Warning For Credit ETFs: Liquidity May Be Threatened By Underlying Asset Liquidity

Exchange-traded funds are generally seen as simple investment vehicles because they are passive in nature. They track their underlying index or assets, but the way they do so is far from simple. Although the ETF markets have enjoyed a calm period of tremendous growth over the last 10 years, they could experience their first round of extended volatility in the near future.

Equity and credit ETFs have grown fast

In a note last week, Moody’s analyst Fadi Abdel Massih and team note that it requires a wide array of participants to provide and maintain liquidity in the ETF market. “Market-makers and Authorized Participants” seek arbitrage opportunities by balancing the supply and demand of shares in ETFs and their underlying assets, “helping minimize tracking errors.”

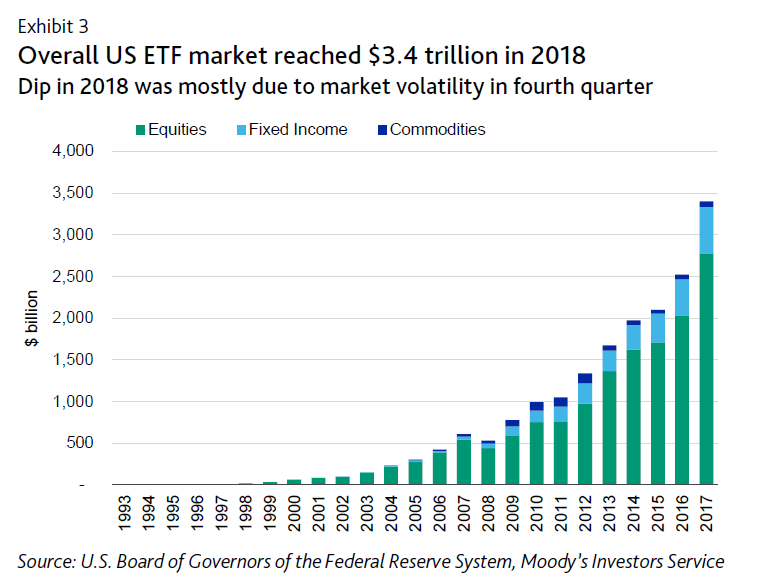

However, they note that the ETF markets haven't yet been tested by a "prolonged period of market distress or high volatility." They have grown almost six-fold over the last 10 years, which have been relatively calm. The one dip observed in 2018 occurred during the fourth quarter.

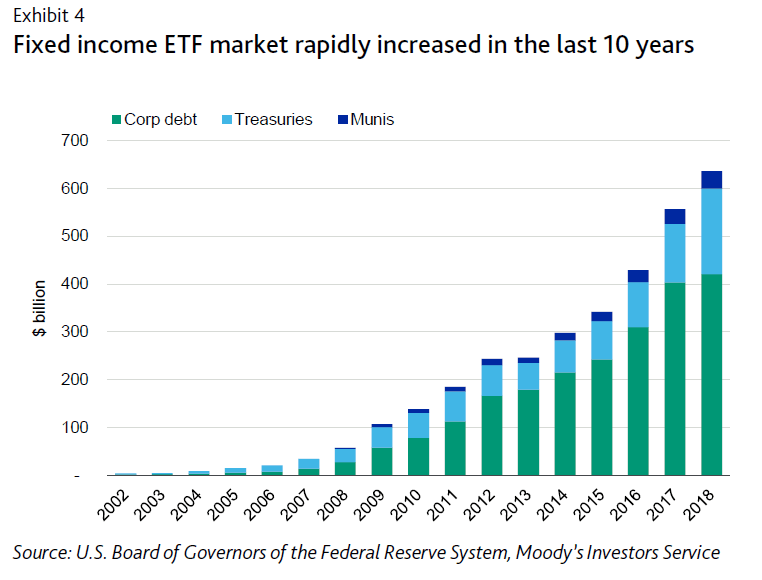

Both equity and credit ETFs have grown rapidly, and although the equity ETF market is still much bigger, fixed income ETFs have been following a similar growth trajectory. Moody's estimates that about two-thirds of fixed income ETFs track corporate debt. The firm pegs this segment of the market at approximately $420 billion, an increase from $50 billion a decade ago.

