Vacation Trades: Option Strategies For When You Are Away

Suppose you are about to go on vacation and cannot check on your positions. What are the best option trades for this situation?

Technologically speaking, you could; but you are too busy sipping Mai Tai’s at the beach.

You could move all positions to cash. But will not profit on the upside.

Let’s see what strategies we can put on where we set and forget for at least three weeks — where it will still be okay if the market crashes right after we get onto our airplane.

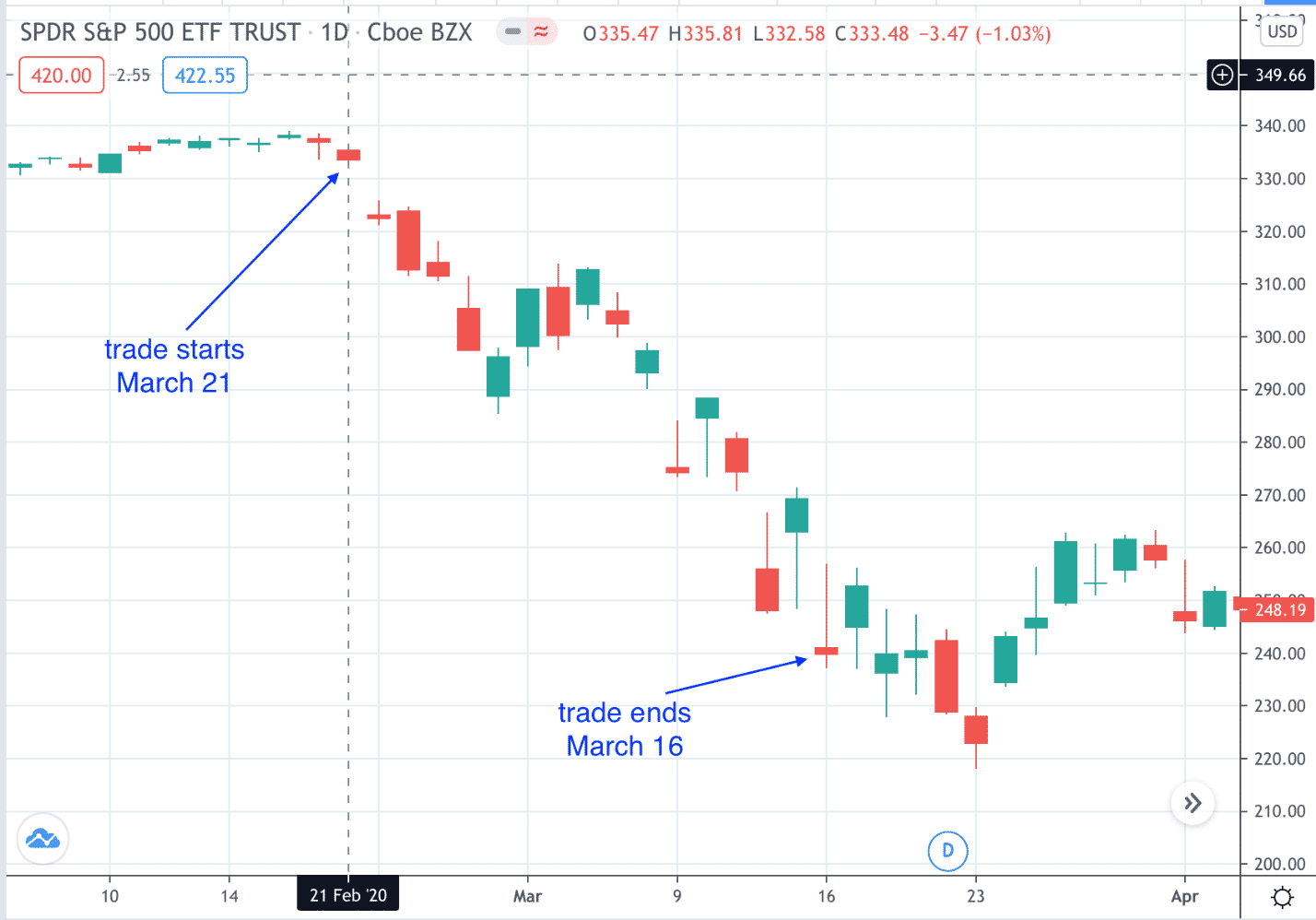

Suppose an investor places the trade at the market close on Friday, February 21, 2020, and takes a three week vacation to return to his desk Monday, March 16, to find that the market had dropped about 28%.

(If the investor had gone on a more extended vacation, the market fell further than that.)

