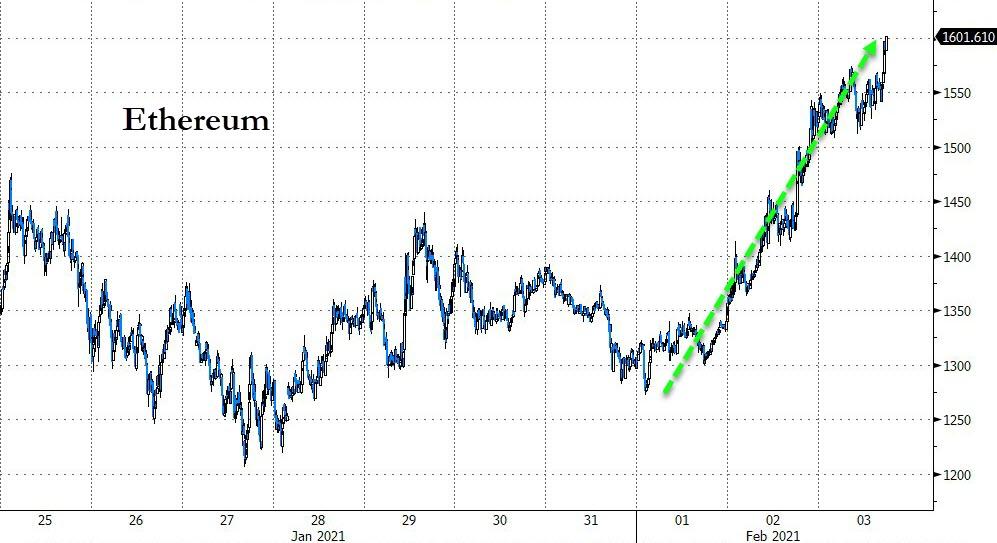

Ethereum Surges Above $1600, New Record High

While GameStop (GME) and Silver are losing their appeal, crypto markets are breaking out once again with Ethereum leading the charge.

The De-Fi foundation crypto topped $1600 this morning, a new record high...

(Click on image to enlarge)

Source: Bloomberg

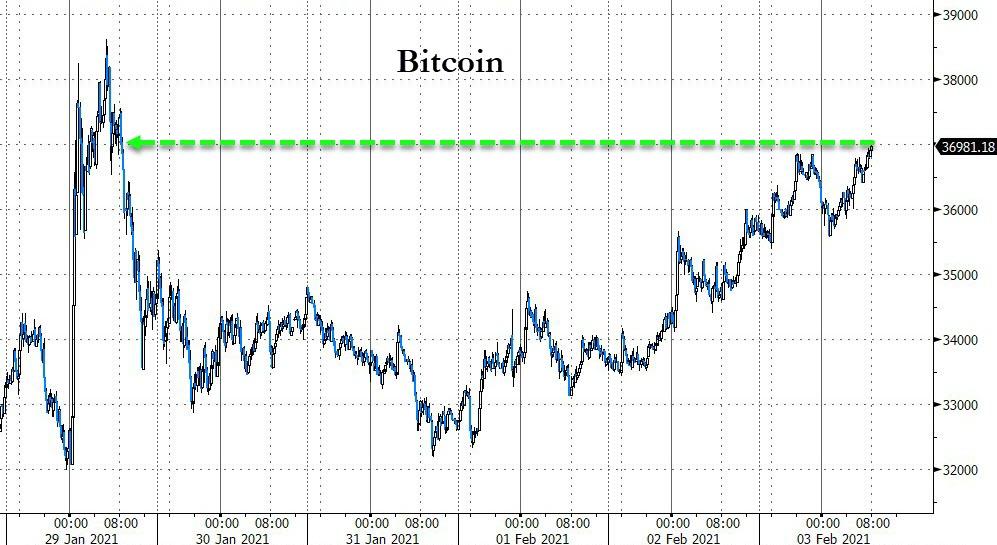

And while Bitcoin is also rallying, back above $37,000...

(Click on image to enlarge)

Source: Bloomberg

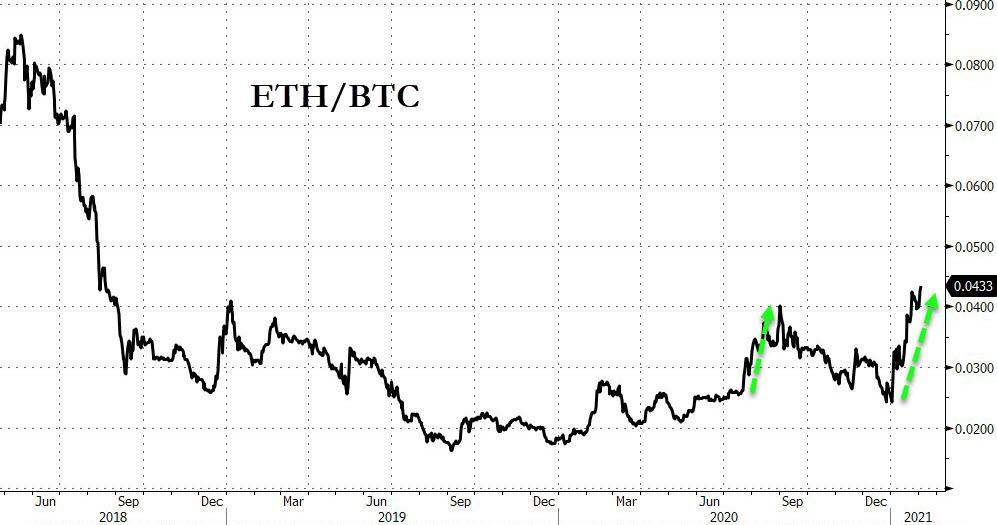

ETH's outperformance of BTC has been impressive...

