Thoughts For Thursday: Santa's On His Way

It seems that Santa's on his way. The markets enjoyed two days of successive climbs Tuesday and Wednesday and this morning futures are showing a dusting of green.

On Wednesday the S&P 500 closed at 4,697, up 47 points or 1%, the Dow closed at 35,754, up 261 points or 0.74% and the Nasdaq Composite closed at 15,522, up 181 points or 1.2%. Currently S&P futures are trading up 13 points, Dow futures are up 105 points and Nasdaq 100 futures are trading up 29 points.

Yesterday's most actives were across sectors. Apple (AAPL) led the list closing up 1.5% at $175.64 and Ford (F) in the number 2 spot, closed at $20.14, up 2.7%.

Chart: The New York Times

TalkMarkets contributor Diego Colman comments on the current rally and the near term forecast for the Nasdaq in Nasdaq 100 Gains As Traders Seek Exposure To Risk-Assets On Santa Rally Hopes.

"Although December is usually one of the quieter periods for financial markets, volatility has been extraordinarily high this time around amid pandemic uncertainty and the Fed's monetary policy hawkish turn. During this period, the VIX has exploded higher, reaching a 10-month high of 35.32, before settling below the psychological level of 20 as excessive fear has begun to dissipate...From a technical standpoint, after bouncing off support earlier this week, the Nasdaq 100 has managed to break above its 50-day moving average, a bullish signal for price action. If the tech index holds above this indicator in the coming sessions, buying interest could accelerate, paving the way for a move towards the 16,430-resistance zone. If this barrier is breached, the index could be on track to retest its all-time high near 16,765."

Nasdaq 100 Technical Chart

Contributor Charles Hugh Smith cites concern about the economic recovery being dependent upon only a small slice of the population in his essay Watch The Top 5%--They're The Key To The Whole Economy.

"Here's the problem with concentrating most of the income and wealth in the top 5%: the whole economy now depends on their spending and "the wealth effect" of bubbles driving that spending. As the charts below show, the top tier of households own the vast majority of the wealth and take home roughly half of all income, including virtually all (97%) the income derived from capital."

"Since the spending of the top 5% has been the only source of higher consumption, the economy has been optimized to serve the top 5%. Hence the proliferation of fine-dining restaurants, pricey AirBNB rentals in exotic destinations, luxury brand boutiques, etc. Once the top 5% no longer have the means or desire to spend freely on discretionary purchases, a huge swath of the U.S. economy falls into an abyss. And since we've structured our system to make the rich richer so they can spend more, there is no substitute source of spending to replace the collapse of top 5% spending."

Elsewhere, contributor Tyler Durden brings us 5 of the Top 10 Themes For 2022 as compiled by Deutsche Bank (DB).

"5 of the biggest themes the bank believes will define the coming year are 1) An overheating economy; 2) COVID optimism; 3) A hypersonic labor market and inflation; 4) Corporate focus on asset efficiency; 5). Inventory glut. The second part, which we will publish tomorrow will turn to 1) Antitrust (or competition) renaissance; 2. The end of free money in stock markets; 3) Space: a worrying geopolitical frontier; 4) Central Bank Digital Currencies: Growing into reality; 5) ESG bonds go mainstream."

Below are the 5 top themes for 2022 as per DB, in abbreviated format. See the article for the full text. Durden promises Part 2 with themes 6-10, as well.

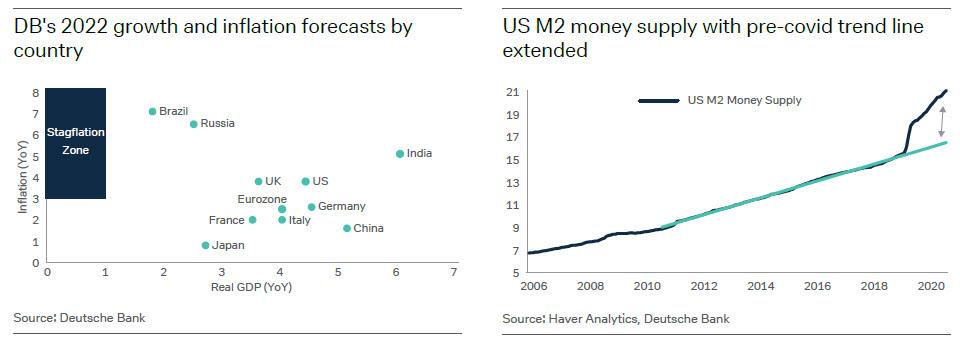

1. An overheating economy, by Jim Reid

"While some commentators worry about stagflation in 2022, it is far more likely that the US economy will encounter overheating risks...the huge stimulus that remains in the system, alongside easy policy conditions, will continue to ensure both inflation and growth stay high.

