Value Opportunities In International Markets

Value investing is one of the most solid and time-proven investment strategies. The statistical evidence shows that following a value investing approach can produce not only superior returns but also reduced downside risk over the long term.

Smart value investing is not just about picking the best stocks in a particular market. Selecting the right markets can make an even bigger difference in terms of the value you can get.

Even if you look for the cheapest stocks in the US stock market, those stocks can still be expensive when the US market as a whole is overvalued. When hunting for value, it makes a lot of sense to have a broad vision and search for opportunities among different countries and regions.

Looking at the global landscape in terms of value, investors can currently get much more attractive prices in international markets than in the United States.

The Impact Of Value On Return And Risk

Stock market returns depend on a multiplicity of variables, and many of them are practically impossible to predict. However, the starting valuation you pay for a stock is one of the few variables that you can actually control when making investment decisions, and it can have a massive impact on the returns you get over the long term.

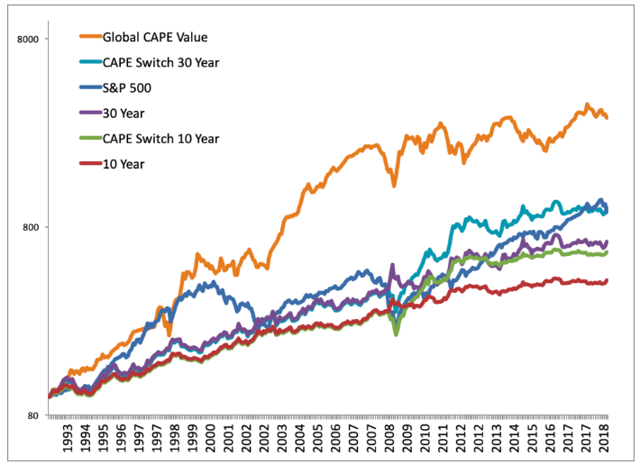

The chart below is from an excellent article by Mebane Faber showing how investors can optimize returns by choosing among different markets and asset classes based on long-term valuation metrics such as the CAPE ratio.

Source: You Would Have Missed 961% In Gains Using The CAPE Ratio, And That’s A Good Thing

The author explores a wide variety of combinations, but for the extent of our purposes, we can focus on the Global CAPE Value strategy. This is based on investing in the cheapest 25% of global stock markets as measured by the CAPE ratio. In other words, the strategy only buys the cheapest markets in the world.

According to the data, from 1993 to 2018, the Global Value strategy produced a cumulative return of 3051%, more than tripling the 961% produced by the S&P 500 in the same period.

The strategy also generated those superior returns with smaller downside risk. The maximum drawdown was 39.62% for the Global Value strategy versus a maximum drawdown of 50.95% for the S&P 500 in the same period.

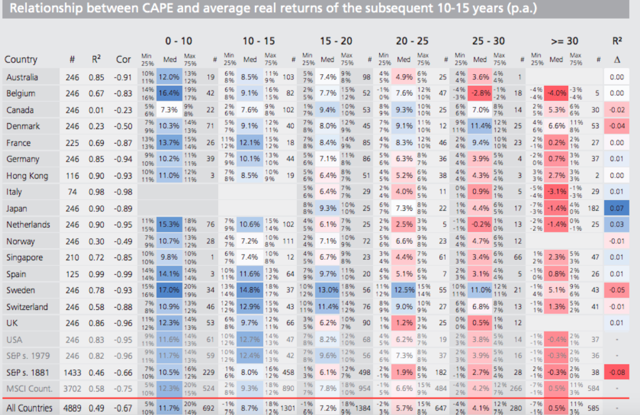

The table below is from a research paper by StarCapital entitled Predicting Stock Market Returns Using the Shiller CAPE. It shows what kinds of returns different stock markets have produced over long periods of time in comparison to the starting CAPE ratio. The data is quite clear, and it shows that valuation is a major determinant for long term returns.