Unfortunately, the Moody's team adds that the underlying assets of the credit ETFs, mostly corporate debt and issuances, are showing signs of declining liquidity, which could pose a problem for the ETFs that track them.

Experimentation and disruption

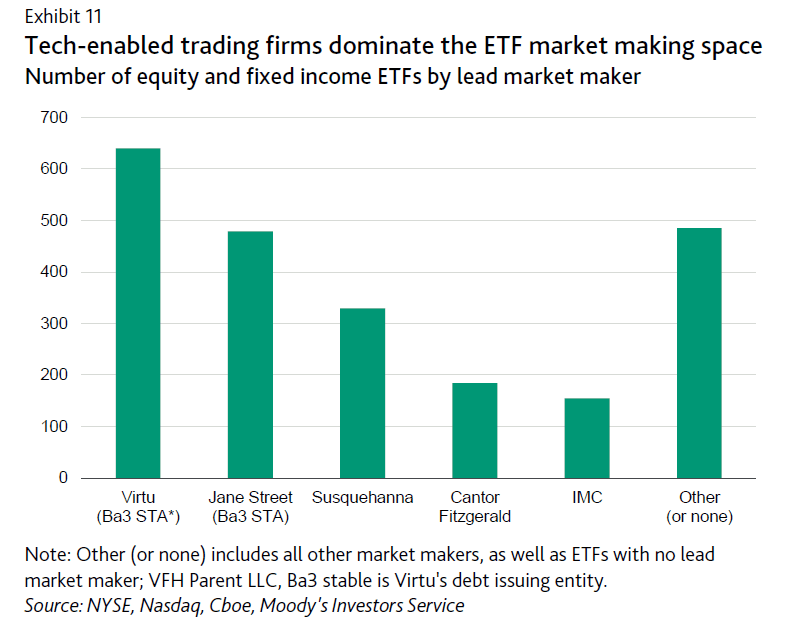

Over the last decade, the structure of the ETF market and its participants have changed quite a bit, they add. The Moody's team notes that today most ETF market-makers are "less regulated, technologically advanced trading firms."

They add that these firms have disrupted both the primary and secondary market by "experimenting with new models for liquidity provision that continually pressure industry margins." They expect non-bank trading firms to become more and more dominant as providers of liquidity in ETF market making.

Concerns about ETF liquidity

However, they also warn that extreme or long periods of volatility may demonstrate that ETF liquidity also tracks the liquidity of the underlying market. ETF investors might have certain expectations when it comes to the liquidity of their ETF holdings. However, they should be advised that not all ETFs have the same levels of liquidity.

"A stress event could diminish the amount of standing orders at various prices and reduce the perceived liquidity of the ETF market, even when ETFs are operating as designed," they warned.

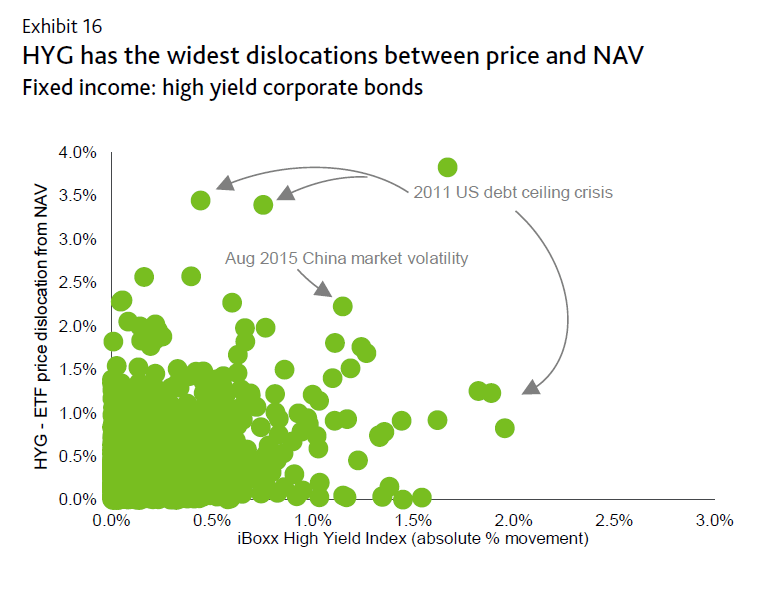

They believe ETFs tracking high-yield credit and other "inherently illiquid markets" could cause the biggest problems, especially by reducing potential rewards for market-makers.

