Yes, Buy This Dip

It's been several weeks now since I put out my "Yes, Of Course, There Is A Bubble" article. While discussing the idea that there are "bubbles" in various areas of the market, the segments that we put most emphasis on in the article were EVs, alternative energy, and digital assets. Now that a few weeks have gone by, these areas as well as others have deflated by quite a bit. After seeing significant corrections in various areas of the market we see some notable buying opportunities materialize at this time.

Looking Back on Some Pullbacks

Several specific names we discussed as being substantially overbought included Tesla (TSLA), NIO Limited (NIO), Plug Power (PLUG), iShares Global Clean Energy ETF (ICLN), and Dogecoin (DOGE-USD)(DOGE-X). Yet, the argument wasn't designed to single out these names. Rather the discussion was meant to shine a light on the extremely overbought nature of several particular sectors as well as other frothy areas in the market.

From recent peak to trough:

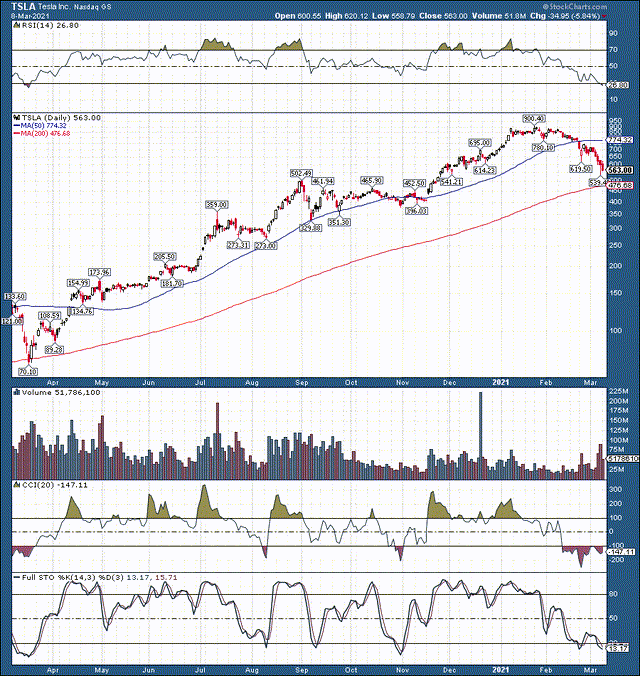

Tesla declined by 40%.

Source: StockCharts.com

Tesla's correction has been ongoing for about two months now, and the stock has given up approximately 40% of its value. We also see the relative strength index RSI at about 27, a level indicative of extremely oversold market conditions. Furthermore, Tesla has a very solid technical support level of around $550.

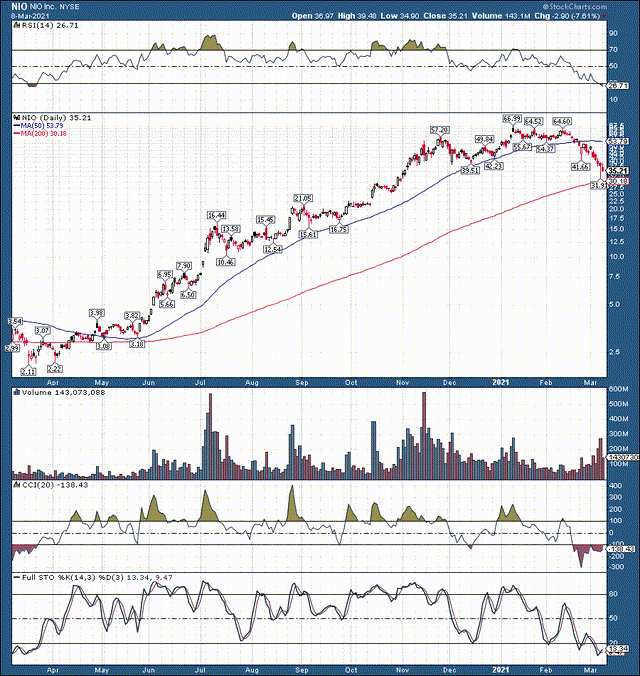

NIO gave up 52%.

NIO, much like Tesla, is also notably oversold here. The stock was down by more than 50% from its highs, the RSI is around 27 as well, and the stock hit a level consistent with a major technical support level in recent sessions.