Source: StarCapital

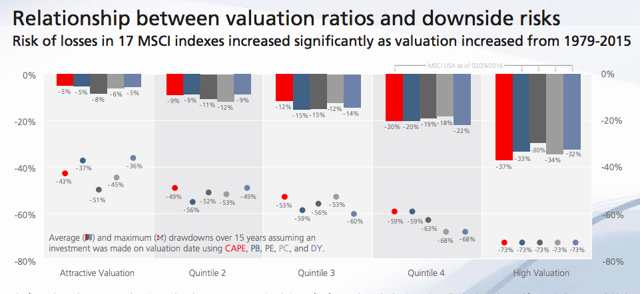

The chart, also from StarCapital, shows the average and maximum drawdown for different markets according to their valuation levels. The key takeaway is that valuation provides a margin of safety, the lower the price you pay, the lower your downside risk too.

Source: StarCapital

SPY data by Ycharts

Even if the CAPE ratio is not your favorite valuation indicator, it is important to note that most valuation ratios such as CAPE, price to cash flow, and dividend yield generally move in the same direction over time. It is not about CAPE in particular but valuation in general, and the data shows that valuation has a massive impact on both returns and risk over the long term.

Hunting For Value In Global Markets

US stocks have materially outperformed international stocks over the past decade. The chart below shows the evolution of SPDR S&P 500 (SPY), iShares MSCI EAFE (EFA), and Vanguard FTSE Emerging Markets (VWO). Investing in the United States has produced tremendous outperformance in comparison to global markets.

It is easy to make the case that the US economy has also generated more stable economic growth, and many of the most successful corporations on a global scale are traded in the United States markets, so this explains the outperformance of US stocks in the past decade.

However, investment decisions need to be based on forward-looking considerations as opposed to past performance. Even assuming that the US economy will continue to do better than the rest of the world, the valuation gap is now quite substantial, and this is a crucial consideration to keep in mind.

The CAPE ratio for US stocks currently stands at 26.8, while Developed Europe trades at a CAPE ratio of 16.5 and Emerging Markets carry a CAPE ratio of 14.5 according to data from StarCapital.

The table below compares valuation indicators for SPDR S&P 500, iShares MSCI EAFE, and Vanguard FTSE Emerging Markets. To provide more context about the attractiveness of valuations in international markets, we can also include Cambria Global Value (GVAL), which is an ETF focused on undervalued stocks on a global scale.

Data source: Morningstar

The difference is quite staggering. The average valuation level for stocks in Cambria Global Value is nearly half the valuations available for companies in the US in terms of price to earnings, price to book, price to sales, and price to cash flow. The dividend yield rises from 2.2% in the case of SPDR S&P 500 to 6.3% in Cambria Global Value.

There are many reasons why we can justify a higher valuation for SPDR S&P 500. This is not only related to macroeconomic factors but also sector exposure. The technology sector represents 22% of the portfolio in SPDR S&P 500, while Cambria Global Value has 29% of assets in financial services. Since tech stocks obviously trade at higher multiples than financials, the comparisons are not completely straightforward.

But that is beyond the point. The statistical evidence shows that value has a consistently positive impact on returns over the long term. This is in spite of the well-known valuation differences at the sector level.

We can also say that international markets are riskier than the US on a standalone basis, since economic prospects and the institutional landscape are more uncertain. Even assuming that this is completely true, risk needs to be managed at the portfolio level, not at the individual position level. Adding an ETF such as Cambria Global Value to a portfolio of US stocks can do wonders in terms of diversification.

Besides, even if the fundamentals are more uncertain in international markets, valuations are also much cheaper, and the data shows that investing in cheap markets reduces downside risk by providing a margin of safety.

Value investing works, not only at the individual stock level but also when it comes to market selection. When considering upside potential, drawdown risk, and the benefits of diversification, it makes a lot of sense to consider some exposure to value stocks in international markets.

Disclosure: I am long GVAL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more