Yes, Of Course, There's A Bubble

There seems to be some debate on whether there's a bubble or not. I think that it's quite clear. There are numerous "bubbles" in various asset classes right now. The real question is, for how much longer and how much further can these bubbles inflate?

Some Prominent Areas of Froth

Solar/alt energy names - Solar, clean, alternative energy has been very hot in recent months. In fact, many prominent stocks/ETFs are up by hundreds or even thousands of percent since their lows in 2020.

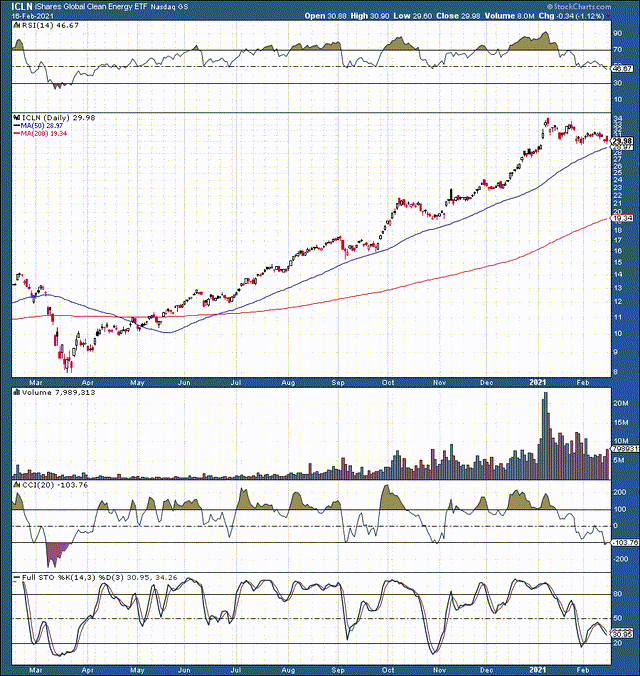

iShares Global Clean Energy ETF (ICLN)

Source: StockCharts.com

We can see that this prominent ETF is up by around 300% since the big bottom in March 2020, and is up by more than 100% from its pre-meltdown top. Are things really twice as good as they were one year ago?

In reality, it does not seem so. In fact, a year ago there were limited coronavirus effects on the economy. Thus, there was likely more demand and the overall economic image was arguably brighter.

Then why are prices so much higher than they were a year ago?

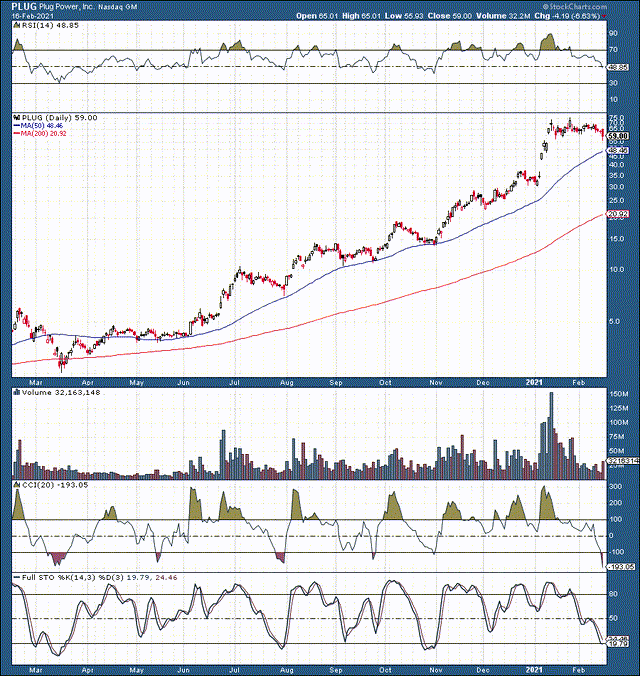

The top holding in ICLN is a company called Plug Power (PLUG).

Here's a chart of PLUG, up by nearly 3,000% from trough to peak inside of one year. I understand that alternative energy is hot and that Plug Power is one of the hottest stocks in this segment. However, this company is now worth a whopping $31 billion. Yet, it has no profits. Sure, roughly 40% YoY revenue growth is impressive, but should this company be trading at around 100 times sales right now?

Electric vehicles

Just about everyone seems to love EVs now. We don't have to go far to see just how hot this segment is.