The result is likely to be a “growthflationary” environment in 2022. In turn, the Fed will likely become more aggressive in 2022 in order to curb inflation...should the economy overheat, and the pace of tightening outweigh the historically easy level of financial conditions, the cycle’s end could be brought into sharper focus with a recession in 2023 or 2024 increasingly debated.

...One of the biggest differences between this cycle and the last is the US output and employment gap. After the financial crisis both took eight years to close. That was the slowest recovery in history so with hindsight it is quite easy to see why we did not see inflation. In this cycle the gaps will close over the next quarter which will be one of the quickest recoveries in history. So the US economy will be bumping against its inflationary speed limit in 2022..."

"Some argue that stagflation is a bigger threat than overheating. The reality is that most economies are still a long way from it. If DB’s growth forecasts prove correct, then most of the G7 economies will still generate economic growth of at least three percent next year. This is some way above trend and inconsistent with ‘stagflationary’ dynamics.

We can therefore expect robust growth and elevated inflation. This makes the overheating of the global economy a key risk in 2022..."

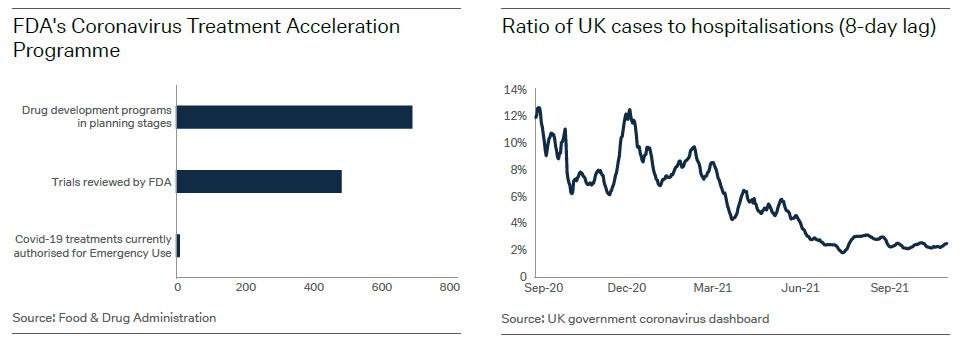

2. COVID optimism. – Henry Allen

"The COVID outlook for the northern hemisphere winter is deeply concerning. Numerous countries are moving into fresh lockdowns, and the arrival of the Omicron variant has led to new travel restrictions and another bout of financial market turmoil. Nevertheless, there are credible reasons to be optimistic about how the pandemic may evolve in 2022. Critically, improved medicines will hopefully become mainstream. At the same time, an expected increase in the availability of several COVID vaccines means that those populations without access should finally receive it. And as the world begins to manage COVID, it is likely that benefits will be found in some neglected areas of society upon which the pandemic has thrown a light.

...Apart from pills (Pfizer (PFE) and Merck (MRK), treatments are broadening. For example, the US Coronavirus Treatment Acceleration Program is supporting a range of therapies in development, such as antiviral pills, neutralizing antibodies, and also immunomodulators that reduce the immune reaction to the virus and prevent it going into harmful overdrive.

Vaccine manufacturing will also accelerate in 2022. The production of the Pfizer vaccine is expected to increase by a third to 4bn doses. Moderna (MRNA) will also increase supply. A chunk of this inventory is likely to be distributed in the developing world where vaccine access has, so far, been poor. Moreover, the extension of the vaccine to younger age groups will push developed countries closer to herd immunity. The US has already authorized the Pfizer vaccine for children aged 5-11. Other countries are following suit...Of course, new variants still pose a risk, and the arrival of the new Omicron variant has demonstrated this once again. Yet over the medium term, history shows that many viruses can become less dangerous over time,"

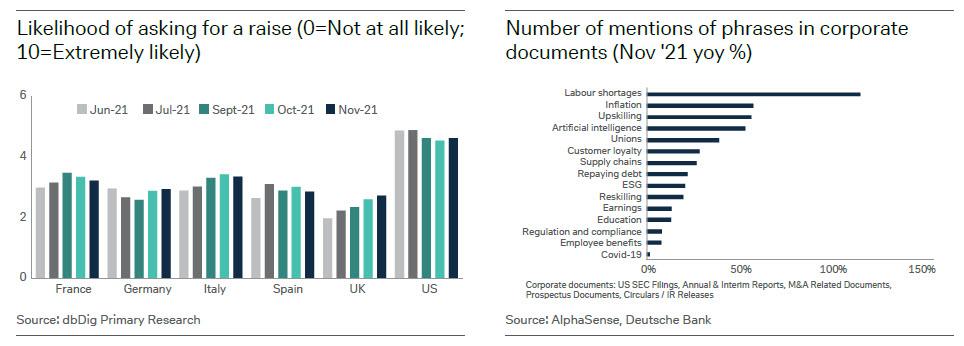

3. A hypersonic labor market and inflation, Olga Cotaga

"...the hypersonic recovery of the labor market is stirring inflationary concerns. That will likely be exacerbated in 2022 as workers that are upskilling themselves leave their current roles in search of a better job.