"So, in effect, ETFs track not only the performance of their underlying assets, but also the liquidity of these assets," they explained. "Therefore ETFs targeting illiquid instruments, such as corporate bonds and leveraged loans, would present greater risks, and investors trading on the premise that ETFs are more liquid than their baskets may find that results fall short of expectations in a stressed environment."

Equity versus credit ETFs

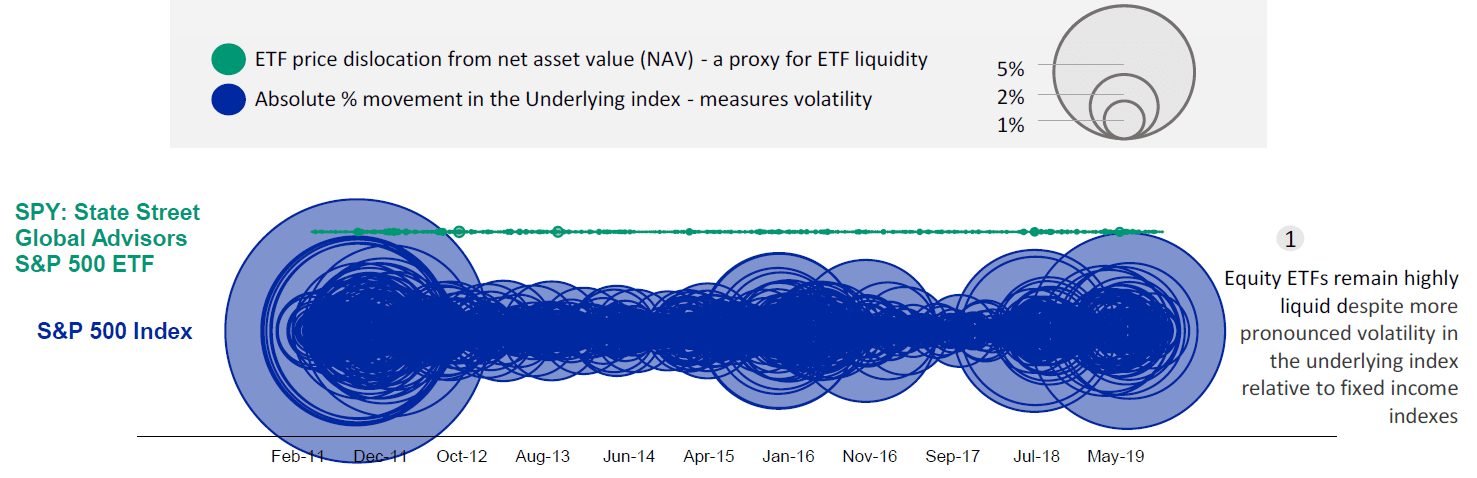

The Moody's team pointed out that the underlying markets for equity and credit ETFs are very different. Equity markets are deeper, while fixed income security markets "are more heterogenous and generally shallower." However, they believe that developing and increasing "electronification of credit market liquidity venues" should help make trading of credit ETFs easier and more efficient.