Here is the S&P500 ETF (SPY) chart showing 15 candles in between the start and end of the trade.

While this market decline is a rare scenario, we want to see what options strategies can withstand such a black swan event without adjusting.

After seeing the chart, you might say that a long put would be successful. And you would be right.

But we are looking at the scenario where the price goes against us, and we are not there to adjust.

Contents

Iron Condors? Nope

A vacation trade would be a defined-risk trade, no doubt.

Let’s start with the popular Iron Condor.

Here is a 42 days-to-expiration (DTE) Iron Condor with short strikes at 15 delta:

Date: February 21, 2020

Price: SPY @ $333.45

Buy five Apr 3 SPY $305 put @ $1.52

Sell five Apr 3 SPY $310 put @ $1.97

Sell five Apr 3 SPY $347.5 call @ $0.60

Buy five Apr 3 SPY $352.5 call @ $0.19

Max Gain: $430

Max Loss: $2070

Risk to Reward: 4.8

P&L on March 16: –$2062

Percent loss relative to max risk: -99.6%

The put spread has been completely breached, and the trade is nearly at the maximum loss. Bull put credit spreads at the 10 Deltas would have been breached as well.

So those are not going to work as vacation trades.

Long-term Iron Condors? Not even

How about using slower-moving Iron Condors at 147 DTE with a short strike around the 10 Delta?

Date: February 21, 2020

Price: SPY @ $333.45

Buy five July 17 SPY $270 put @ $1.93

Sell five July 17 SPY $275 put @ $2.26

Sell five July 17 SPY $365 call @ $0.91

Buy five July 17 SPY $370 call @ $0.56

Max Gain: $337.5

Max Loss: $2162.5

Risk to Reward: 6.4

P&L on March 16: –$1695

Percent loss of relative to max risk: -78%

While the Iron Condor is a defined risk trade, we cannot set and forget — even if it expires five months out. If the price goes through one of our spreads, we can lose multiple times the amount that we usually make. In this example, it is 6.4 times.

Debit Spreads? Maybe

Let’s try debit spreads that are set up with a one-to-one risk to reward ratio.

Here is a 42 DTE bull call debit spread:

Date: February 21, 2020

Price: SPY @ $333.45

Buy five Apr 3 SPY $333 call @ $6.55

Sell five Apr 3 SPY $343 call @ $1.56

Max Gain: $2505

Max Loss: $2495

Risk to Reward: 1.0

P&L on March 16: -$2487.50

Percent loss relative to max risk: -99.7%

Some investors do not adjust debit spreads. They either have a timed exit or hold till expiration.

Because the risk to reward is one-to-one, it only takes one winning trade to make up for one max loss loser. If that is their trading plan, then yes, they can leave the trade while on vacation.

However, other investors whose trading plan is to exit if half the initial investment is lost will need to be around to monitor the trade.

Calendars? Not really

How about calendars?

Here is a calendar with the short expiry one month away and the long expiry five months away:

Buy five Jul 17 SPY $334 put @ $12.81

Sell five Mar 23 SPY $334 put @ $6.07

Max Gain: $2000 (estimated — depends on IV of the long put)

Max Loss: $3372.50

Risk to Reward: 1.7

P&L on March 16: –$2360

Percent loss relative to max risk: -70%

Option strategies are naturally leveraged. That means that their P&L can change a lot in comparison to the capital that they use.

They are very capital efficient. You can have significant percentage gains and losses on the capital at risk.

Long Stock? Rather Not

Stocks are not leveraged, requiring a lot of capital to have any significant gains.

Suppose an investor buys 100 shares of SPY.

Date: February 21, 2020

Buy 100 shares of SPY @ $333.4

Max Gain: unlimited

Capital invested: $33,345

Price of SPY on March 16: $239.41

P&L on March 16: –$9404

Percent loss relative to max risk: -28%

A 28% loss on a stock position during three weeks is a significant drawdown. It will require a return of 39% on the remaining capital invested to get back to even.

For a stock investment to achieve a 39% return is not so easy to do quickly.

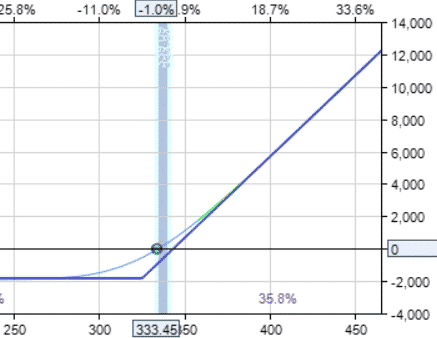

Married Put — Yes

Suppose that the 100 shares were purchased at the same time, the investor had purchased insurance on those shares via a put option contract with expiry five months out.