The big difference in this labor market recovery is its breath-taking speed. After a normal recession, it usually takes between four to seven years for the labor market to recover. This time, it is recuperating much faster. The US unemployment rate has now returned to 4.2 percent, not far from the 3.5 percent seen just before COVID. In France and Spain labor force participation is already higher than prior to COVID...An outlook for an unusually tight labor market is a perfect recipe for wage-driven price growth. Our economists have previously commented that excluding the stagflation period of the late-1970s and early- 1980s there is a decent correlation (41 percent) between unemployment and inflation, although the correlation has weakened over time.

Amplifying the issue is that COVID has inspired people to upskill and find a better-suited and better-paid job. Indeed, more than two-thirds of workers globally are willing to retrain for new jobs. Meanwhile, a third of people who have ever registered on a ‘Massive Open Online Course’ platform joined in 2020. A global survey of nearly 6,000 people found that 40 percent are at least somewhat likely to leave their current jobs.

The issue is dominating the corporate discussion, as seen in the chart above, and pushing companies to be more proactive. Alphabet (GOOG), Amazon (AMZN), IBM (IBM), Walmart (WMT), and many other large companies are introducing training programs. Some now pay for higher education. Corporates are also spending more on wages and salaries because of labor shortages."

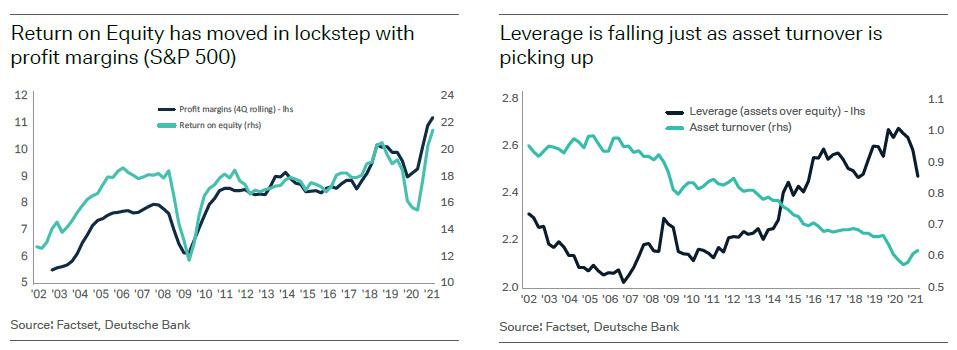

4. Corporate focus on asset efficiency, Luke Templeman

"Investors have not needed to care about bloated companies until now. After all, for the last decade or so, corporate returns were juiced by rising profit margins and super-cheap debt. Companies grew through acquisitions and ignored their asset efficiency. Indeed the median S&P 500 company earned $1 in sales for every $1 it held in assets in the early 2000s. It now earns just 60 cents.

In 2022, the focus on asset efficiency is set to return as the two other sources of returns on equity – profit margins and leverage – are coming under significant pressure.

Profit margins will be squeezed as workers increasingly demand higher wages and benefits...Leverage, too, appears set to drop in 2022. Possible interest rate rises will make debt more expensive and, if some level of higher inflation proves permanent, companies can expect higher debt costs in the medium term...Since it hit a multi-decade peak in mid-last year, leverage in the median S&P 500 company has dropped eight percent and now sits at 2016 levels.

There are initial signs that asset efficiency is hitting managers’ radar. Over the last three quarters, the asset turnover ratio of S&P 500 companies has risen quicker than at any time since the financial crisis. This is good news. If asset turnover returns to pre-financial crisis levels, returns on equity would theoretically increase by two-thirds.

...Just as 2022 will likely usher in the return of investor focus on asset efficiency, it will separate companies into three groups: those that are already asset efficient, those that ignore the issue, and those that are inefficient but addressing the problem. The latter group may provide investors with the most value."

