Ether Trading Volume Growth Beat Bitcoin's In H1 For The First Time

Two months ago, just days after the latest crypto wave peaked, Goldman - which recently formed an internal cryptocurrency trading team - initiated on the crypto space with a provocative angle: the investment bank said that whereas bitcoin was a one trick pony whose glory was set to fade, it was ethereum which it called the "amazon of information" that is the rising star in the crypto space - something we first suggested back in 2017 -and repeated its bullish Ether stance a few weeks later when it made the following observation:

Within the crypto space, Ether currently looks like the cryptocurrency with the highest real use potential as Ethereum, the platform on which it is the native digital currency, is the most popular development platform for smart contract applications. We would therefore not be surprised if in coming years Ether, or some other cryptocurrency with more real use, overtakes Bitcoin as the dominant digital store of value.

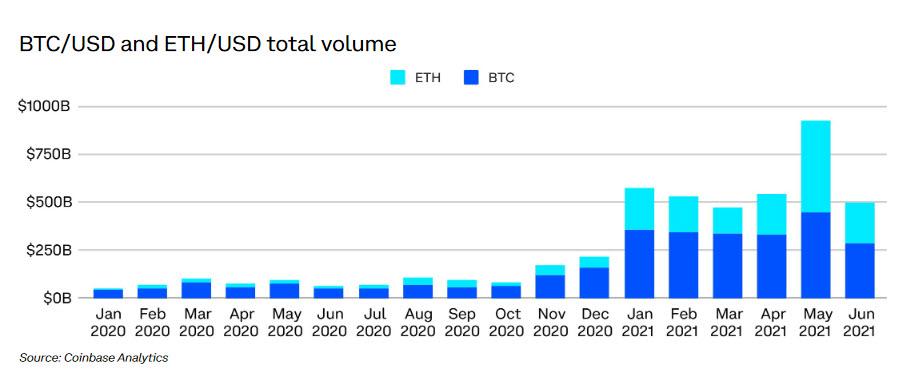

It appears that the general public is now agreeing, and according to Bloomberg citing a report published today by CoinBase, trading volume of Ether grew faster than that of Bitcoin in the first half of the year, and in the month of May, total ETH trading volume was tied with that of bitcoin for the first time ever.

Looking at data from 20 major exchanges worldwide, Coinbase found that Bitcoin’s trading volume for the period reached $2.1 trillion, up 489% from $356 billion over the first half of last year. Total ETH volume, meanwhile, reached $1.4 trillion, up 1,461% from $92 billion in H1 2020. This was the first sustained period of time ever for Ether’s trading pace to exceed Bitcoin’s, according to Coinbase.

(Click on image to enlarge)

Both Bitcoin and Ethereum jumped this week amid a furious short squeeze, in part catalyzed by expectations that Amazon would soon offer crypto payment services, after sinking in May after Elon Musk shunned bitcoin on concerns about its environmental impact and a regulatory crackdown in China.

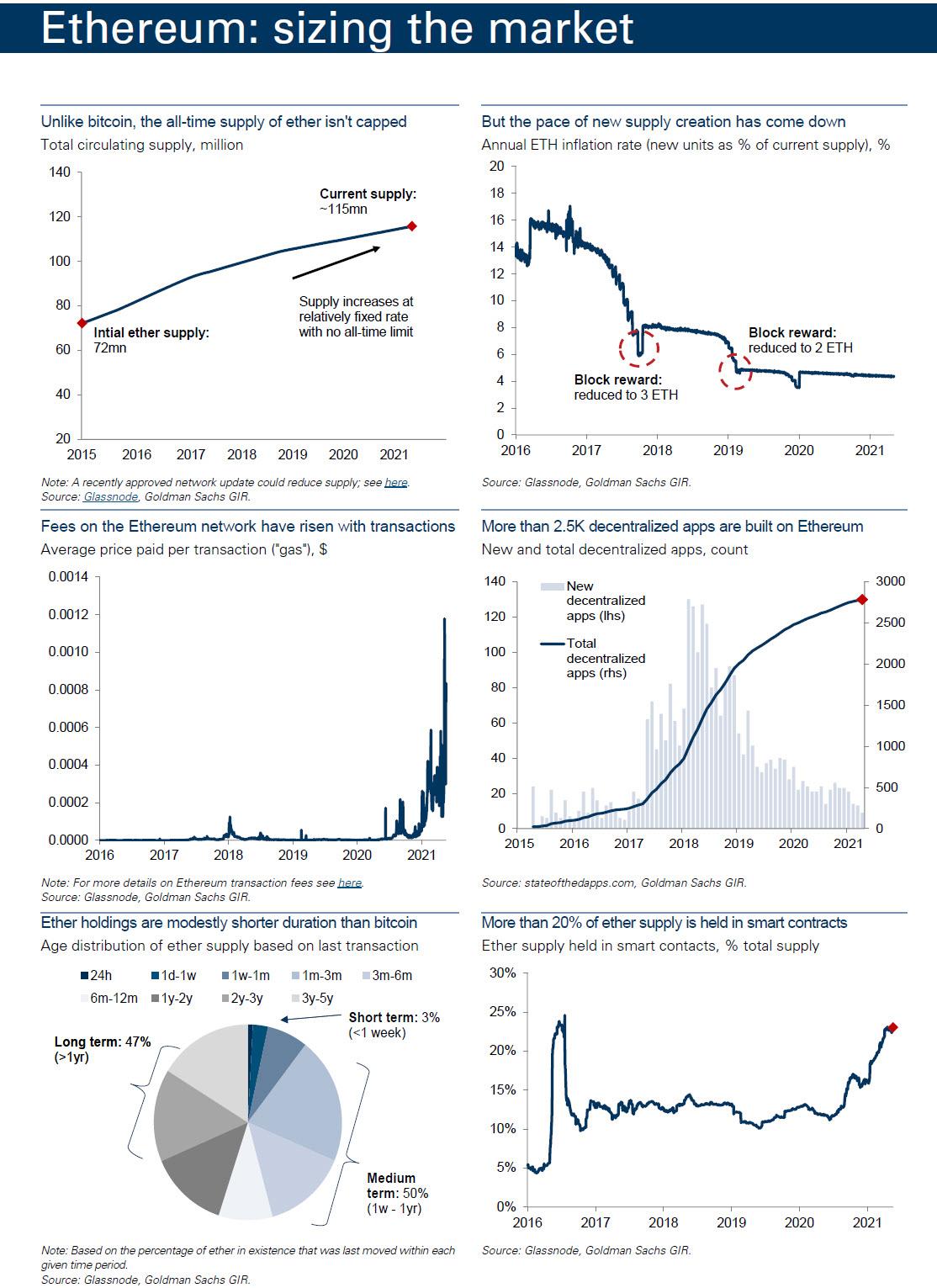

Unlike bitcoin, which is mostly used for peer-to-peer payments and as a store of value, Ethereum has been at the center of a new crop of apps allowing for peer-to-peer lending, borrowing, and trading. It is also facing an upgrade due around Aug. 4 that will reduce the amount of outstanding tokens by destroying some of them every time it’s used to fuel transactions, which will spur even more price gains once the current accumulation period ends.

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more