These Are The Kind Of Dividend Stocks To Own For The Next Recession

This stock market makes it difficult for me to write about undervalued sectors or nice conservative income stocks. With the stock market indexes and big name companies climbing to new highs every day, there is euphoria with investors who now believe the good times will keep rolling into 2020. They have so far through the first three weeks of the new year.

With so much positive news and opinion about the stock market, it goes against human nature to think about what happens when the market takes a tumble. Although it feels like it won’t happen in such good times as these, I want you to think about your plan if the stock market drops by 20% to 25%. (Note: In early February I’ll be giving a live presentation on how to sustain your income portfolio during a recession. Details here.)

Don’t think it can’t happen. Investors felt the same in the Fall of 2018 when the stock market was marching steadily higher and setting new all-time (for that time) records. Without warning, over the final four months of 2018, the major stock market indexes dropped by 20%. It took seven months following the September 2018 peak before the S&P 500 again exceeded that previous high. The first half of 2019 was in truth, just making up for the losses of the final four months of 2018.

If you bought into the stock market (as measured by the S&P 500) at the bottom in December 2018, your investment is up 35%. If you bought at the 2018 peak and held on until now, your gain is only 12%. Timing matters for the stock market, and you want to buy on the declines and sell at the top when other investors are piling in.

The tricky part is that we only see peaks and bottoms in the historical rearview mirror. It’s hard to make money off the stock market table when share prices continue to march higher. Yet, history shows that at some point, we will get a 20% stock market correction. Market declines of more than 10% happen on average once a year. Here are some ideas to help you get ready to take advantage of the next big market decline.

- Build up your cash holding. Have a plan to put it to work if the market falls. For example, you may decide to invest 30% of the cash after a 15% decline and another 30% if the market falls an additional 10%.

- Sell some stock investments to lock in profits. If you have a stock that’s up 40%, consider selling 30% to 40% of the current position. You will still make money if it keeps going up, but the partial sale will feel pretty good if the stock price turns down.

- Invest in conservative, higher yield income stocks. Earning a steady income from your portfolio makes it easier to live through a market downturn. Reinvesting dividends along the way provides a growing income stream when the market recovers.

Of course, keep in mind that these are ideas and you need to evaluate them against your own personal financial situation, goals, and risk tolerance level.

My research area is income stocks. My strategy involves investing in building an income stream and not trying to time the ups and downs of the stock market. Here are three income investment ideas that will pay well through any stock market downturn and recovery.

The dividends paid on preferred stock shares have priority over common stock dividends from the issuing companies. You can count on preferred stock dividends through almost any disruption in the markets.

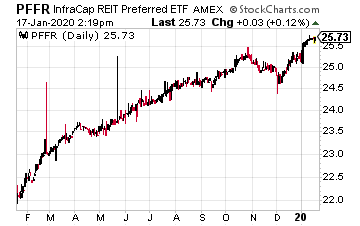

I like an exchange-traded fund (ETF) for preferred stock exposure. The InfraCap REIT Preferred ETF (PFFR) only invests in preferred shares issued by real estate investment trusts (REITs).

That gives extra security of commercial property rents backing the dividends. PFFR pays monthly dividends and yields 5.6%.

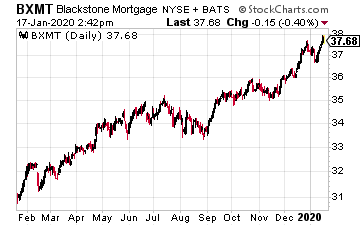

The finance REIT sector can be divided into two groups. Residential mortgage REITs play a dangerous game with interest rates. Commercial finance REITs make loans on commercial properties.

The commercial side of real estate lending is more specialized and provides more predictable profits.

There are three or four commercial finance REITs that will carry an investor through any market downturn. One is Blackstone Mortgage Trust, Inc. (BXMT),which yields 6.6%.

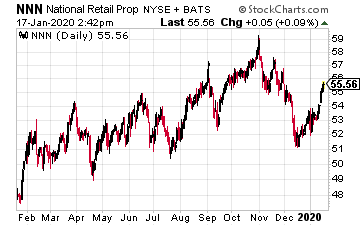

The net lease REITs how properties, where the tenants pay all of the expenses and the REIT’s only job, is to collect rent checks. Also, to release empty properties and raise the rent when leases are up.

The conservative net lease REITs own large numbers of properties to spread the risk and have long histories of dividend growth.

National Retail Properties (NNN) owns 3,057 properties across 48 states covering 37 lines of trade.

This REIT has increased its dividend for 30 consecutive years. The current yield is 3.7%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more