(Click on image to enlarge)

Source: Bloomberg

Notably, the ETH ramp is taking place despite an overnight hit piece by Bloomberg seeking to hammer the crypto, by reporting that CME is set to launch Ethereum futures, and reminding readers that the last time new crypto futures were launched in bitcoin, the price crashed (a Federal Reserve Bank of San Francisco analysis posits the derivatives opened the door for bearish investors).

The listing of Ether futures may also see “negative price dynamics,” Nikolaos Panigirtzoglou, global market strategist with JPMorgan Chase & Co., wrote in a note Tuesday. Initial volumes are likely to be low, he added.

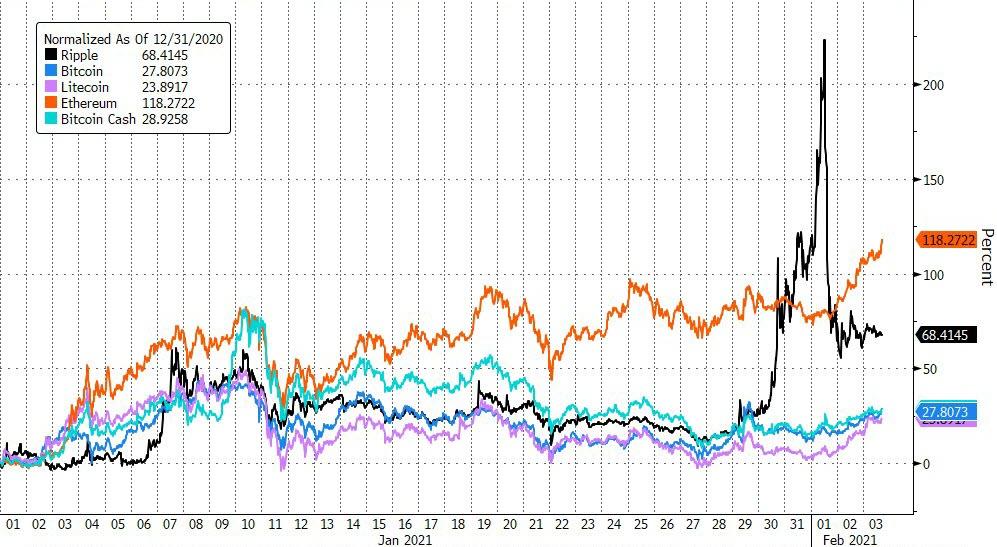

Ether so far is unruffled, as Year-to-date, it is the biggest gainer, up 120%...

(Click on image to enlarge)

Source: Bloomberg

Crypto's gains come after news that Visa is piloting a suite of application programming interfaces (APIs) that will allow banks to offer bitcoin services, the payments giant announced Wednesday.

Additionally, as CoinDesk notes, Scott Minerd, chief investment officer of the multi-billion dollar investment firm Guggenheim Partners, has revised his previous prediction for bitcoin’s long-term price potential. In an interview with CNN’s Julia Chatterley on Tuesday, Minerd said, based on Guggenheim’s fundamental research, he believes bitcoin could eventually climb as high as $600,000 per bitcoin.

“If you consider the supply of bitcoin relative … to the supply of gold in the world, and what the total value of gold is, if bitcoin were to go to those kinds of numbers, you’d be talking about $400,000 to $600,000 per bitcoin,” he said.

However, the cryptocurrency’s rapid rise in just weeks from $20,000 to $40,000 “smacks of short-term speculation,” he said. Further, the institutional levels of market participation, while growing, aren’t yet big enough to support current price levels.

Additionally, the fund associated with the VIX whale formally known as '50-cent' - Jonathan Ruffer - made more than $750m (£540m) from its recent and controversial Bitcoin investment: “We’ve been surprised by how well it has done and how quickly. We did not expect immediate fireworks.

“The 2.5pc allocation we made in November across all our funds, which totalled around $600m. This has more than doubled so we decided to take out our ‘book cost’ and take $650m in profits. We still have around $700m left in and are currently up by $750m overall,” he said.

“We have been following Bitcoin’s rise for a few years. Back in 2017 we were very sceptical and I remember laughing in meetings at it all at the time. But in 2020 everything has changed – the economic environment for Bitcoin right now could not be better,”

“We are seeing negative interest rates and bond yields everywhere. We have seen the war on cash ramping up because of the pandemic. At the same time, everything is going digital – our lives are far more digital than a year ago.

"There are now proper regulated institutions buying in too. People are desperate for alternative safe haven assets and Bitcoin is like a digital gold."

“We are at the foothills of a long upward trend in its institutionalisation”, he added.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more