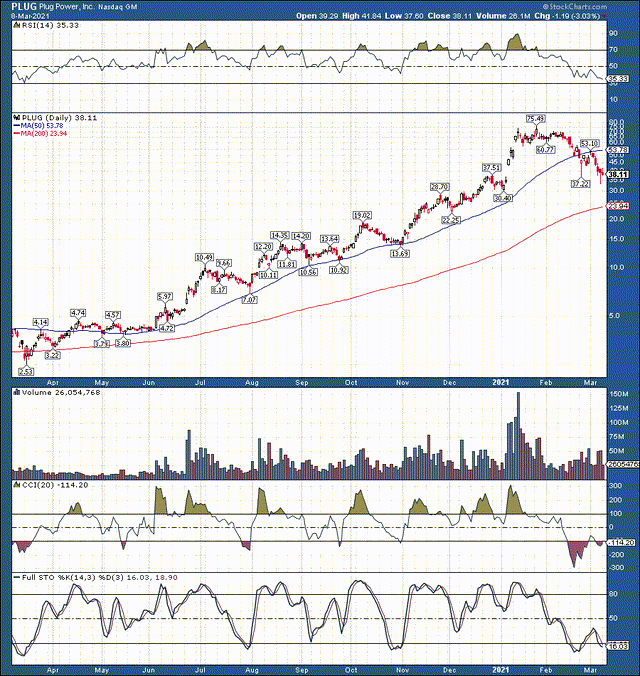

PLUG lost 56%.

PLUG, along with many other solar/alternative energy names, has gotten crushed lately. This stock filled some key gaps, and also hit a very key technical level in recent trading sessions.

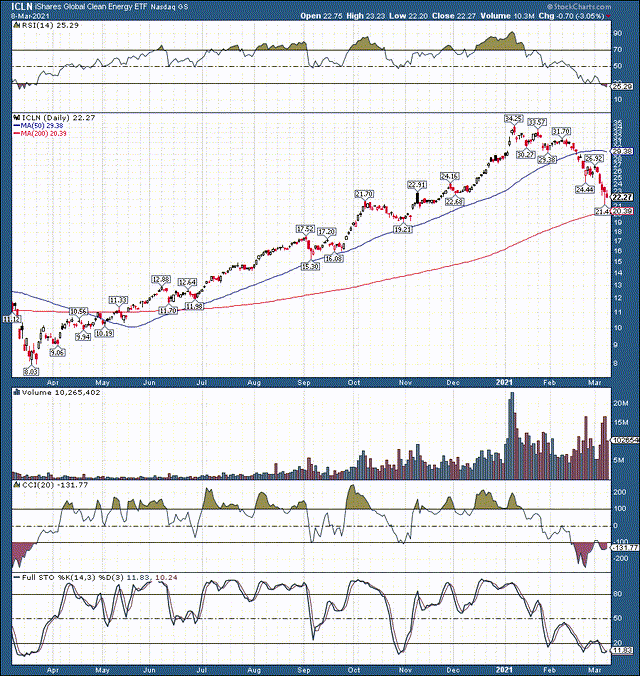

ICLN gave back 38%.

With an RSI at around 25, ICLN is drastically oversold now. We see that this ETF also filled a key gap from several months ago. In fact, this ETF along with other key solar/alt energy ETFs has dropped to levels not seen in around 4-5 months.

Dogecoin went down by 53%.

Source: Binance.com

After Dogecoin's rapid ascend the digital asset put in a double top followed by a prolonged correction process. While we do not invest in Dogecoin, the correction pattern is largely emblematic of the digital asset industry in general.

Now that the Nasdaq and other major market averages have gone through healthy corrections, this is likely a very attractive level to get into some badly beaten-down names. In fact, we recently started new positions in Tesla, NIO, as well as in a number of other stocks, ETFs, and digital assets.

Why Markets are Headed Higher from Here

Some people may be saying, "but what if this is only the beginning?" To address this concern let's examine why this correction occurred in the first place. Several primary reasons for the recent selloff include rising rates, frothy valuations in some sectors, an end to earnings season, passing of fiscal stimulus, and some good old profit-taking. These appear to be transitory factors, and there doesn't appear to be anything systemic threatening markets.

The 10-year has exploded higher, essentially going vertical recently after tripling from its August 2020 lows. Now, I don't think that such sharp moves are sustainable from an intermediate or longer-term perspective. The U.S. simply has too much debt for Treasuries to continue to move notably higher from here.

Therefore, the sharp uptick we've witnessed recently is likely a knee-jerk reaction to expectations for higher growth and higher levels of inflation going forward. Furthermore, higher growth and elevated inflation are bullish elements for stocks, commodities, and other risk assets going forward.

Corporate earnings and the announcement for fiscal stimulus can be "sell the news" type events. This is very likely what occurred, as earnings were largely better than expected, and better than expected earnings along with fiscal stimulus are both favorable for stocks as well as for other risk assets.

