will be raised as to the economic cost of containing the virus.”

Meanwhile, in the Friday morning trading session, yields on French (0.02%) and German 10-year bonds -0.47%) were somewhat lower, while Italian (1.88%) and Spanish notes (0.94%) softened.

Marc Chandler, the chief market strategist at Bannockburn Global Forex, also observed that Spanish and Portuguese 10-year yields have risen about 10-12 basis points this week, Italy about 5bp, and Greece over 15bps, while comparable German and French yields were1-2bps softer.

The U.S. 10-year benchmark was little changed on the week – hovering near 0.60% intraday Friday.

In terms of the euro, Chandler added that the currency has fallen every day this week, approaching its lowest level in a month – near $1.0725 ahead of the weekend – compared to last week’s level of around $1.0875, while the U.S. dollar held firm against all the major currencies, “not just on the day but for the week as well.”

Sovereign Debt Sales and Credit Deterioration

Some European peripheral countries have tapped the debt markets recently to help stop the bleeding in their respective economies.

Spain and Italy, for example, each sold €16b worth of new sovereign bonds, with massive oversubscriptions, to the surprise of many in the market who fear the economic and financial well-being of these countries, as their perceived creditworthiness comes under intensifying pressure.

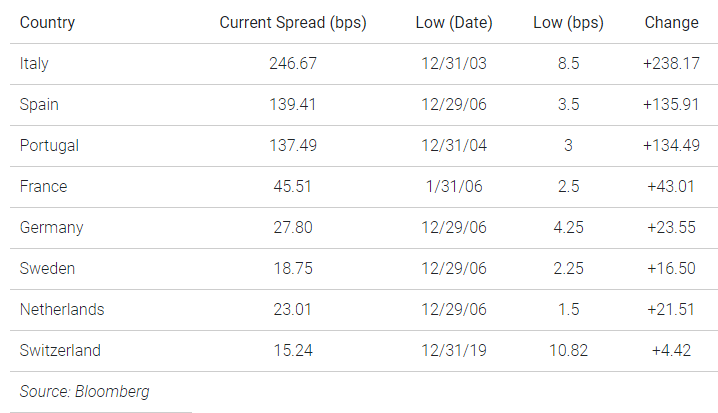

While spreads on some European countries’ five-year credit default swap (CDS) contracts intraday Friday compared to their lows indicate a significant widening of some peripherals, they remain roughly 50% tight of their 2011 highs.

(Click on image to enlarge)

(Click on image to enlarge)

Bank Liquidity Concerns

Against this backdrop, the European Central Bank (ECB) has committed to several actions to help buoy economies and the financial system. However, uncertainties persist over whether area banks are sufficiently capitalized and hold enough liquidity to weather the storm.

Fitch Ratings recently noted that it expects “a widespread and material rise in loan impairment charges (LICs) for most banks” in the first quarter of 2020 and a “material increase in problem loans later in the year.” Fitch said it anticipates that asset quality will suffer most at banks with higher exposures to small and medium-sized enterprises (SMEs), consumer finance, as well as the most affected corporate sectors, including oil and gas, tourism, shipping, and retail. “Crucially, the degree to which asset quality will deteriorate depends on the effectiveness of the vast fiscal stimulus programs and the duration of the crisis,” the agency said.

However, unlike a financial crisis, where the exposure ceilings may be calculated, losses from the coronavirus-induced economic destruction remain unknown.

“The ultimate effect of the crisis on banks’ credit profiles is still unclear and the full economic impact will depend on the scale and duration of the outbreak, the severity of containment measures, and economic policy responses,” Fitch added.

The ECB is set Thursday to announce its next monetary policy decision, after having implemented a slew of accommodative measures to help shore-up liquidity and stave-off financial and economic impacts from the virus.

(Click on image to enlarge)

In fact, central banks globally have scrambled to introduce rate cuts and liquidity support, with others executing mammoth asset purchase programs, including the ECB, the U.S. Federal Reserve, the Bank of England, the Bank of Japan, and the Reserve Bank of Australia, among several others.

The International Monetary Fund (IMF) cited in its World Economic Outlook (WEO) for April 2020 that several central banks have also activated bilateral swap lines to improve access to international liquidity.

However, the IMF admits there is “extreme uncertainty” around the global growth outlook “because the economic fallout depends on uncertain factors that interact in ways hard to predict,” including, for example, the “pathway of the pandemic, the progress in finding a vaccine and therapies, the intensity and efficacy of containment efforts, the extent of supply disruptions and productivity losses, the repercussions of the dramatic tightening in global financial market conditions, shifts in spending patterns, behavioral changes (such as people avoiding shopping malls and public transportation), confidence effects, and volatile commodity prices.”

The IMF foresees a 7.1% contraction in the growth of the EU, led in advanced economies by Italy (-9.1%) and Spain (-8.0%).

Shares of companies in both core and peripheral European regions have also been plunging, as evidenced by the year-to-date 2020 performances of several iShares MSCI exchange-traded funds (ETFs), including the Germany Index Fund (NYSEARCA: EWG, -24.4%); the France Index (NYSEARCA: EWQ, -28.86%); Italy Index (NYSEARCA: EWI, -32.75%); and Spain (NYSEARCA: EWP, -31.88%).

Among the top holdings of these ETFs:

- Germany – SAP (NYSE: SAP), financial sector firm Allianz (OTCMKTS: AZSEY) and industrial manufacturer Siemens (OTCMKTS: SIEGY);

- France – oil giant Total (NYSE: TOT) and pharma firm Sanofi (Nasdaq: SNY);

- Italy – Enel (OTCMKTS: ENLAY), energy company Eni (NYSE: E), and financials Intesa Sanpaolo (OTCMKTS: ISNPY) and UniCredit (OTCMKTS: UNCRY); and

- Spain – electric utility Iberdrola (OTCMKTS: IBDRY), and financials Banco Santander (NYSE: SAN) and Banco Bilbao Vizcaya Argentaria (NYSE: BBVA).

Investors will likely be paying close attention to developments in Europe as the coronavirus continues to cause carnage across the continent.

On the Economic Calendar:

Wednesday, April 29

- Business Confidence (Apr)

- Consumer Confidence (Apr)

- Economic Sentiment (Apr)

Thursday, April 30

- GDP (Flash – Q1)

- CPI/Core CPI (Flash – Apr)

- Unemployment Rate (Mar)

- European Central Bank (ECB) Monetary Policy Decision

- ECB press conference following the Governing Council (in Frankfurt)

In the meantime, select the Event Calendar option in the IBKR Trader Workstation for a full list of the U.S. and global corporate events and earnings, dividend schedules, economic data, IPOs, and more.

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more