Date: February 21, 2020

Buy 100 shares of SPY @ $333.45

Buy one July 17 SPY $325 put @ $9.80

Max Gain: unlimited

Capital invested: $34,325 (cost of stock and the put)

Max possible loss at expiration: –$1825 (lost $980 and lost $845)

Max possible loss of capital invested: 5.3%

Payoff diagram on February 21:

P&L on March 16: –$1462

Percent loss of capital invested: -4.3%

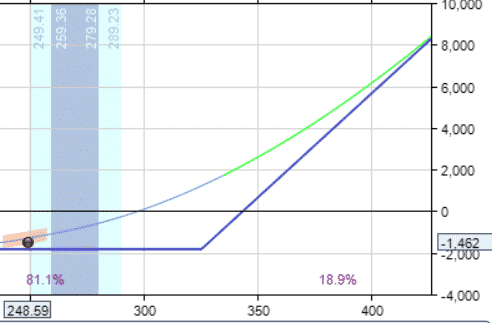

Payoff diagram on March 16:

Upon returning from vacation on March 16, the investor sees that the price of SPY has dropped to $248.59 (it had been purchased at $333.45).

The stock lost $8486.

The put value has ballooned from $9.80 to $80.04, offsetting some of the losses by $7024. The investor can sell both the stock and the put now for a net loss of –$1462 or a net loss of 4.3% of the initial capital invested.

The initial capital invested is the cost of the stock plus the cost of the put: $33345 + $980 = $34325

While the investor has the right to exercise the put option and sell the 100 shares at $325, this would not be financially wise because the investor would have used up the put option while it still had both intrinsic and extrinsic value left.

Calculation

In that case, the loss on the stock would be $333.45 – $325 = $845.

And the loss on the initial cost of the put is $980, giving a net loss of $1825. This is the max loss for the strategy.

Exercising now would mean locking in the max loss now. A better alternative is for the investor to wait till the put option expires on July 17. It may or may not be better than selling both the stock and put option now. It all depends on where the price of SPY is at the time of expiry.

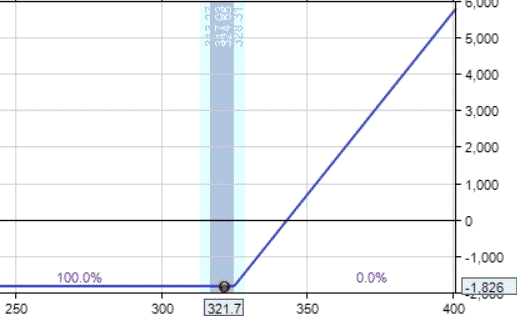

On expiration July 17, the market did come back up, but not to the level at the start of the trade. SPY closed at $321.72 on that day.

The put option was automatically exercised, and the 100 shares were sold at $325 per share. The investor lost $845 from the stock, plus lost $980 from the purchase of the put option.

The total loss is –$1825, which is 5.3% of the initial capital invested.

This is the max loss possible for the strategy.

If the price of SPY had come up a little bit more, we would not have been at the max loss.

The Collar — Yes

During all that time when the protective put is in place, the investor could also be selling covered calls (one month at a time) to help pay for the put.

Date: February 21, 2020

Buy 100 shares of SPY @ $333.45

Buy one July 17 SPY $325 put @ $9.80

Sell one March 25 SPY $340 call @ $2.05

Capital invested: $34,120

Max possible loss at expiration of the put: -980 + 205 – $845 = –$1620 Max possible loss of capital invested: 4.7%

P&L on March 16: –$1412

Percent loss of the capital invested: -4.1%

P&L on July 17: -1620

Percent loss of the capital invested: 4.7%

By selling the call, the investor reduced the capital invested and reduced the max loss.

The tradeoff is that it would have also limited the upside gain (if there had been any).

Summary

The married put and the collar strategies can be structured to reduce the risk of the trade to the percentage the investor is comfortable with.

In our example, we constructed the max loss to be around 5%.

Most investors will probably be comfortable going on vacation knowing that the maximum drawdown will be 5% even in the event of a significant selloff.

For an even more conservative trade with a lower max loss, an investor could purchase the put with a higher strike price closer to the stock’s current price or even buy an in-the-money put option.

For investors who can withstand a larger drawdown, they can purchase the put further out of the money and spend a lower cost to buy it.