What Is UVXY And How Does It Work?

UVXY is the ticker symbol for the Ultra VIX Short-Term Futures ETF, a type of Exchange Traded Fund (ETF) that uses leverage and tracks short-term volatility.

An ETF is simply a collection of securities (e.g. stocks) that track an underlying strategy.

You can track a specific sector such as technology or even the entire market using an ETF.

For example, the SPY tracks the S&P 500 which means that when the S&P 500 goes up by 2%, so too will the ETF.

In practice, commissions, fund fees, tracking errors, etc., can contribute to ETFs moving slightly off their underlying securities but the amount is usually negligible.

The main advantage of an ETF is that it allows investors to be exposed to a particular market, sector, or strategy in a cost-effective and liquid way.

Since ETFs are traded on public exchanges, it means traders can buy or sell them like they would any other security.

This allows traders to use advanced strategies without having to worry about liquidity.

What Does UVXY Track?

According to the UVXY prospectus, it attempts to measure 1.5 times the daily returns of the S&P VIX Short-Term Futures.

This is a hypothetical portfolio that is comprised of the two VIX futures contracts that are nearest to expiration.

VIX futures are used as it is the closest thing to tracking the VIX (and there are no securities that directly match the VIX).

Every day a new mix of VIX futures is chosen, with the index maintained by S&P Dow Jones Indices.

Since VIX futures are not as volatile as the VIX itself, the UVXY is leveraged to get the ETF volatility as close as possible to the VIX.

To keep the price of UVXY at 1.5 times the daily returns of the short-term index, authorized participants (which are specially approved wholesalers) are permitted to intervene in the market if the UVXY diverges too much from the IV value.

The authorized participants have an agreement in place that allows them to perform this at a profit, so there is a significant incentive for them to maintain the correct price.

How Long Can You Hold UVXY?

If you were to compare the annual returns of UVXY in any given year, you would find that it almost always ends lower than when it began.

Simply put, while you could hold the UVXY for as long as you wanted, you would end up losing money with a buy and hold strategy.

The reason this happens is due to what’s called contango.

As each day goes by, the ETF manager needs to buy and sell futures to maintain the right mix.

Referred to as “roll” in futures circles, the ETF manager sells the current month futures contract and buys a contract from the following month.

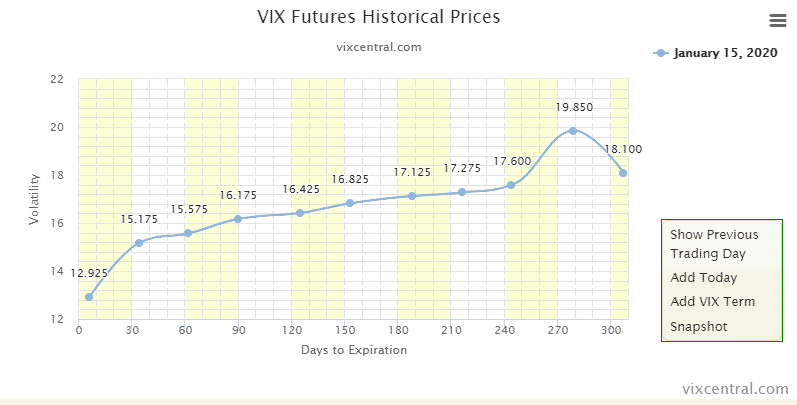

When the futures are in a state called contango, it means that future months’ contracts are more expensive while the current month prices have decayed.

Ultimately, the manager is buying high and selling low which is bad for the price of the ETF, leading to price decay over time.

As a result, using UVXY is all about timing, specifically trying to time periods of rising volatility.

Generally speaking, buying volatility gets more expensive the further out you go.

For example, in the next few days, the odds of a market crash are low so VIX futures are cheaper compared to futures six months out where the odds of a crash are greater.

Therefore, when buying UVXY you don’t want to hold for very long – get in just before you expect a spike in volatility and then get out around the time of the volatility spike.

In periods of high volatility such as the recent COVID-19 market crash, due to the leveraged nature of UVXY, it’s not uncommon to see it jump 30% or more in the space of an hour.

What Is The Opposite Of UVXY?

The opposite of the UVXY is the Short VIX Short-Term Futures (SVXY).

SVXY is also an ETF however it differs from UVXY by being an ‘inverse ETF’.

An inverse ETFs means that it is designed to return the opposite of the underlying security.

In the case of SVXY since it is inverse the VIX, if the VIX were to fall in price then the SVXY would go up in price.

A word of caution if you’re considering trading the SVXY.

Since volatility is unbounded to the upside (there’s no limit to how high it can go), this means that if there was a sharp spike in the VIX futures index then SVXY could end up worthless.

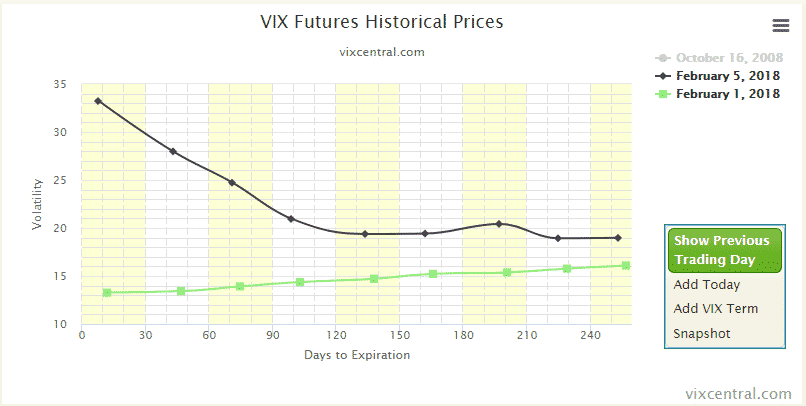

In fact this almost happened during the “volpocalypse” in February 2018.

In early February that year, the VIX futures curve flipped from normal contango to heavy backwardation as you can see below.

It’s for this reason you have to make sure you’re familiar with how SVXY works and to be wary of buying it on margin, lest you end up owing more than what you originally invested.

Conclusion

UVXY is an ETF that allows investors to be exposed to short-term volatility.

It achieves this by using a portfolio comprised of the two VIX futures contracts that are nearest to expiration.

It uses leverage at 1.5 times and has authorized representatives who can buy and short large blocks to ensure it tracks the price as closely as possible.

Due to the roll and contango effects in futures, over time the price of UVXY will decay.

This means it is ill-suited to a long-term buy and hold strategy and is instead suited to very short-term bets on price volatility.

Traders can also take the opposite of UVXY, which is the SVXY.

SVXY tracks the opposite of the VIX, such that if the VIX goes down, SVXY goes up.

Since volatility is unbounded to the upside, traders should exercise caution when using SVXY as a spike in the VIX could make the SVXY ETF worthless.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more