What To Consider In Buying A Tech ETF

Amid the discussions about various technology companies and their current place in the tech company business life cycle, their particular risk-reward offering, and the specific currents in the sub-sectors they operate in, I noticed that a lot of discourse does not mention technology-oriented ETFs and the crucial role they can play.

(Source: PBS)

ETFs offer the benefit of allowing broad-based investment in an entire general category, such as technology, or more specifically in a particular sub-sector of the technology industry. Even if one decides to invest in particular technology companies one also has a particular conviction in, a broader ETF can help center your portfolio, reduce volatility and "black swan" risk that comes from being more concentrated in individual companies, and essentially allow broader trends to do the work for you.

Nowadays the array of technology ETFs span every sub-sector possible. A quick look on ETFdb shows over 44 general tech ETFs, some broad-based and some specific to a particular sub-industry, and in examining the list I can say it is definitely not even close to exhaustive.

You can invest in a general "tech" ETF (XLK) (VGT) (IYW) or go specific, digging into cloud computing (SKYY), Internet services (FDN), semiconductors (SOXX), gaming (GAMR), AI, software, or even the more microscopic in mobile payments (IPAY), 3D printing, analytics, and more.

Risk 1 For Tech ETFs: Critical Assets Size And Sudden Closure

Many of these tiny sub-sector ETFs are extremely appealing, as they allow one to create a basket of investments in a particular mini-sector one believes will rise and I believe that it is an extremely worthwhile investment strategy due to the power of secular trends in pushing a lot of tech up right now.

However, the big worry for these focused ETFs is that often their asset sizes are extremely small, numbering under $100 million and putting them at extreme risk of closing down suddenly. It is worth remembering that each ETF is a business product and the company running them usually needs a certain critical mass to justify the ETF's continued existence.

While a company may tolerate having an unprofitable or low-profit ETF for a while in anticipation of future growth, if it appears it is at a standstill they may very well close the ETF, as happens nowadays extremely often.

To understand this, consider an ETF with $100 million. Expense ratios range widely but often are around 0.25%, 0.50%, or 0.75% for many tech ETFs. At that fund size that means a yearly revenue for the ETF sponsor of $250,000, $500,000, or $750,000. That money then goes to support the ETF's managing staff and analysts, as well as the compliance, data processing, filing, marketing and other costs for keeping the ETF going.

At $100 million the ETF may be just enough to pay down all those costs and give the firm a little bit of profit, but when it hits the $50 million or below level the numbers become untenable - at say $125,000, $250,000, or $375,000 in annual average revenue.

As you explore technology ETFs therefore, it is important to balance the attractiveness of some sub-sector ETFs with the knowledge that they have a unique risk of shutdown to them, which means you may be forced to exit the investment at an inopportune time and perhaps left with no exact or even similar alternatives to that very specific ETF. This can be exceptionally disruptive to an investment strategy, as timing in entry and exit is everything.

Risk 2 For Tech ETFs: Differing Holdings Composition And Indexes

Because of how broad many technology categories are and not firm or standardized in exactly what they include or not include, in the tech investment world, a lot of ETFs may sound very similar but differ immensely in the index of particular investments they track.

That means that two ETFs that sound roughly the same in terms of either being a broad category or specific focus can own significantly different stocks and perhaps at very different weightings.

This makes looking at the index than a tech ETF tracks of special importance, as well as the rules that govern the index and how it may change, as this allows you to really understand the investment basket you are acquiring.

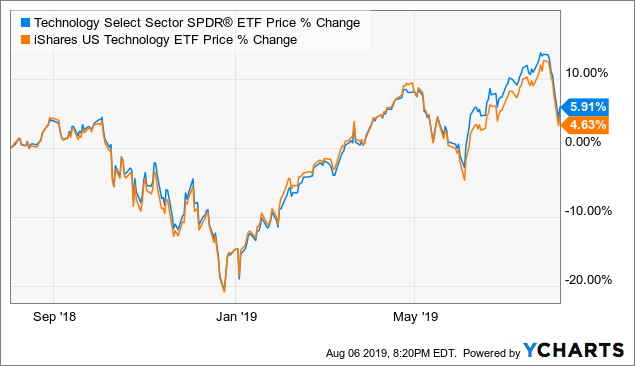

For example, let's compare two large "general" technology ETFs - State Street's The Technology Select Sector SPDR Fund (XLK) and BlackRock's iShares U.S. Technology ETF (IYW). Both describe themselves as broad-based technology ETFs and yet their performance has differed by an absolute almost 1.3% this past year alone.

Data by YCharts

Upon closer examination, we see that while they hold many of the same stocks in similar proportions, there are essential differences. For example, XLK has a slightly greater, but significant, weighting to its top two holdings - Microsoft (MSFT) and Apple (AAPL) - than IYW does. IYW also has as its third largest holding, Google (GOOGL) (GOOG), consisting of about 12% of its portfolio, while XLK doesn't appear to own any Google stock.

Furthermore, XLK has only about 71 holdings in comparison to IYW's 149 holdings. However, as a similarity, IYW's top 10 holdings account for 64.06% of the portfolio while XLK's top 10 account for 64.95%.

These are only some of their many differences which result in sometimes significant divergences in performance for similar-sounding ETFs.

An ETF that states to be representative of a sector may be comfortably weighted to just a few large companies in that sector or even to particular companies for no justifiable reason. It is important to look at the ETF's publicly listed holdings and prospectus to examine exactly what is in it and how it functions.

Conclusion

As described above, tech ETFs are generally extremely worthwhile either to gain the general benefits of ETFs in stabilizing your portfolio or to focus on particular sub-sectors in which you can ride tailwinds in those specific industries.

Nonetheless, there also are significant risks involved with tech ETFs, namely that many attractive ETFs in terms of categories faced potential critical mass risk and the enormous variance in precisely what can go into a "tech" ETF as well as the same for sub-sector ones.

Disclaimer: These are only my opinions and do not constitute investment advice.