European Equities Seem To Offer Relative Value, But That’s A Trap

(Source: DennisM2)

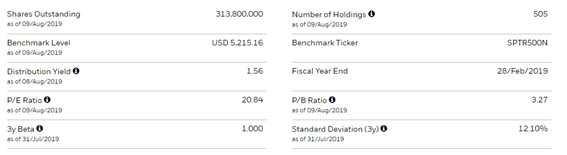

Scanning the global markets for value always makes me stop in Europe. Using the S&P 500 (SPY) as our reference, we get a P/E ratio of 20.84, a P/BV of 3.27, and a distribution yield of 1.56%.

Table 1 – Portfolio characteristics of S&P 500 ETF

(Click on image to enlarge)

(Source: iShares)

Now, looking at the STOXX Europe 600 (DJXXF), we get a P/E ratio of 15.85, P/BV of 1.77, and a distribution yield of 3%.

Table 2 – Portfolio characteristics of STOXX Europe 600 ETF

(Click on image to enlarge)

(Source: iShares)

Comparing both indexes, we can see that there appears to be relative value in Europe. However, it is my conviction that digging just a little bit deeper, reveals that Europe is just a value trap.

The US develops tech, China copycats and Europe taxes it.

Looking back to the last decade, we can see a definite trend where the US has been developing the exciting tech in the world, Chinese companies have been copying it, and the EU has been furiously taxing it.

That has left China, and the US, at the forefront of the tech race. Europe has fallen behind very significantly. Just ask yourself, what is the most popular European search engine Or even, what’s the most important online retailer, or the most known social media company? Well, I don’t know the answers to those questions. We have to face the fact that there aren’t comparable European companies in those fields. To confirm it, compare the top ten holdings of the tech sectors, in both the S&P 500 and the STOXX 600.

Table 3 – iShares S&P 500 Information Technology Sector UCITS ETF

(Click on image to enlarge)

(Source: iShares)

Table 4 – iShares STOXX Europe 600 Technology UCITS ETF (DE) top 10 holdings

(Click on image to enlarge)

(Source: iShares)

The biggest European tech company in the index is the SAP (SAP), which is a $142 billion corporation. Second on the list is ASML (ASML), which is a $90 billion company, and then Amadeus (AMADY), a $33 billion corporation. Compare that with the top 3 tech companies in the S&P, Microsoft (MSFT), Apple (AAPL), and Visa (V). We are talking about more than $2 trillion. And, it’s like the US technology is not making money, Apple and Microsoft are cash-cows.

When a downturn occurs, investors will ditch high valuation stocks, and the tech sector has lots of them. Nevertheless, many of this last wave of tech stocks are disruptors that will destroy the business models of many European companies. And, the European tech sector is missing in action. Since tech will be fundamental for indexes returns during the next decade, the absence of good companies in the field spells doom and gloom for European equity indexes.

Disclosure: I have no positions in the securities mentioned in the article. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no ...

more