Yes, valuations were very frothy in certain areas of the market. EVs, alternative energy, areas of technology, many small-cap names, lithium providers, growth stocks, and high multiple names, as well as other areas in the market, had gotten notably overbought. Therefore, markets needed a correction, some profit-taking in frothy areas, and some rotation to more value-oriented, more defensive areas in the market was necessary. This is exactly what occurred, and now markets can continue to move higher after the recent reset.

Things to Buy on the Dip

I mentioned that we bought Tesla, NIO, and several other names in recent sessions. I want to share several other beaten-down names in areas that are likely to rebound and move higher going forward.

In lithium:

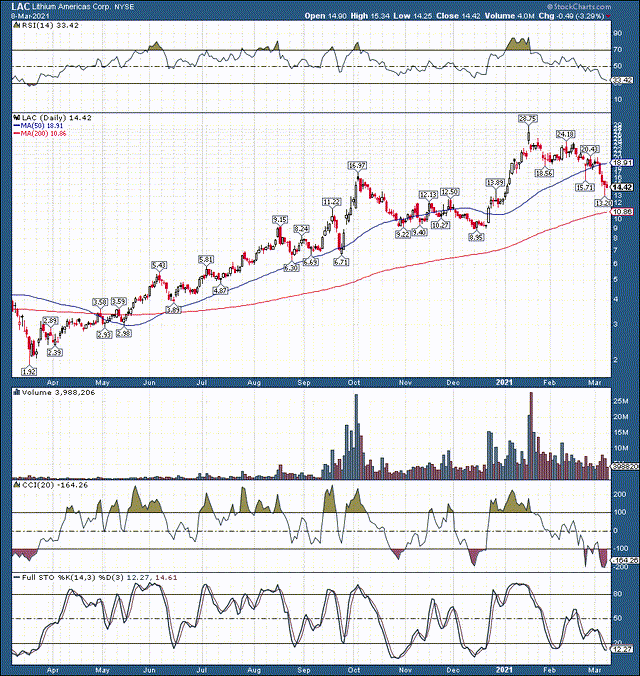

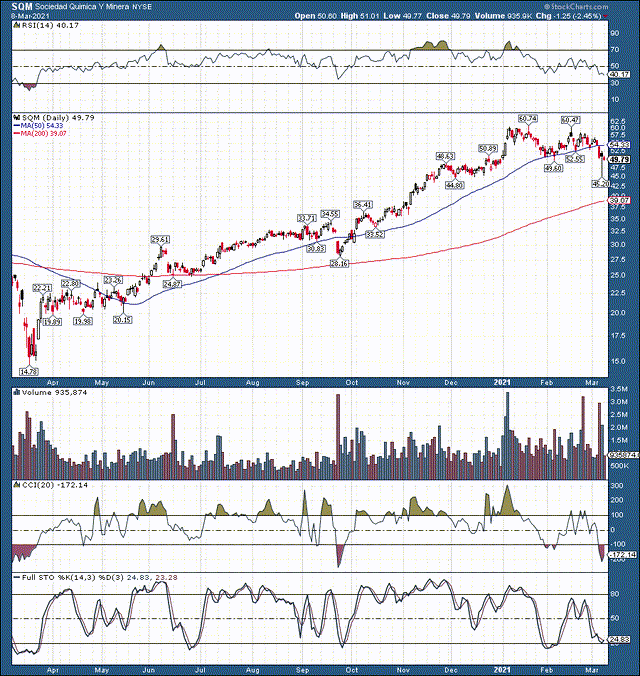

Lithium Americas Corp. (LAC)

Sociedad (SQM)

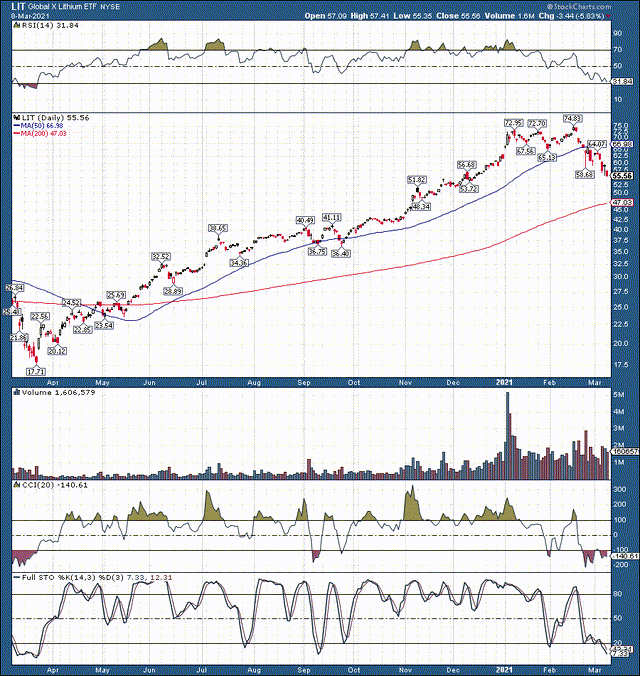

Global X Lithium ETF (LIT)