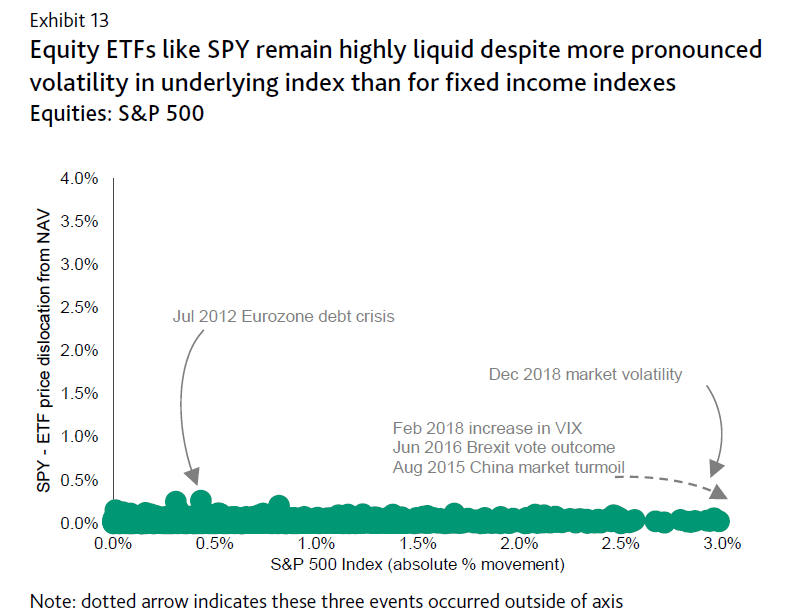

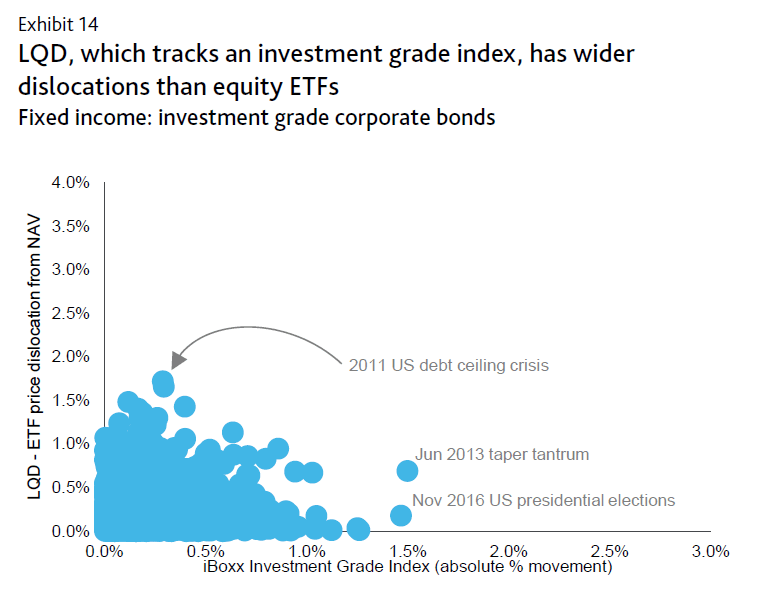

To demonstrate their warning, they displayed the liquidity measures of four major ETFs according to their "price dislocation from net asset value. Equity ETFs such as the SPY remain very liquidity despite volatility in the underlying index.

LQD tracks an investment grade index, and its dislocations are wider than those of equity ETFs.

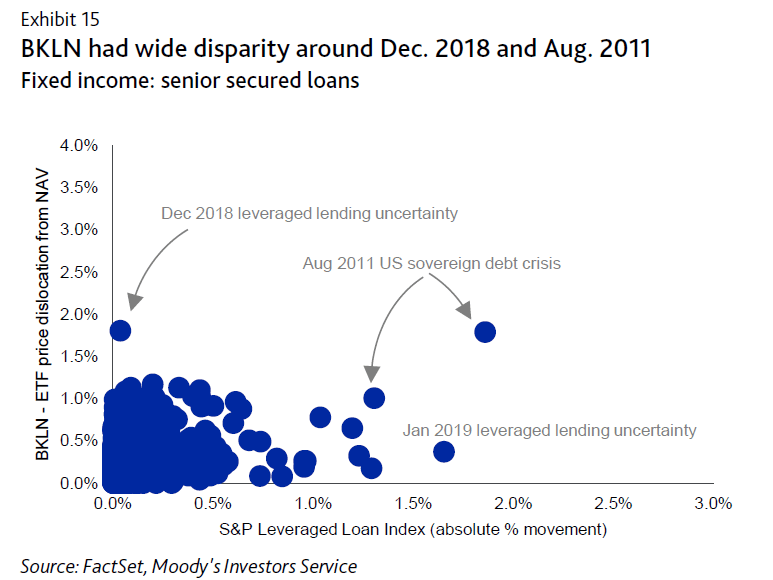

Moody's also examined BKLN and HYG

Thus, they note that equity ETFs remain very liquid even during times of extreme volatility in their underlying index. However, credit ETFs display very obvious differences during times of turbulence in the markets.

This article first appeared on ValueWalk ...

more