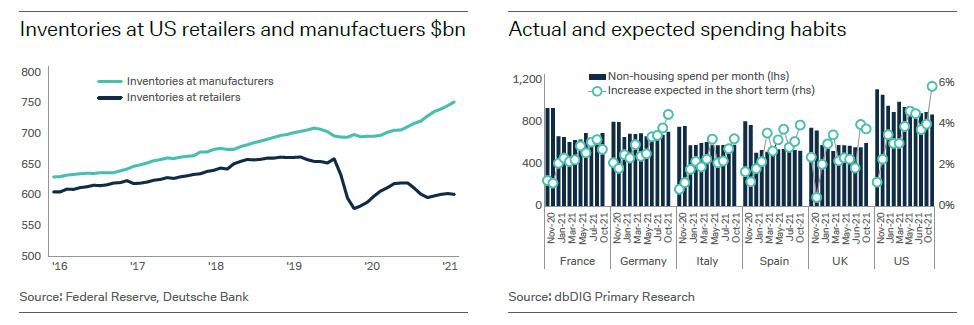

5. Inventory glut, Olga Cotaga

"In 2022, we are going to have a lot of stuff. Everywhere. Supply chain disruptions, coupled with an imperfect market, are likely to lead retailers and manufactures to being stuck with abundant inventories. A slower than expected release of pent-up demand, as well as a focus on experiences over goods, will likely exacerbate the glut. Marie Kondo would not approve.

An inventory glut will follow the fact that retailers do not want to be caught off guard with a lack of product as they have been last year and this. Although their inventories are currently low (partly due to the auto shortage), there are signs that retailers are over-ordering ahead of the busy holiday period. All the while, manufacturers are already producing and holding far more inventory than they did before COVID.

This means 2022 is set for the “bullwhip” effect – where retailers and manufacturers respond to each other by under- and then over-ordering...

Exacerbating the problem are concerns that customer demand does not recover as quickly as corporates think. Our latest presentation on pent-up demand, shows that people expect their spending to rise. But each month so far, those expectations have failed to materialize. Specifically, Americans have been spending less but expect to spend more. This is why expectations of a release of pent-up demand may not materialize. That will leave a glut of inventory either in warehouses or on the shop floor...The swings in the availability of goods will continue back and forth until an equilibrium is eventually established. In other words, the “bullwhip” effect is likely to continue to dominate the supply chains in 2022 and lead to a surplus of inventories. In that case, Marie Kondo's organizational techniques may prove useful."

Still looking for last minute gifts? The team at Zacks Equity Research suggests 4 Mutual Funds To Pick This Christmas.

Image: Bigstock

"It's that time of the year, driven by the Santa Claus rally and a dose of optimism into the year-end when markets move north...Here’re our shortlisted mutual funds that investors can pick to enjoy Christmas and the year-end rally.

Fidelity Select Health Care Portfolio (FSPHX)

The fund aims for capital appreciation. This non-diversified fund invests the majority of assets in common stocks of companies principally engaged in the design, manufacture or sale of products or services used for or in connection with health care or medicine...Specifically, the fund has returned 15.5% and 18.1% over the past three and five-year period, respectively.

Fidelity Select Retailing Portfolio (FSRPX)

This non-diversified fund invests the majority of its assets in securities of companies that merchandise finished goods and services to individual customers. FSRPX invests in both U.S. and non-U.S. stocks...Specifically, FSRPX has returned nearly 26% and 23.3% in the past three and five years, respectively.

Fidelity Select Leisure Portfolio (FDLSX)

The fund aims for capital appreciation. The fund invests at least 80% of its assets in companies that design, produce or distribute goods or services in the leisure industries. This non-diversified fund invests in both domestic and foreign stocks...Specifically, FDLSX has three and five-year returns of 15.8% and 15.1%, respectively.

Fidelity Select Consumer Discretionary Portfolio (FSCPX)

This non-diversified fund invests the majority of its assets in common stocks of companies that manufacture and distribute consumer discretionary goods and services. FSCPX invests in both domestic and foreign stocks...Specifically, FSCPX has three and five-year returns of 23.3% and 19.8%, respectively. "

I have significantly condensed the above article. See the full text for additional commentary and details.

As always, Caveat Emptor.

TalkMarkets contributor Jill Mislinski takes us out on a steady note in reporting that the Chicago Fed: "Index Suggests Economic Growth Moderated In November".

" "Index suggests economic growth moderated in November." This is the headline for this morning's release of the Chicago Fed's National Activity Index, and here is the opening paragraph from the report:

The index is constructed so a zero value for the index indicates that the national economy is expanding at its historical trend rate of growth. Negative values indicate below-average growth, and positive values indicate above-average growth."

Mislinski provides several cuts of the data in different charts in her article. Below is the one I found most interesting. The chart highlights the -0.7 level.

"The Chicago Fed explains:

The current view of the Chicago Fed after slicing and dicing the latest batch of data is that "National Activity, as a function of the 85 indicators in the index, has been declining since its inception in the late 1960s, a trend that roughly coincides with the transition from a goods-producing economy to a post-industrial service economy in the information age."

Time for some strong eggnog to help that sink in.

Here's a link to the Vince Guaraldi Trio playing the classic "Linus and Lucy" melody from "A Charlie Brown Christmas".

Happy Holidays to all.

I'll see you next Tuesday.