These 3 Underperformers Of 2019 Could Deliver Big Gains In 2020

At the end of 2018, the CNN Fear & Greed Index stood at one on a scale of 1 to 100. A rating close to zero is an indication of Extreme Fear. The index finished 2019 at 99 and is still elevated at 91, a rating that indicates Extreme Greed. The great U.S. stock market returns for 2019 show that investors were wrong in their outlook at the start of the year.

Most of the “experts” in the financial news media forecast that the stock market will continue its upward trajectory. Thus, the Extreme Greed index measurement. If history is any indicator, investors expecting a repeat of 2019 may be disappointed.

With the hypothesis that 2020 will be different, with paradigm shifts compared to 2019, here are some investment themes to consider for your 2020 investment planning.

First theme: Be conservative when others are greedy. If you have stocks that have big gains over the past year, consider taking some profits. Put that money into something secure like a money market fund or bond ETFs like we hold in the Dividend Hunter portfolio. There will be a stock market correction at some point in 2020. This is the money you will invest when the investing public turns fearful.

The hot market sectors of last year will not be the winners in 2020. To start this year, look for sectors that underperformed in 2019 or are more conservative than the broader market.

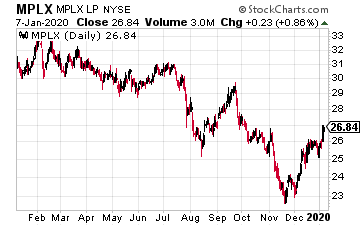

For 2019, Energy was the worst performer out of the 12 S&P 500 industry sectors. You have seen how the recent strife in the Mideast is pushing up the price of crude oil. In 2020, energy commodity prices will stay up, and companies in the sector will grow their profits. There are a lot of ways to invest in energy. I like income stocks. One to consider is MLPX LP (MPLX). This large-cap master limited partnership has growth potential, great dividend coverage, and a 10% yield.

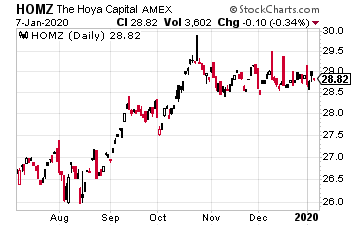

There is a tremendous pent up demand for new housing. Stocks in the sector have not kept pace with new home construction. The Hoya Capital Housing ETF (HOMZ) tracks an index that includes homebuilder stocks, home rental REITs, home improvement and furnishing companies, and home financing related stocks.

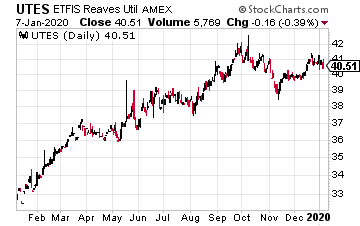

Utility stocks are considered a conservative market sector. Yet they have provided very attractive total returns with less volatility than other market sectors. Utilities landed ninth out of the 12 S&P sectors for 2019, but still produced a 26.4% return for the year.

I know the folks at Reaves Asset Management, a firm that specializes in utility and infrastructure stock investing. They have a great long-term track record. You can get their expertise with the Virtus Reaves Utilities ETF (UTES). The fund returned 24% in 2019 and has a current yield of 2.26%.

As we go through 2020, the pending Presidential election will become more of a factor in investment results. Be ready to shift your strategy if the political outlook turns negative compared to your expectations.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more