European Banks: Do They Have What It Takes?

European banks have so far drawn €1,699bn funding from the ECB TLTRO-III operations. We examine whether banks are likely to reach the lending thresholds that would allow them to benefit from the lowest available funding rates.

European banks drew €174.5bn from the fifth tranche of the ECB funding program TLTRO-III yesterday, substantially down from the €1,308bn drawn from the fourth tranche. The total size of the TLTRO-III program stands at a substantial €1,699bn.

Motivation to participate in the fifth tranche could have been driven by a growing understanding of bank loan demand in the Covid-19 environment, a possible access to funds at the -1% level until June 2021, the consideration of no stigma or reputational risk left after the significant June take-up, and removal of a possible leverage ratio constraint.

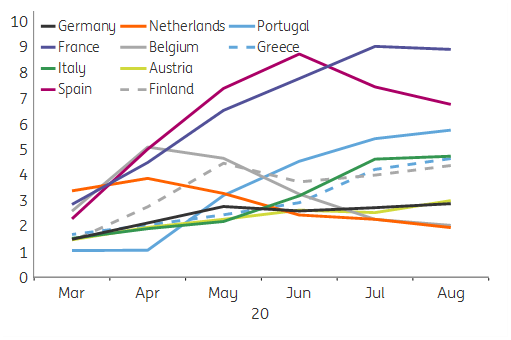

The interest rate in the ECB TLTRO-III operation is tied to lending development. If banks meet the set lending criteria, they can obtain the TLTRO funding at a rate as low as -1% for one year and at -0.50% for the rest of the time. In our view, banks are in general well positioned to meet the benchmark with their eligible net lending growth on a country basis by March 2021. Yet there are clear country differences.

Countries where initial liquidity needs were mostly met by bank loans and, in turn, backed by government guarantees, are comfortably above the benchmark. This applies to Spain, Italy, Portugal, but also France.

At the other end of the spectrum are countries where more of the support was provided by governments directly to businesses and households, mainly via tax deferrals and temporary wage support schemes. This is the case in, for example, Germany and the Netherlands.

Despite the fact that the latter group of countries has less leeway above the benchmark, we think all countries presented here are in a good position to meet or exceed the net lending benchmark. Countries are also generally on track to meet or exceed the benchmark in the second reference period.

Cumulative eligible net lending since March 2020 (%)

(Click on image to enlarge)

Source: Lending to businesses and non-mortgage lending to households. Compared to country net lending benchmark as defined by ECB. Corrected for sale/securitisation where applicable. Source: ING-calculations based on ECB-data.

French and Italian banks were the largest users of the ECB’s longer-term refinancing operations in July, drawing €350bn and €345bn, respectively, followed by German and Spanish banks, at €284bn and €257bn, respectively. This is not surprising taking into account the lending developments and the bond market pricing. The banking sectors of France, Spain, and Italy are among those showing the strongest lending growth in the special reference period. Among them, Italy and Spain in particular, but also to a lesser extent France, stand to benefit from the attractive funding levels of the TLTRO program as compared to funding via bond markets.

From a funding cost angle, it would currently make sense for banks across the Eurozone to draw funds from the TLTRO-III, especially if they were to meet the special reference period lending benchmark and thus realize the attractive -1% rate for one year and a rate of -0.5% for the rest of the operation. The TLTRO-III tranches I-V have the first repayment opportunity in September 2021.

Thus, banks can enjoy the special interest rate period, and only then consider whether to repay the funds early or keep them to maturity. The willingness to repay early is likely to be driven by lending development, bond market trading levels, tiering effects, and the economic outlook.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more