We've seen some notable downside in the lithium sector during the recent pullback. This segment essentially goes hand in hand with EVs, as lithium is needed in increasing quantities to meet growing EV demand. With an increased demand for EVs, and a likely uptick in inflation lithium should perform very well going forward. Therefore, we like the underlying sector after the substantial pullback in recent weeks.

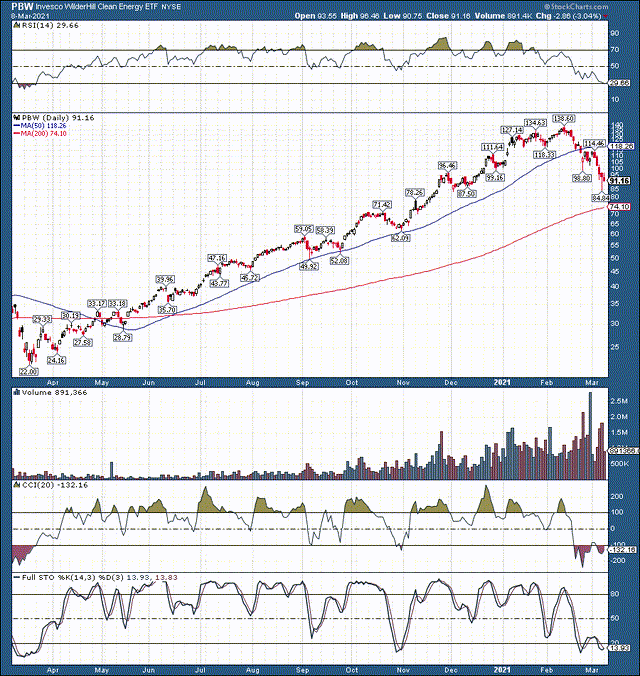

In solar/alt energy:

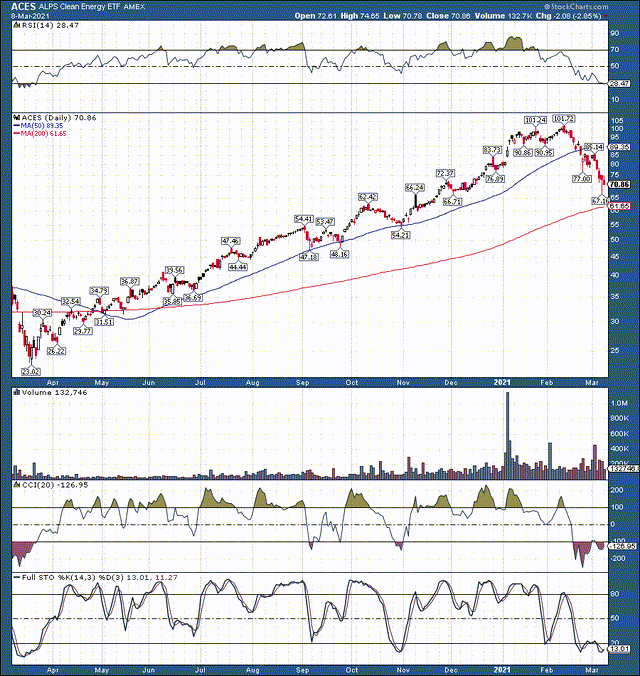

ALPS Clean Energy ETF (ACES)

Invesco WilderHill Clean Energy ETF (PBW)

The solar/alternative energy space is full of compelling ETFs and attractive companies. In addition to the names discussed, First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN), and Invesco Solar ETF (TAN) are amongst our favorite picks in this space. The alt energy/solar segment was on fire throughout 2020, and after the recent selloff, 2021 could be another blockbuster year for this space. Higher energy prices, a global push toward cleaner energy sources, inflation, as well as other factors are creating a favorable environment for the underlying space.

