VOX Elliott Wave View: Extending Higher As Impulse

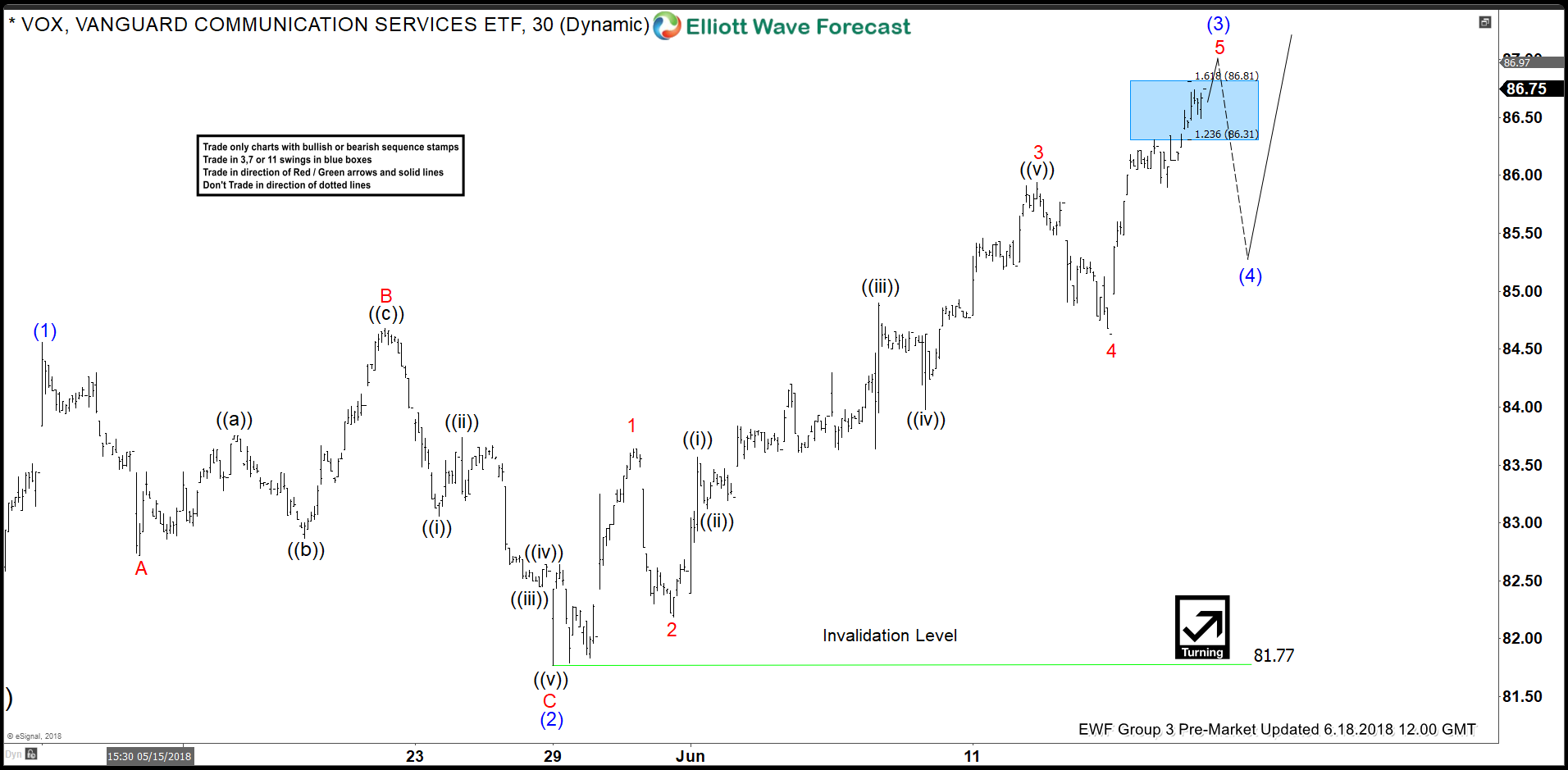

Vanguard communication services ticker symbol: VOX short-term Elliott Wave view suggests that the rally to 84.50 on 5/11 peak ended intermediate wave (1) as an impulse. Down from there, the pullback to 81.78 on 5/29 low ended intermediate wave (2) pullback as expanded Flat. The internals of a Flat correction ended Minor wave A at 82.76, Minor wave B ended at 84.67 high and Minor wave C of (2) ended at 81.78 low.

Up from there, the rally is extending higher in an impulse sequence with extension with lesser degree sub-division showing 5 waves structure in Minor wave 1, 3 & 5. Those 5 waves are expected to complete either intermediate wave (3) or can end some sort of wave (C) of a Flat correction from 5/09 low. The internal of Minor wave 1 ended in 5 waves at 83.62 high, Minor wave 2 ended at 82.19 low. Then the rally to 85.92 high completed another 5 waves in Minor wave 3 higher. The pullback to 84.63 low ended Minor wave 4.

Above from there Minor wave 5 of (3) remains in progress in another 5 waves structure & expected to complete soon as it already reached the minimum extension area already. But in case of further extension higher, the ETF can see 87.19-87.80 0.618-0.764% Fibonacci extension area of 1+3 to complete intermediate wave (3). Afterwards, the ETF is expected to do a pullback in wave (4) for the correction of 81.78 cycle in 3, 7 or 11 swings before further upside is seen. We don’t like selling it into a proposed pullback.

VOX 1 Hour Elliott Wave Chart

(Click on image to enlarge)

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more