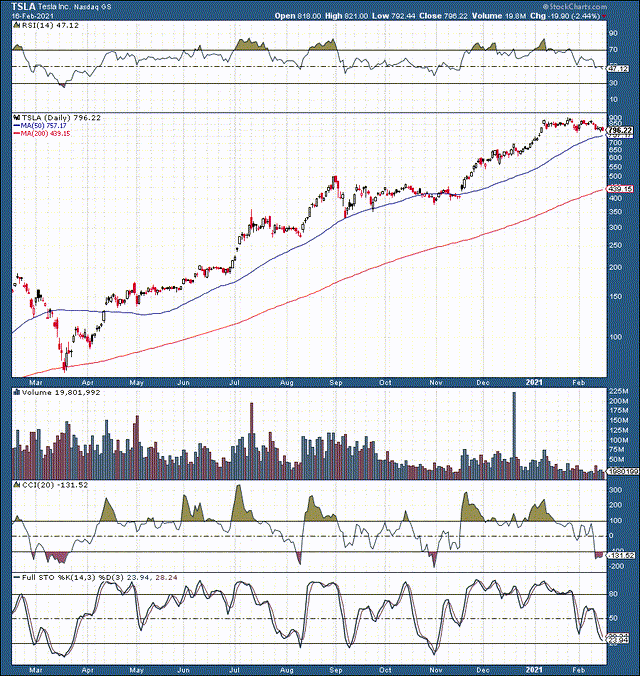

We can simply look at Tesla's (TSLA) stock.

At about $800 a share, roughly $4,000 pre-split adjusted, Tesla is now one of the most valuable companies in the world. People were saying that the company was expensive at $50 billion. Well, it has a market cap of over $750 billion at the time of writing this update. In comparison, Toyota (TM) is worth around $220 billion, General Motors (GM) is valued at roughly $77 billion.

So, I think it's safe to say that Tesla is worth several of its nearest competitors combined, roughly 10 times the size of GM. With a valuation of around 360 times trailing earnings, this may be "extreme."

NIO (NIO), Tesla's cheaper Chinese competitor, is valued at nearly $100 billion (no profits), and this company only had around $2.5 billion in sales last year - 40 times sales for this EV manufacturer. I understand there's future potential here, but at what price is it simply too much?

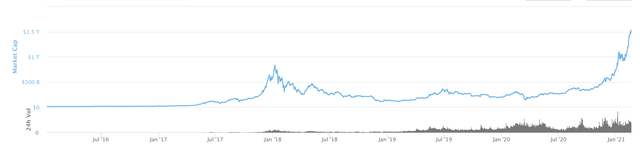

Digital assets

While Bitcoin (BITCOMP) has seen some notable gains lately (broke out above $50K recently), other digital assets are up by much more. Just look at Dogecoin (DOGE-X). DOGE shot up by a couple of thousand percent in just around two months' time.

This has become a familiar theme in the digital asset market, as various alt coins essentially take turns shooting up day in and day out. In fact, the market cap of the cryptocurrency complex has exploded to over $1.5 trillion, roughly doubling its prior peak at the top of the market in early 2018.

The trouble with such remarkable gains is that these assets are essentially impossible to value. Popularity drives demand, and demand pushes prices higher and higher. Therefore, it's quite common to see extraordinary gains of 1,000% or more inside of a relatively short-time frame, and who is to say that prices are too high?

The Takeaway

These are only a few examples of the various "bubbles" continuously expanding in this new economic reality. Other bubbles can arguably be observed in areas of technology, small and mid-cap stocks, growth-oriented names, other areas in the stock market, and in other asset classes as well.

The Cause

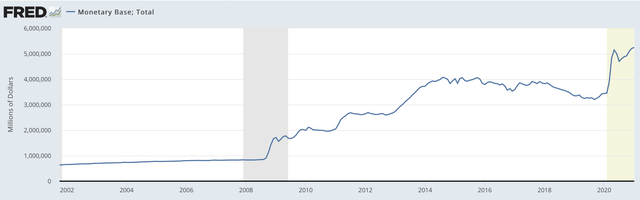

Perhaps the main enabler of today's frothy atmosphere is the Fed and its extremely easy monetary policies. QE unlimited, various bailouts and backstops, extraordinarily low-interest rates, and other variables are causing the Fed's balance sheet as well as the U.S.'s monetary base to expand notably.

Such extreme expansions of the monetary base are enabling a great deal of capital to come into markets. With most Treasuries yielding little to no real interest, this continuous influx of capital naturally gravitates toward risk assets (i.e. stocks, digital assets, etc.). Furthermore, it appears that much of the capital is going into some of the riskiest assets such as higher growth, higher risk/reward, little to no profits equities, and other areas promising to deliver the highest possible return on investment.

The Bottom Line

For now, this seems normal. In fact, the new economic reality is what I call the environment we are in right now. In this easy monetary atmosphere stocks and other risk assets could continue to rise and will rise until they don't anymore. Unless you can see the future, it's essentially impossible to predict when the current bubble environment will come to a pop. There will be periods of relatively minor deflation, followed by more inflation, but I think this new economic environment could last for some time.

In my view, the likeliest party to prick this bubble is the Fed, but it's unlikely that the Federal Reserve will impose notably stricter monetary policy this year, or going into 2022 for that matter. Therefore, we could be in this advantageous atmosphere for risk assets for some time, and things could eventually get a lot frothier before the music finally comes to an end.

Disclosure: I am/we are long BTC-USD.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any ...

more