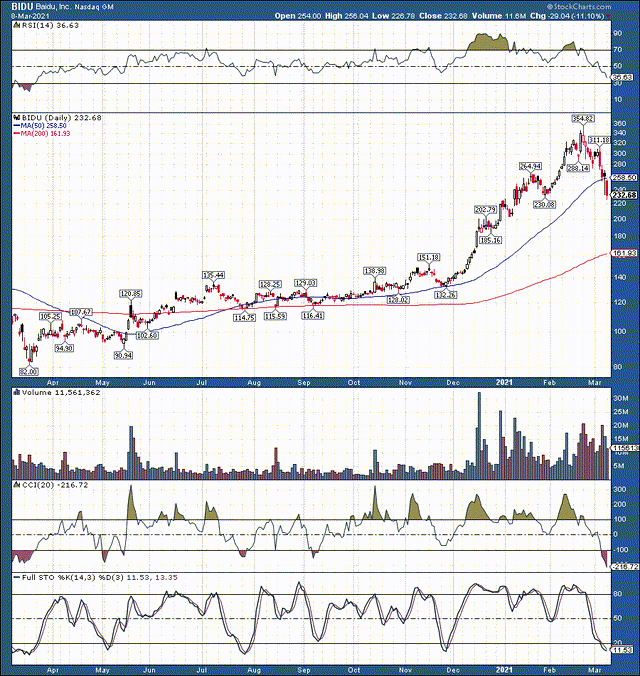

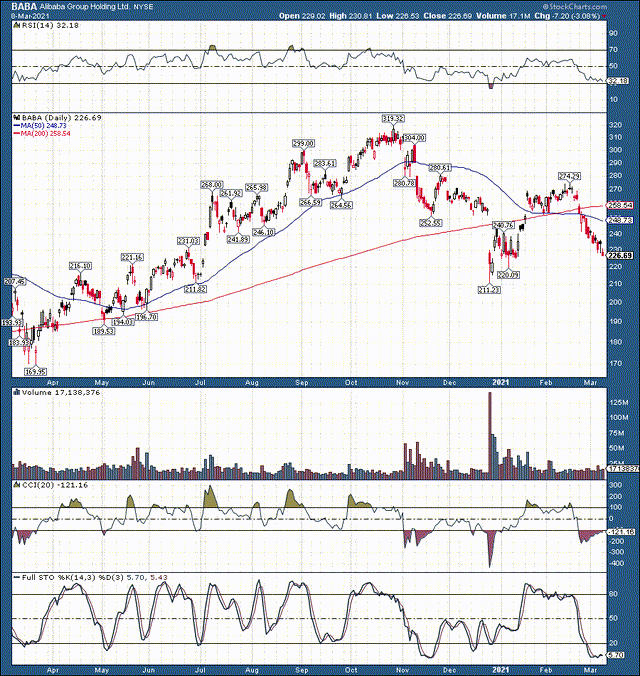

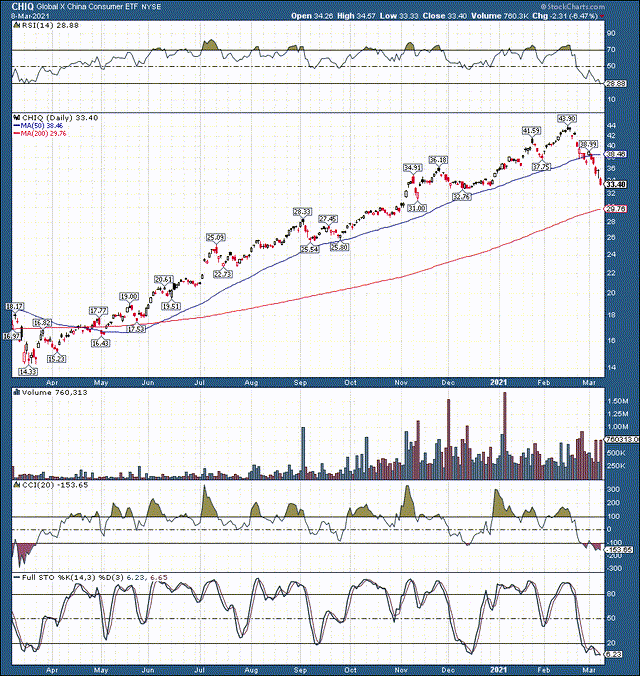

In China:

Baidu (BIDU)

Alibaba (BABA)

Global X China Consumer ETF (CHIQ)

China remains the land of growth and opportunity. Now that global demand is coming back online, this huge export economy should do particularly well going forward. There has been a significant pullback in Chinese companies and now appears to be a favorable time to get back into some of the best quality names.

Disclosure: I am/we are long TAN, CNRG, PBW, ACES, NIO, TSLA, BIDU, CHIQ, LAC, SQM, LIT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for ...

more